Costco 2006 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2006 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

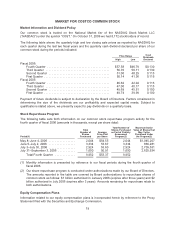

MARKET FOR COSTCO COMMON STOCK

Market Information and Dividend Policy

Our common stock is traded on the National Market tier of the NASDAQ Stock Market LLC

(“NASDAQ”) under the symbol “COST.” On October 31, 2006 we had 8,172 stockholders of record.

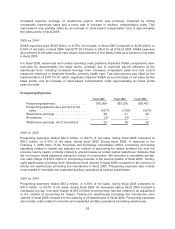

The following table shows the quarterly high and low closing sale prices as reported by NASDAQ for

each quarter during the last two fiscal years and the quarterly cash dividend declared per share of our

common stock during the periods indicated.

Price Range Cash

Dividends

DeclaredHigh Low

Fiscal 2006:

Fourth Quarter ........................................ $57.58 $46.79 $0.130

Third Quarter ......................................... 56.70 50.11 0.130

Second Quarter ....................................... 51.00 48.29 0.115

First Quarter .......................................... 50.14 41.36 0.115

Fiscal 2005:

Fourth Quarter ........................................ 46.62 42.04 0.115

Third Quarter ......................................... 47.00 40.17 0.115

Second Quarter ....................................... 49.69 45.51 0.100

First Quarter .......................................... 49.74 39.99 0.100

Payment of future dividends is subject to declaration by the Board of Directors. Factors considered in

determining the size of the dividends are our profitability and expected capital needs. Subject to

qualifications stated above, we presently expect to pay dividends on a quarterly basis.

Stock Repurchase Program

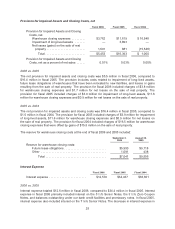

The following table sets forth information on our common stock repurchase program activity for the

fourth quarter of fiscal 2006 (amounts in thousands, except per share data):

Period(1)

Total

Number of

Shares

Purchased

Average

Price Paid

per Share

Total Number of

Shares Purchased

as Part of Publicly

Announced

Program(2)

Maximum Dollar

Value of Shares that

May Yet be

Purchased Under

the Program(2)

May 8–June 4, 2006 ................. 2,044 $54.55 2,044 $1,045,207

June 5–July 2, 2006 ................. 3,334 53.67 3,334 866,281

July 3–July 30, 2006 ................. 2,924 53.60 2,924 2,709,531

July 31–September 3, 2006 ........... 1,650 50.91 1,650 2,625,534

Total Fourth Quarter ............. 9,952 $53.37 9,952

(1) Monthly information is presented by reference to our fiscal periods during the fourth quarter of

fiscal 2006.

(2) Our share repurchase program is conducted under authorizations made by our Board of Directors.

The amounts reported in the table are covered by Board authorizations to repurchase shares of

common stock as follows: $1 billion authorized in January 2006 (expires after three years) and $2

billion authorized in July 2006 (expires after 3 years). Amounts remaining for repurchase relate to

both authorizations.

Equity Compensation Plans

Information related to our equity compensation plans is incorporated herein by reference to the Proxy

Statement filed with the Securities and Exchange Commission.

19