ComEd 2004 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2004 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Discussion of Financial Results – Enterprises

Results of Operations – Enterprises

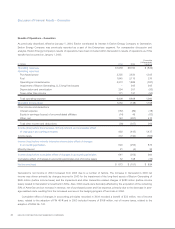

As previously described, effective January 1, 2004, Enterprises contributed its interest in Exelon Energy Company to

Generation. Exelon Energy Company was previously reported as a part of the Enterprises segment. For comparative discussion

and analysis, the results of Exelon Energy Company have been excluded from Enterprises’ 2003 results of operations dis-

cussed below.

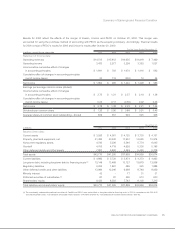

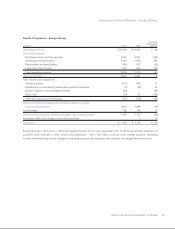

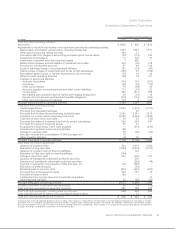

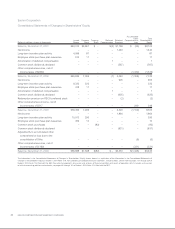

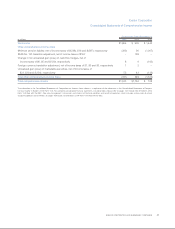

in millions 2004 2003

Favorable

(Unfavorable)

Variance

Operating revenues $155 $ 923 $(768)

Operating and maintenance expense 211 1,027 816

Operating loss (62) (139) 77

Loss before income taxes, minority interest and cumulative effect

of changes in accounting principles (7) (187) 180

Loss before cumulative effect of changes in accounting principles (13) (117) 104

Net loss (22) (118) 96

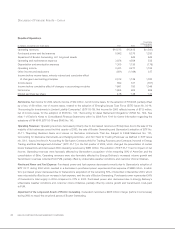

The decrease in Enterprises’ net loss before cumulative effect of changes in accounting principles in 2004 was primarily due to

a decrease in operating and maintenance expense, partially offset by a decrease in operating revenues. Depreciation and

amortization expense decreased $23 million before income taxes from 2003 to 2004 primarily as a result of the sale of the

majority of property, plant and equipment since September 2003. In 2004, Enterprises recorded impairment charges of invest-

ments of $15 million before income taxes due to other-than-temporary declines in value, partially offset by 2003 charges for

impairment of investments of $46 million before income taxes and a net impairment of other assets of $8 million before income

taxes. The adoption of EITF 03-16 increased the 2004 net loss by $9 million. The adoption of SFAS No. 143 increased the 2003

net loss by $1 million, net of income taxes.

EXELON CORPORATION AND SUBSIDIARY COMPANIES 31