Circuit City 2001 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2001 Circuit City annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company had net income for the year ended December 31, 2001 of $653,000 compared to a net loss for the year ended December 31, 2000

of $40.8 million and net income for the year ended December 31, 1999 of $36.0 million.

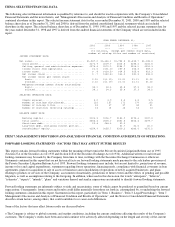

The following table represents the Company's consolidated statement of income data expressed as a percentage of net sales for the three most

recent fiscal years:

NET SALES

Net sales of $1.55 billion in 2001 were $139 million or 8.3% lower than the $1.69 billion reported in 2000. A slowdown in the worldwide

market for PCs resulted in a $75 million, or 18%, decrease in sales of PCs in 2001. PC sales represented approximately 23% of the Company's

total sales in 2001 and included sales of other manufacturers' PCs, which the Company has been reselling at sharply reduced prices, but at

acceptable gross profit margins, and Systemax PCs. Sales in North America decreased 13.7% to $983 million in 2001 from $1.14 billion in

2000 primarily as a result of the economic slowdown in the United States. Decreased sales to business customers were partially offset by

increased sales through television retailers. European sales increased 3.0% to $564.4 million in 2001 from $548 million in 2000. Movements in

foreign exchange rates, however, negatively impacted the European sales comparison by approximately $25 million in 2001 compared to 2000.

Excluding the movements in foreign exchange rates, European sales would have increased 7.5% over the prior year. Most of the Company's

European businesses reported sales increases in local currency, but at a slower rate of growth from the previous year.

For the year ended December 31, 2000, net sales decreased by $68 million or 3.9% to $1.69 billion from $1.75 billion in 1999. Worldwide

sales of PCs, which represented approximately 25% of the Company's total sales, were down 1% for the year as a result of difficulties in that

market. Sales attributable to the Company's North American operations decreased 9.9% to $1.14 billion in 2000 from $1.26 billion in 1999.

The decrease was primarily in the Company's computer products business, as a result of lower incoming orders from inbound customers.

European sales increased 11.6% to $548.1 million in 2000 from $491.1 million in 1999, as all of the Company's operations in Europe reported

sales increases for the year. Movements in foreign exchange rates negatively impacted the European sales comparison by approximately $57

million in 2000 compared to 1999. Excluding the movements in foreign exchange rates, European sales would have increased 23% over the

prior year. The table below reflects European sales for the three reported years at constant exchange rates (in millions):

GROSS PROFIT

Gross profit, which consists of net sales less product, shipping, assembly and certain distribution center costs, recovered to $276.9 million in

2001 up 32.0%, or $67.1 million, from $209.9 million in 2000. The improvement was attributable to cost reductions implemented in the

Company's PC assembly business and the absence of inventory liquidation costs in the PC assembly business which adversely affected 2000.

The Company closed one of its computer products distribution warehouses in the fourth quarter of 2001, with the full effect of the cost

reduction to be realized in future years. Gross profit in 2001 was also favorably affected by the elimination of a liability of $3 million recorded

in a prior year which the Company determined is no longer required. The gross profit margin was 17.9% (17.7% excluding the effect of the $3

million adjustment) in 2001 compared to 12.4% in 2000. The gross profit margin in Europe remained constant compared to the prior year.

Gross profit in 2000 decreased $104.6 million to $209.9 million, from $314.5 million in 1999. Gross profit in 2000 was significantly impacted

by losses in the Company's PC assembly business, principally related to increased sales returns and losses on liquidation of excess inventory.

Increased technical support and service costs also contributed to the lower margin. The gross profit margin decreased to 12.4% in 2000 from

17.9% in 1999. Gross profit margin in the North American computer products business declined by approximately 3 percentage points on the

lower sales volume and gross profit margin in Europe declined by 1.5 percentage points.

The market for computer products is subject to intense price competition, which the Company anticipates will continue to have a negative

impact on gross margins. Gross profit margins on industrial product sales remained consistent in 2001 from 2000 and 1999, but continuing

lower sales contributions of these higher-margin products negatively impacted the Company's overall gross profit margin.

SELLING, GENERAL AND ADMINISTRATIVE EXPENSES

Selling, general and administrative expenses totaled $274.4 million, or 17.7% of net sales in 2001, compared to $270.9 million, or 16.1% of net

sales in 2000. This was due to a variety of reasons, including the following. In 2001, the Company incurred television advertising expenses

2001 2000 1999

---- ---- ----

Net sales 100.0% 100.0% 100.0%

Gross profit 17.9 12.4 17.9

Selling, general and administrative expenses 17.7 16.1 14.5

Income (loss) from operations .2 (3.6) 3.4

Interest and other income (.1)

Interest expense .1 .3

Income taxes (1.5) 1.4

Net income (loss) .1 (2.4) 2.1

2001 2000 1999

European sales as reported $564.4 $548.1 $491.1

European sales at 1999 exchange rates $648.4 $603.8 $491.1