Circuit City 2009 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2009 Circuit City annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

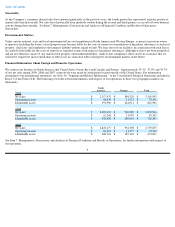

Systemax common stock is traded on the NYSE Euronext Exchange under the symbol “SYX.” The following table sets forth the high and low

closing sales price of our common stock as reported on the New York Stock Exchange for the periods indicated.

On January 2, 2010, the last reported sale price of our common stock on the New York Stock Exchange was $15.71 per share. As of January 2,

2010, we had 215 shareholders of record.

On November 16, 2009, the Company’s Board of Directors declared a special dividend of $.75 per share payable on December 15, 2009 to

shareholders of record on December 1, 2009. This special dividend is the third dividend we have paid since our initial public offering.

Depending in part upon profitability, the strength of our balance sheet, our cash position and the need to retain cash for the development and

expansion of our business, we may decide to declare another special dividend in the future.

On March 3, 2008, the Company’s Board of Directors declared a special dividend of $1.00 per share payable on April 2, 2008 to shareholders of

record on March 21, 2008. This special dividend is the second dividend we have paid since our initial public offering.

On March 14, 2007, the Company’s Board of Directors declared a special dividend of $1.00 per share payable on April 12, 2007 to shareholders

of record on April 2, 2007. This special dividend was the first dividend we have paid since our initial public offering.

In May 2008, the Company’s Board of Directors authorized the repurchase of up to 2,000,000 shares of the Company’s common stock. During

2009 the Company repurchased 98,934 common shares. Details of all repurchases are as follows:

19

High

Low

2009

First Quarter

$

14.19

$

9.12

Second Quarter

17.30

11.25

Third Quarter

14.29

11.34

Fourth Quarter

16.46

12.00

2008

First Quarter

$

20.32

$

9.01

Second Quarter

20.89

12.06

Third Quarter

18.43

14.04

Fourth Quarter

15.10

8.75