ComEd 2005 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2005 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

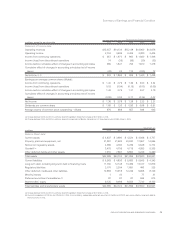

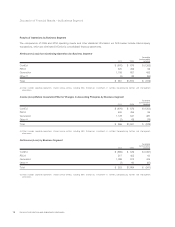

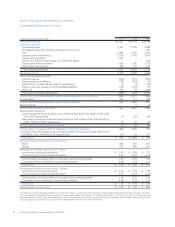

Discussion of Financial Results – Generation

Results of Operations – Generation

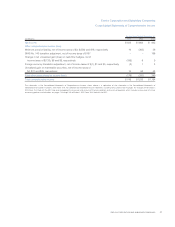

2005 2004

Favorable

(unfavorable)

variance

Operating revenues $9,046 $7,703 $1,343

Operating expenses

Purchased power 2,569 2,307 (262)

Fuel 1,913 1,704 (209)

Operating and maintenance 2,288 2,201 (87)

Depreciation and amortization 254 286 32

Taxes other than income 170 166 (4)

Total operating expenses 7,194 6,664 (530)

Operating income 1,852 1,039 813

Other income and deductions

Interest expense (128) (103) (25)

Equity in losses of unconsolidated affiliates (1) (14) 13

Other, net 95 130 (35)

Total other income and deductions (34) 13 (47)

Income from continuing operations before income taxes and minority interest 1,818 1,052 766

Income taxes 709 401 (308)

Income from continuing operations before minority interest 1,109 651 458

Minority interest – 6 (6)

Income from continuing operations 1,109 657 452

Discontinued operations

Loss from discontinued operations – (45) 45

Gain on disposal of discontinued operations 24 – 24

Income taxes 5 (29) (34)

Income (loss) from discontinued operations 19 (16) 35

Income before cumulative effect of changes in accounting principles 1,128 641 487

Cumulative effect of changes in accounting principles (30) 32 (62)

Net income $1,098 $ 673 $ 425

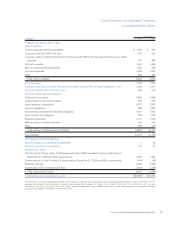

Generation’s net income in 2005 increased $425 million as compared to the prior year, primarily as a result of higher revenue,

net of purchased power and fuel expense, partially offset by higher operating and maintenance expense and interest expense.

Generation’s revenue, net of purchased power and fuel expense, increased $872 million in 2005 as compared to the prior year.

This increase was driven by the contractual increase in prices associated with Generation’s power sales agreement with

ComEd and higher average margins on wholesale market sales as higher spot market prices more than compensated for

higher fuel prices and the impact of higher nuclear generation.

EXELON CORPORATION AND SUBSIDIARY COMPANIES 31