Circuit City 1997 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 1997 Circuit City annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.networking equipment; ergonomic accessories such as adjustable monitor support arms and antiglare screens; packaged software; and

hardware. Computer sales include a wide array of build-to-order PCs complimented with offerings of the most popular brand named PCs and

notebook computers.

Office products include furniture, chairs, small office machines and related supplies. The Company's industrial product lines focus primarily on

storage equipment such as metal shelving, bins, lockers, light material handling equipment such as hand carts and hand trucks and consumable

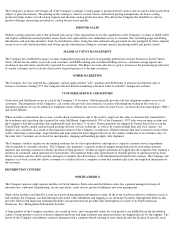

industrial products such as first aid items, safety items, protective clothing and OSHA compliance items. The table below summarizes the

Company's mix of sales by product category:

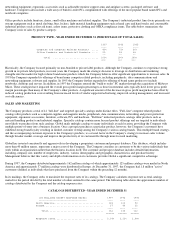

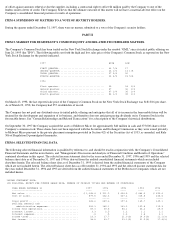

PRODUCT TYPE - YEAR ENDED DECEMBER 31 (PERCENTAGE OF TOTAL SALES)

Historically, the Company focused primarily on non-branded or private label products. Although the Company continues to experience strong

growth in its private label products, in recent years the Company made the strategic decision to leverage its distribution and marketing

strengths into the market for high volume brand name products which the Company believes offer significant opportunities to increase sales. In

1993 the Company expanded its offerings of brand name computer related products, including peripherals, data communications and

networking equipment, software and supplies. In 1995 the Company further expanded its offering of brand name products to include

notebooks, desktops and servers. In addition, in 1997 the Company entered the "build to order" PC market through the acquisition of Midwest

Micro. These strategies have impacted the overall gross profit margin percentages as those incremental sales typically have lower gross profit

margin percentages than many of the Company's other products. A significant amount of the decrease in gross profit margin has been offset by

reduced catalog production costs resulting from increased levels of vendor supported advertising, improved catalog management, and increased

cost efficiencies.

SALES AND MARKETING

The Company produces a total of 41 "full-line" and targeted specialty catalogs under distinct titles. "Full- line" computer related product

catalogs offer products such as computer supplies and magnetic media, peripherals, data communication, networking and power protection

equipment, ergonomic accessories, furniture, software, PCs and hardware. "Full-line" industrial products catalogs offer products such as

material handling products and industrial supplies. Specialty catalogs contain more focused product offerings and are targeted to individuals

most likely to purchase from such catalogs. Global mails multiple catalogs to many individuals at each location, providing the Company with

multiple points-of-entry into a business location. Once a prospect purchases a particular product, however, the Company's customers have

exhibited strong brand loyalty resulting in limited customer overlap among the Company's various catalog brands. This multiple brand strategy,

and the accompanying customer exposure to the Company's products, is a crucial factor in the Company's strategy to increase sales volume

through broader market coverage and improve the productivity of its customer file through more focused marketing.

Global has invested consistently and aggressively in developing a proprietary customer and prospect database. This database, which includes

more than 40 million names, represents a major asset of the Company. The Company considers its customers to be the various individuals that

work within an organization rather than the business location itself. The customer and prospect database includes detailed information,

including company size, number of employees, industry, various demographic and geographic characteristics and purchase history.

Management believes that this variety and depth of information on its customers provides Global a significant competitive advantage.

During 1997, the Company distributed approximately 162 million catalogs of which approximately 125 million catalogs were mailed in North

America and approximately 37 million catalogs were distributed in Europe. At December 31, 1997, the Company had 1.8 million "active"

customers (defined as individuals that have purchased from the Company within the preceding 12 months).

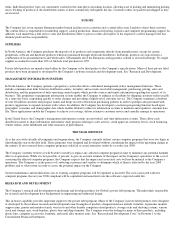

In its mailings, the Company seeks to maximize the response rates of its catalogs. The Company calculates response rate as total catalogs

mailed for the period divided by the total number of orders entered for the same period. The following table shows the approximate number of

catalogs distributed by the Company and the catalog response rates:

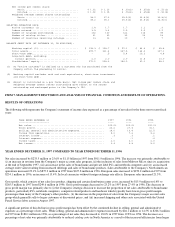

CATALOGS DISTRIBUTED - YEAR ENDED DECEMBER 31

1997 1996 1995

---- ---- ----

Computer and Computer Related Products ..... 80% 75% 66%

Office Products and Industrial Products...... 20 25 34

-- -- --

Total ................................. 100% 100% 100%

=== === ===

(IN MILLIONS EXCEPT RESPONSE RATES) 1997 1996 1995

----------------------------------- ---- ---- ----

North America.................................... 125 120 90

Europe........................................... 37 40 32

---- ---- ----

Total........................................ 162 160 122

====== ====== ======

Response rates................................... 2.18% 2.12% 2.08%