Cogeco 2009 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2009 Cogeco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4 COGECO CABLE INC. 2009 Financial highlights

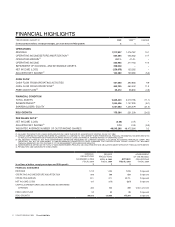

FINANCIAL HIGHLIGHTS

YEARS ENDED AUGUST 31, 2009

2008

(1)(2)

CHANGE

(in thousands of dollars, except percentages, per share data and RGU growth) $

$

%

OPERATIONS

REVENUE

1,217,837

1,076,787

13.1

OPERATING INCOME BEFORE AMORTIZATION

(3)

524,395

445,452

17.7

OPERATING MARGIN

(3)

43.1%

41.4%

–

OPERATING INCOME

253,965

217,153

17.0

IMPAIRMENT OF GOODWILL AND INTANGIBLE ASSETS

399,648

–

–

NET INCOME (LOSS)

(256,675)

133,282

–

ADJUSTED NET INCOME

(3)

103,592

109,280

(5.2)

CASH FLOW

CASH FLOW FROM OPERATING ACTIVITIES

431,688

392,883

9.9

CASH FLOW FROM OPERATIONS

(3)

400,725

360,402

11.2

FREE CASH FLOW

(3)

95,412

98,890

(3.5)

FINANCIAL CONDITION

TOTAL ASSETS

2,665,403

3,019,155

(11.7)

INDEBTEDNESS

(4)

1,054,506

1,147,399

(8.1)

SHAREHOLDERS’ EQUITY

1,031,663

1,305,079

(21.0)

RGU GROWTH

175,364

231,209

(24.2)

PER SHARE DATA

(5)

NET INCOME (LOSS)

(5.29)

2.75

–

ADJUSTED NET INCOME

(3)

2.13

2.25

(5.3)

WEIGHTED AVERAGE NUMBER OF OUTSTANDING SHARES

48,545,296

48,472,364

0.2

(1) INCLUDES THE RESULTS OF COGECO DATA SERVICES INC. SINCE THE DATE OF ACQUISITION OF CONTROL ON JULY 31, 2008.

(2) CERTAIN COMPARATIVE FIGURES HAVE BEEN RECLASSIFIED TO CONFORM TO THE CURRENT YEAR’S PRESENTATION. FINANCIAL INFORMATION HAS BEEN RESTATED

TO REFLECT THE PRESENTATION OF FOREIGN EXCHANGE GAINS OR LOSSES AS FINANCIAL EXPENSE INSTEAD OF OPERATING COSTS.

(3) THE INDICATED TERMS DO NOT HAVE STANDARDIZED DEFINITIONS PRESCRIBED BY CANADIAN GENERALLY ACCEPTED ACCOUNTING PRINCIPLES (“GAAP”) AND

THEREFORE, MAY NOT BE COMPARABLE TO SIMILAR MEASURES PRESENTED BY OTHER COMPANIES. FOR FURTHER DETAILS, PLEASE CONSULT THE “NON-GAAP

FINANCIAL MEASURES” SECTION ON PAGE 37 OF THE MANAGEMENT’S DISCUSSION AND ANALYSIS.

(4) INDEBTEDNESS IS DEFINED AS THE TOTAL OF BANK INDEBTEDNESS, PRINCIPAL ON LONG-TERM DEBT AND OBLIGATIONS UNDER DERIVATIVE FINANCIAL INSTRUMENTS.

(5) PER MULTIPLE AND SUBORDINATE VOTING SHARE.

(in millions of dollars, except percentages and RGU growth)

ORIGINAL

PROJECTIONS

NOVEMBER 3, 2008

FISCAL 2009

$

REVISED

PROJECTIONS

APRIL 8, 2009

FISCAL 2009

$

ACTUALS

FISCAL 2009

$

ACHIEVEMENT

OF THE REVISED

PROJECTIONS

FISCAL 2009

FINANCIAL GUIDELINES

REVENUE

1,210 1,205 1,218 Surpassed

OPERATING INCOME BEFORE AMORTIZATION

508 500 524 Surpassed

OPERATING MARGIN

42% 42% 43.1% Surpassed

NET INCOME (LOSS)

107 (275)

(257)

Surpassed

CAPITAL EXPENDITURES AND INCREASE IN DEFERRED

CHARGES

300 300 305 Under-achieved

FREE CASH FLOW

90 80 95 Surpassed

RGU GROWTH

100,000 100,000 175,364 Surpassed