Circuit City 2001 Annual Report Download - page 10

Download and view the complete annual report

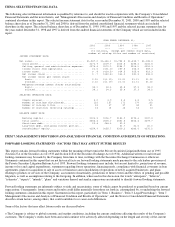

Please find page 10 of the 2001 Circuit City annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 6. SELECTED FINANCIAL DATA.

The following selected financial information is qualified by reference to, and should be read in conjunction with, the Company's Consolidated

Financial Statements and the notes thereto, and "Management's Discussion and Analysis of Financial Condition and Results of Operations"

contained elsewhere in this report. The selected income statement data for the years ended December 31, 2001, 2000 and 1999 and the selected

balance sheet data as of December 31, 2001 and 2000 is derived from the audited consolidated financial statements which are included

elsewhere in this report. The selected balance sheet data as of December 31, 1999, 1998 and 1997 and the selected income statement data for

the years ended December 31, 1998 and 1997 is derived from the audited financial statements of the Company which are not included in this

report.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

FORWARD LOOKING STATEMENTS - FACTORS THAT MAY AFFECT FUTURE RESULTS

This report contains forward looking statements within the meaning of that term in the Private Securities Litigation Reform Act of 1995

(Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934). Additional written or oral forward

looking statements may be made by the Company from time to time, in filings with the Securities Exchange Commission or otherwise.

Statements contained in this report that are not historical facts are forward looking statements made pursuant to the safe harbor provisions of

the Private Securities Litigation Reform Act of 1995. Forward looking statements may include, but are not limited to, projections of revenue,

income or loss and capital expenditures, statements regarding future operations, financing needs, compliance with financial covenants in loan

agreements, plans for acquisition or sale of assets or businesses and consolidation of operations of newly acquired businesses, and plans

relating to products or services of the Company, assessments of materiality, predictions of future events and the effects of pending and possible

litigation, as well as assumptions relating to the foregoing. In addition, when used in this discussion, the words "anticipates", "believes",

"estimates", "expects", "intends", "plans" and variations thereof and similar expressions are intended to identify forward looking statements.

Forward looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified based on current

expectations. Consequently, future events and results could differ materially from those set forth in, contemplated by, or underlying the forward

looking statements contained in this report. Statements in this report, particularly in "Item 1. Business", "Item 3. Legal Proceedings", "Item 7.

Management's Discussion and Analysis of Financial Condition and Results of Operations", and the Notes to Consolidated Financial Statements

describe certain factors, among others, that could contribute to or cause such differences.

Some of the factors that may affect future results are discussed below.

o The Company is subject to global economic and market conditions, including the current conditions affecting the results of the Company's

customers. The Company's results have been and could continue to be adversely affected depending on the length and severity of the current

YEAR ENDED DECEMBER 31,

------------------------------------

2001 2000 1999 1998 1997

---- ---- ---- ---- ----

(In millions, except per common share data,

number of catalog titles and number of countries)

INCOME STATEMENT DATA:

Net sales...................................... $1,547.0 $1,686.1 $1,754.5 $1,435.7 $1,145.4

Gross profit................................. $276.9 $209.9 $314.5 $288.6 $265.5

Selling, general and administrative expenses. $274.4 $270.9 $254.7 $224.2 $206.3

Income (loss) from operations................ $2.5 $(61.0) $59.8 $64.3 $59.3

Income taxes................................. $ .4 $(24.5) $24.5 $25.8 $23.3

Net income (loss)............................ $ .7 $(40.8) $36.0 $41.3 $38.8

Net income (loss) per common share:

Basic...................................... $.02 $(1.19) $1.01 $1.11 $1.02

Diluted.................................... $.02 $(1.19) $1.01 $1.11 $1.02

Weighted average common shares outstanding:

Basic...................................... 34.1 34.3 35.8 37.3 38.0

Diluted.................................... 34.1 34.3 35.8 37.3 38.2

SELECTED OPERATING DATA:

Orders entered............................... 4.0 3.9 4.4 3.8 3.5

Number of catalogs distributed............... 126 157 171 179 162

Number of catalog titles..................... 38 37 37 44 41

Number of countries receiving catalogs....... 14 14 14 14 13

BALANCE SHEET DATA:

Working capital ............................. $103.3 $106.7 $186.9 $194.6 $187.8

Total assets................................. $454.4 $538.0 $551.8 $454.4 $399.7

Short-term debt.............................. $2.8 $48.6 $9.0

Long-term debt, excluding current portion.... $1.7 $2.5 $2.0

Stockholders' equity......................... $254.9 $255.7 $310.2 $286.6 $272.2