Costco 2006 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2006 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

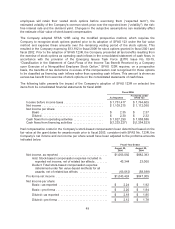

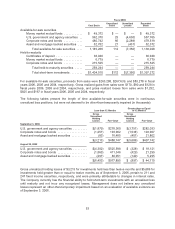

Fiscal 2005

Cost Basis Unrealized

Gains Unrealized

Losses Recorded

Basis

Available-for-sale securities

Money market mutual funds ............ $ 49,372 $ — $ — $ 49,372

U.S. government and agency securities . . 562,370 25 (4,630) 557,765

Corporate notes and bonds ............ 480,742 66 (2,289) 478,519

Asset and mortgage backed securities . . . 52,782 21 (431) 52,372

Total available-for-sale securities .... 1,145,266 112 (7,350) 1,138,028

Held-to-maturity

Certificates of deposit ................. 36,940 — — 36,940

Money market mutual funds ............ 6,779 — — 6,779

Corporate notes and bonds ............ 215,525 — — 215,525

Total held-to-maturity securities ..... 259,244 — — 259,244

Total short-term investments ........ $1,404,510 $112 $(7,350) $1,397,272

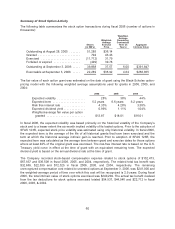

For available-for-sale securities, proceeds from sales were $263,288, $267,639, and $83,278 in fiscal

years 2006, 2005 and 2004, respectively. Gross realized gains from sales were $170, $90 and $128 in

fiscal years 2006, 2005 and 2004, respectively, and gross realized losses from sales were $1,252,

$825 and $167 in fiscal years 2006, 2005 and 2004, respectively.

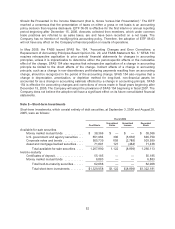

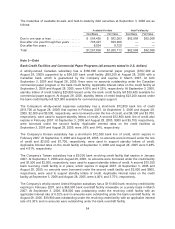

The following tables present the length of time available-for-sale securities were in continuous

unrealized loss positions, but were not deemed to be other-than-temporarily impaired (in thousands):

Less than 12 Months Greater than or Equal

to 12 Months

Gross

Unrealized

Holding

Losses Fair Value

Gross

Unrealized

Holding

Losses Fair Value

September 3, 2006

U.S. government and agency securities ......... $(1,879) $278,360 $(3,751) $282,033

Corporate notes and bonds ................... (1,251) 193,902 (1,534) 103,907

Asset and mortgage backed securities .......... (83) 16,485 (401) 21,802

$(3,213) $488,747 $(5,686) $407,742

August 28, 2005

U.S. government and agency securities ......... $(4,302) $525,598 $ (328) $ 18,121

Corporate notes and bonds ................... (1,860) 411,346 (429) 21,299

Asset and mortgage backed securities .......... (291) 40,951 (140) 5,295

$(6,453) $977,895 $ (897) $ 44,715

Gross unrealized holding losses of $3,213 for investments held less than twelve months and $5,686 for

investments held greater than or equal to twelve months as of September 3, 2006, pertain to 211 and

247 fixed income securities, respectively, and were primarily attributable to changes in interest rates.

The Company currently has the financial ability to hold short-term investments with an unrealized loss

until maturity and not incur any recognized losses. Management does not believe any unrealized

losses represent an other-than-temporary impairment based on an evaluation of available evidence as

of September 3, 2006.

53