ComEd 2004 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2004 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Discussion of Financial Results – Exelon

(continued)

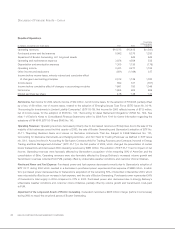

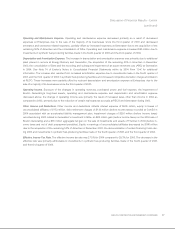

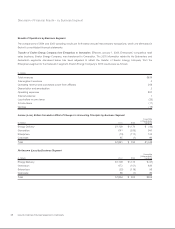

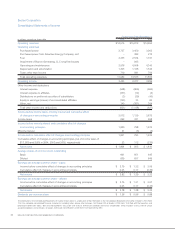

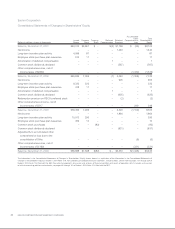

Operating and Maintenance Expense. Operating and maintenance expense decreased primarily as a result of decreased

expenses at Enterprises due to the sale of the majority of its businesses since the third quarter of 2003 and decreased

severance and severance-related expenses, partially offset by increased expenses at Generation due to the acquisition of the

remaining 50% of AmerGen and the consolidation of Sithe. Operating and maintenance expense increased $65 million due to

investments in synthetic fuel-producing facilities made in the fourth quarter of 2003 and the third quarter of 2004.

Depreciation and Amortization Expense. The increase in depreciation and amortization expense was primarily due to additional

plant placed in service at Energy Delivery and Generation, the acquisition of the remaining 50% in AmerGen in December

2003, the consolidation of Sithe and the recording and subsequent impairment of an asset retirement cost (ARC) at Generation

in 2004. See Note 14 of Exelon’s Notes to Consolidated Financial Statements within its 2004 Form 10-K for additional

information. The increase also resulted from increased amortization expense due to investments made in the fourth quarter of

2003 and the third quarter of 2004 in synthetic fuel-producing facilities and increased competitive transition charge amortization

at PECO. These increases were partially offset by reduced depreciation and amortization expense at Enterprises due to the

sale of a majority of its businesses since the third quarter of 2003.

Operating Income. Exclusive of the changes in operating revenues, purchased power and fuel expense, the impairment of

Boston Generating’s long-lived assets, operating and maintenance expense and depreciation and amortization expense

discussed above, the change in operating income was primarily the result of increased taxes other than income in 2004 as

compared to 2003, primarily due to the reduction of certain real estate tax accruals at PECO and Generation during 2003.

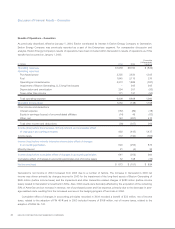

Other Income and Deductions. Other income and deductions reflects interest expense of $905 million, equity in losses of

unconsolidated affiliates of $153 million, debt retirement charges of $130 million (before income taxes) recorded at ComEd in

2004 associated with an accelerated liability management plan, impairment charges of $255 million (before income taxes)

recorded during 2003 related to Generation’s investment in Sithe, an $85 million gain (before income taxes) on the 2004 sale of

Boston Generating and a $35 million aggregate net gain on the sale of investments and assets of Thermal in 2004 (before in-

come taxes and net of debt prepayment penalties). Equity in earnings of unconsolidated affiliates decreased by $186 million

due to the acquisition of the remaining 50% of AmerGen in December 2003, the deconsolidation of certain financing trusts dur-

ing 2003 and investments in synthetic fuel-producing facilities made in the fourth quarter of 2003 and the third quarter of 2004.

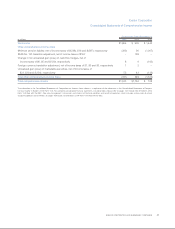

Effective Income Tax Rate. The effective income tax rate was 27.5% for 2004 compared to 29.3% for 2003. The decrease in the

effective rate was primarily attributable to investments in synthetic fuel-producing facilities made in the fourth quarter of 2003

and the third quarter of 2004.

EXELON CORPORATION AND SUBSIDIARY COMPANIES 27