Cogeco 2009 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2009 Cogeco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. Management’s discussion and analysis COGECO CABLE INC. 2009 13

on the consolidated balance sheet, with changes in fair value recorded in the consolidated statements of income, except for the

changes in fair value of the cross-currency swap and interest rate swap agreements, which are designated as cash flow hedges of

the Senior Secured Notes Series A and the Euro-denominated Term Loan facilities and are recorded in other comprehensive

income. The Corporation does not hold or use any derivative instruments for speculative trading purposes. Net receipts or payments

arising from cross-currency swap and interest rate swap agreements are recognized as financial expense.

CONTINGENCIES AND COMMITMENTS

The Corporation is subject to various claims and contingencies related to lawsuits, taxes and commitments under contractual and

other commercial obligations. The contractual and other commercial obligations primarily relate to network fees and operating lease

agreements for use of transmission facilities. The Corporation recognizes liabilities for contingencies and commitments when a loss

is probable and can be reasonably estimated based on currently available information. Significant changes in assumptions as to the

likelihood and estimates of a loss could result in the recognition of an additional liability.

RELATED PARTY TRANSACTIONS

Cogeco Cable is a subsidiary of COGECO Inc. (“COGECO”) which holds 32.3% of the Corporation’s equity shares, representing

82.7% of the votes attached to the Corporation’s voting shares. As of September 1, 1992, Cogeco Cable executed a management

agreement with COGECO under which the parent company agreed to provide certain executive, administrative, legal, regulatory,

strategic and financial planning services and additional services to the Corporation and its subsidiaries (the “Management

Agreement”). These services are provided by COGECO’s officers, including the President and Chief Executive Officer, the Senior

Vice President and Chief Financial Officer, the Vice President, Corporate Affairs and the Chief Legal Officer and Secretary. No direct

remuneration is payable to such officers by the Corporation. The Corporation granted 29,711 stock options to its officers, who also

are COGECO’s officers, during the 2009 fiscal year, compared to 22,683 in the 2008 fiscal year. During fiscal 2009, Cogeco Cable

charged COGECO an amount of $0.4 million with regards to Cogeco Cable’s options granted to COGECO’s employees which is the

same amount charged during fiscal 2008.

Under the Management Agreement, the Corporation pays monthly fees equal to 2% of its total revenue to COGECO for the above-

mentioned services. In 1997, the management fee was capped at $7 million per year, subject to annual increases based on the

variation in the Consumer Price Index in Canada. Accordingly, for the year ended August 31, 2009, the maximum amount of

$9 million was paid to COGECO, compared to $8.7 million in 2008, which represents about 0.7% of the Corporation’s total revenue

for fiscal 2009 compared to 0.8% for fiscal 2008. The Audit Committee of the Corporation can increase the cap under certain

circumstances upon request to that effect by COGECO. In addition, the Corporation reimburses COGECO’s out-of-pocket expenses

incurred with respect to services provided to the Corporation under the Management Agreement. In fiscal 2010, the management

fee will remain the same at $9 million pursuant to the Management Agreement.

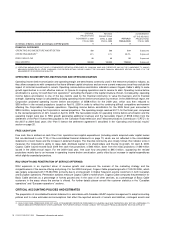

ADOPTION OF NEW ACCOUNTING STANDARDS

ADOPTED DURING FISCAL 2009

CAPITAL DISCLOSURES AND FINANCIAL INSTRUMENTS

Effective September 1, 2008, the Corporation adopted the Canadian Institute of Chartered Accountants (“CICA”) Handbook Section

1535, Capital Disclosures, Section 3862, Financial Instruments – Disclosures and Section 3863, Financial Instruments –

Presentation.

Capital disclosures

Section 1535 of the CICA Handbook requires that an entity disclose information that enables users of its financial statements to

evaluate the entity’s objectives, policies and processes for managing capital, including disclosures of any externally imposed capital

requirements and the consequences for non-compliance. These new disclosures are included in note 19 of the Corporation’s

consolidated financial statements.

Financial instruments

Section 3862 on financial instrument disclosures requires the disclosure of information about the significance of financial instruments

for the entity's financial position and performance and the nature and extent of risks arising from financial instruments to which the

entity is exposed during the period and at the balance sheet date, and how the entity manages those risks.

Section 3863 establishes standards for presentation of financial instruments and non-financial derivatives. It deals with the

classification of financial instruments, from the perspective of the issuer, between liabilities and equities, the classification of related

interest, dividends, gains and losses, and circumstances in which financial assets and financial liabilities are offset.