Costco 2006 Annual Report Download - page 61

Download and view the complete annual report

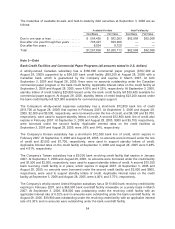

Please find page 61 of the 2006 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Note 6—Stock-Based Compensation Plans

The Company’s 1993 Combined Stock Grant and Stock Option Plan (1993 Plan) provided for the

issuance of up to 60 million shares of its common stock upon the exercise of stock options and up to

3,333,332 shares through stock grants. During fiscal 2002, the 2002 Stock Incentive Plan (2002 Plan)

was adopted following shareholder approval. The 2002 Plan authorized 30 million shares of common

stock for issuance, subject to adjustment. For future grants, the 2002 Plan replaces the 1993 Plan and

the 1993 Plan has been amended to provide that no more options or stock grants may be issued under

such plan. All shares under the 1993 Plan that were available for future option grants (and any

additional shares that subsequently become available through cancellation of unexercised options

outstanding) are to be added to the number of shares available for grant under the 2002 Plan. The

2002 Plan authorizes the Company to grant stock options to eligible employees, directors and

consultants.

In January 2005, the 2002 Plan was amended following shareholder approval and is referred to as the

Amended and Restated 2002 Stock Incentive Plan (Amended and Restated 2002 Plan). The Amended

and Restated 2002 Plan authorized the issuance of an additional 10 million shares for option grants

and authorized the award of stock bonuses or stock units in addition to stock option grants currently

authorized. The number of shares issued as stock bonuses or stock units is limited to one-third of

those available for option grants.

In January 2006, the Amended and Restated 2002 Plan was amended following shareholder approval

and is now referred to as the Second Restated 2002 Plan. The Second Restated 2002 Plan authorizes

the issuance of an additional 10 million shares for future grants in addition to grants currently

authorized. Stock options generally vest over five years and have a ten-year term. Each share issued

in respect of stock bonuses or stock units would be counted as 1.75 shares toward the share limit and

each share issued in respect of options would be counted as one share.

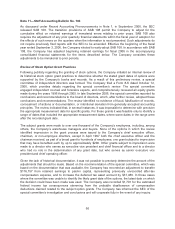

In conjunction with the adoption of SFAS 123 at the beginning of fiscal 2003, the Company changed its

method of attributing the value of stock-based compensation expense from the accelerated multiple-

option approach to the straight-line single-option method. Compensation expense for all stock-based

awards granted prior to fiscal 2003 will continue to be recognized using the accelerated multiple option

approach, while compensation expense for all stock-based awards granted subsequent to fiscal 2002

will be recognized using the straight-line single-option method. Additionally, SFAS 123R requires the

estimation of the number of stock-based awards that will ultimately not complete their vesting

requirements (forfeitures), and requires that the compensation expense recognized equals or exceeds

the number of stock-based awards vested. While options and restricted stock units (RSUs) generally

vest over five years with an equal amount vesting on each anniversary of the grant date, the

Company’s plans allow for daily vesting of the pro-rata number of shares that would vest on the next

anniversary of the grant date in the event of retirement or voluntary termination. As such, the Company

does not reduce stock-based compensation for an estimate of forfeitures because this would result in

less compensation expense recognized than the number of stock-based awards vested.

The Company issues new shares of common stock upon exercise of stock options and vesting of

RSUs.

59