Circuit City 2001 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2001 Circuit City annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 3. LEGAL PROCEEDINGS.

The Company is a party to various pending legal proceedings and disputes arising in the normal course of its business, including those

involving certain commercial, employment and intellectual property related claims, none of which, in management's opinion, is anticipated to

have a material adverse effect on the Company's consolidated financial position or results of operations.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

During the quarter ended December 31, 2001, there were no matters submitted to a vote of the Company's security holders.

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS.

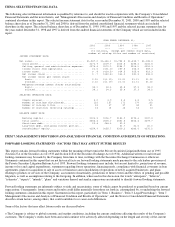

The Company's Common Stock is traded on the New York Stock Exchange under the symbol "SYX". The following table sets forth the high

and low closing sales price of the Company's Common Stock as reported on the New York Stock Exchange for the periods indicated.

On March 13, 2002, the last reported sale price of the Company's Common Stock on the New York Stock Exchange was $2.65 per share. As of

March 13, 2002, the Company had 257 stockholders of record.

The Company has not paid any dividends since its initial public offering and anticipates that all of its cash provided by operations in the

foreseeable future will be retained for the development and expansion of its business, and therefore does not anticipate paying dividends on its

Common Stock in the foreseeable future.

Sales and Distribution Center...............Naperville, IL 241,000 2010

Sales Center................................Holmdel, NJ 13,000 2004

Sales and Distribution Center...............Markham, Ontario 45,000 2005

Sales and Distribution Center...............Verrieres le Buisson, France 45,000 2008

Sales and Distribution Center...............Frankfurt, Germany 92,000 2010

Sales and Distribution Center...............Madrid, Spain 35,000 (3)

Sales and Distribution Center...............Milan, Italy 90,000 2003

Sales and Distribution Center...............Greenock, Scotland 78,000 owned

Sales and Distribution Center...............Wellingborough, England 33,000 2013

Sales, Distribution and PC

Assembly Center ........................London, England 64,000 2006

Sales Center................................Miami, FL 71,000 2010

Sales Center................................Amstelveen, Netherlands 5,000 2002

PC Assembly, Sales

and Distribution Center..................Fletcher, Ohio 297,000 owned

European Headquarters.......................Uxbridge, England 7,400 2005

Sales Office................................Uxbridge, England 3,600 2010

Sales and Distribution Center...............Lidkoping, Sweden 20,000 2002

Sales Center................................Stockholm, Sweden 3,000 2003

(1) For information about facilities leased from related parties, see "Certain

Relationships and Related Transactions--Agreements--Leases"

(2) Approximately 120,000 sq. ft. are leased to a third party through March

2004.

(3) Terminable upon two months prior written notice.

2001 HIGH LOW

FIRST QUARTER..................................... $2.75 $1.00

SECOND QUARTER.................................... 3.60 1.50

THIRD QUARTER..................................... 2.80 1.40

FOURTH QUARTER.................................... 2.70 1.30

2000 HIGH LOW

First quarter..................................... $11.06 $8.19

Second quarter.................................... 9.13 3.44

Third quarter..................................... 5.19 2.75

Fourth quarter.................................... 3.00 1.00