Costco 2006 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2006 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Expansion Plans

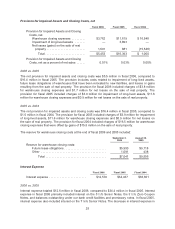

Our primary requirement for capital is the domestic and international financing of the land, building and

equipment costs for new and remodeled warehouses plus the costs of initial warehouse operations and

working capital requirements.

While there can be no assurance that current expectations will be realized, and plans are subject to

change upon further review, it is management’s current intention to spend approximately $1.4 billion to

$1.6 billion during fiscal 2007 for real estate, construction, remodeling and equipment for warehouse

clubs and related operations. These expenditures are expected to be financed with a combination of

cash provided from operations and the use of cash and cash equivalents and short-term investments.

Plans for the United States and Canada during fiscal 2007 are to open approximately 33 to 35 new

warehouses on a net basis, inclusive of one to two relocations. We expect to continue our review of

expansion plans in our international operations, including the United Kingdom and Asia, along with other

international markets. At present, we are planning to open one additional warehouse in the United

Kingdom during fiscal 2007. Costco Mexico plans to open one to two new warehouses during fiscal 2007.

Additional Equity Investments in Subsidiaries and Joint Ventures

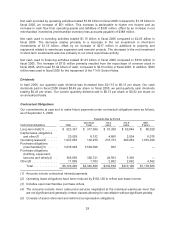

During fiscal 2006 and 2005, we contributed an additional $15 million each year to our investment in

Costco Mexico (a 50%-owned joint venture), which did not impact our percentage ownership of this

entity, as our joint venture partner contributed a like amount. In addition, in fiscal 2005, we acquired the

remaining 4% interest in CWC Travel Inc. for $4 million, bringing our ownership in this entity to 100%.

Bank Credit Facilities and Commercial Paper Programs (all amounts stated in U.S. dollars)

A wholly-owned Canadian subsidiary has a $181 million commercial paper program ($167 million at

August 28, 2005) supported by a $54 million bank credit facility ($50 million at August 28, 2005) with a

Canadian bank, which we guarantee and which expires in March 2007. We intend to renew the bank

credit facility. At both September 3, 2006 and August 28, 2005, there were no amounts outstanding under

the Canadian commercial paper program or the bank credit facility. Applicable interest rates on the credit

facility at September 3, 2006 and August 28, 2005, were 4.65% and 4.25%, respectively. At

September 3, 2006, standby letters of credit totaling $21 million issued under the bank credit facility left

$33 million available for commercial paper support. At August 28, 2005, standby letters of credit totaling

$23 million issued under the bank credit facility left $27 million available for commercial paper support.

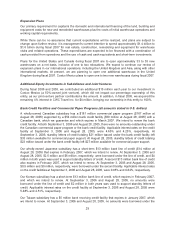

Our wholly-owned Japanese subsidiary has a short-term $13 million bank line of credit ($14 million at

August 28, 2005) that expires in February 2007, which we intend to renew. At September 3, 2006 and

August 28, 2005, $2.5 million and $6 million, respectively, were borrowed under the line of credit, and $4

million in both years was used to support standby letters of credit. A second $13 million bank line of credit

also expires in February 2007, which we intend to renew. At September 3, 2006 and August 28, 2005,

$0.9 million and $9 million, respectively, were borrowed under the second facility. Applicable interest rates

on the credit facilities at September 3, 2006 and August 28, 2005, were 0.95% and 0.84%, respectively.

Our Korean subsidiary has a short-term $13 million bank line of credit, which expires in February 2007,

and which we intend to renew. At September 3, 2006 and August 28, 2005, no amounts were

borrowed under the line of credit and $2 million in both years was used to support standby letters of

credit. Applicable interest rates on the credit facility at September 3, 2006 and August 28, 2005 were

5.48% and 4.51%, respectively.

Our Taiwan subsidiary has a $5 million bank revolving credit facility that expires in January 2007, which

we intend to renew. At September 3, 2006 and August 28, 2005, no amounts were borrowed under the

29