Circuit City 1997 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 1997 Circuit City annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.GLOBAL DIRECTMAIL CORP

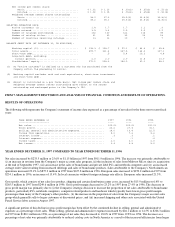

STATEMENTS OF CONSOLIDATED CASH FLOWS

FOR THE YEARS ENDED DECEMBER 31, 1997, 1996 AND 1995

(IN THOUSANDS)

1997 1996 1995

---- ---- ----

CASH FLOWS PROVIDED BY OPERATING ACTIVITIES:

Net income $ 38,812 $ 43,704 $ 35,720

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization, net 5,715 3,813 2,098

Charges associated with the impairment of certain

long lived assets 9,200 - -

Benefit for deferred income taxes (5,308) (330) (1,959)

Provision for returns and doubtful accounts 3,283 2,745 4,178

Changes in certain assets and liabilities:

Accounts receivable (18,395) (29,242) (15,261)

Inventories 3,103 (20,748) (12,155)

Prepaid catalog and other prepaid expenses (1,569) 7,028 (8,500)

Accounts payable and accrued expenses (1,727) 15,760 6,921

------ ------ -----

Net cash provided by operating activities 33,114 22,730 11,042

--------- ----------- ------

CASH FLOWS USED IN INVESTING ACTIVITIES:

Net change in short term instruments 22,014 (31,031) -

Investments in property, plant and equipment (9,989) (8,805) (4,859)

Loans to affiliated entities - - (5,631)

Acquisition of net assets of businesses acquired (37,227) - (1,185)

--------- --------- ----------

Net cash used in investing activities (25,202) (39,836) (11,675)

-------- --------- ----------

CASH FLOWS (USED IN) PROVIDED BY FINANCING

ACTIVITIES:

Net cash provided by short term borrowings from banks - 478 -

Borrowings of long term debt - - 8,392

Repayment of long term debt (470) (6,442) (27,550)

Repayment from related parties - - 4,702

Proceeds from sale and issuance of common shares - 29,896 134,412

Dividends paid - - (2,000)

Payment of notes payable to shareholders - - (97,800)

------------- -------------- ----------------

Net cash (used in) provided by financing activities (470) 23,932 20,156

------------ --------------- ----------------

EFFECTS OF EXCHANGE RATES ON CASH 779 (92) 128

-------- ---------- -----------

NET INCREASE IN CASH AND CASH EQUIVALENTS 8,221 6,734 19,651

--------- ---------- -----------

CASH AND CASH EQUIVALENTS - BEGINNING OF PERIOD 35,211 28,477 8,826

--------- ---------- -----------

CASH AND CASH EQUIVALENTS - END OF PERIOD $ 43,432 $ 35,211 $ 28,477

========= ========== ===========

SUPPLEMENTAL DISCLOSURES:

Interest paid $ 376 $ 1,194 $ 2,548

======== ========= ===========

Income taxes paid $ 29,497 $ 26,606 $ 14,957

======== ========= ===========

See notes to consolidated financial statements.