Circuit City 1997 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 1997 Circuit City annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.LIQUIDITY AND CAPITAL RESOURCES

The Company's primary capital needs have been to fund the working capital requirements necessitated by its sales growth and acquisitions. The

Company's primary sources of financing have been cash from operations, equity offerings, and to a lesser extent bank borrowings. The

Company believes that its cash flows from operations and available lines of credit will be adequate to support its current and anticipated

activities.

Net cash provided by operating activities was $33.1 million, $22.7 million and $11.0 million in 1997, 1996 and 1995, respectively. The

increase from 1996 to 1997 was due to increased asset management, specifically accounts receivable and inventory. The increase from 1995 to

1996 was due to increased working capital as a result of increased sales, improved management of inventory and accounts receivable and

reduced levels of unprinted catalog paper in response to stabilizing paper prices.

Net cash used in investing activities in 1997 was primarily the result of the acquisition of Midwest Micro and the acquisition of additional

furniture, fixtures and leasehold improvements at the new Compton, California facility to accommodate the increased staff levels. Those

expenditures were partially offset by a decrease in short-term investments, for a net outlay of $25.2 million for the year. For 1996, net cash

used in investing activities was $39.8 million, resulting from the investment of surplus cash and the acquisition of computer equipment and

additional furniture and fixtures at the Naperville, Illinois facility to accommodate increased staff levels. For 1995, net cash used in investing

activities was $11.7 million resulting from the acquisition of TigerDirect, property and equipment and the repayment of amounts due to

affiliates.

Net cash (used in) provided by financing activities was ($ .5) million, $23.9 million and $20.2 million in 1997, 1996 and 1995, respectively.

The use of funds in 1997 was primarily due to the repayment of long-term debt. For 1996 net cash provided by financing activities resulted

from the net proceeds from the sale and issuance of 1.0 million shares of common stock, as partially offset by the repayment of long-term bank

debt and the settlement of long-term capital leases. The source of funds in 1995 was due mainly to the net proceeds of the Company's initial

public offering net of the repayment of officers' notes payable and repayment of bank debt.

The Company maintains unsecured lines of credit with various financial institutions under which the maximum aggregate amount available is

$95.0 million. As of December 31, 1997, the Company had no outstanding borrowings under the lines of credit. The lines of credit bear interest

at either the prime rate, LIBOR plus 63 basis points or at the respective bank's base rate and expire on various dates through December 1998. In

addition, the Company may have outstanding letters of credit equal to an amount of the total line less outstanding borrowings.

The Company also maintains a secured line of credit with a bank with a maximum amount available of 2.0 Pounds Sterling. There were no

borrowings under this facility as of December 31, 1997. This line expires in April 1998 and provides for interest at the bank's base rate (6% at

December 31, 1997) plus 2%.

The Company does not anticipate any difficulty in renewing or replacing any of its lines of credit as they expire.

Anticipated capital expenditures in 1998 are expected to be approximately $20 million, which the Company plans to fund out of cash from

operations and existing cash and cash equivalents. These capital expenditures are primarily for

(i) the relocation and expansion of the Company's sales and distribution centers and (ii) the acquisition of information technology systems and

other fixed assets.

FORWARD LOOKING STATEMENTS

This report contains forward looking statements within the meaning of that term in the Private Securities Litigation Reform Act of 1995

(Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934). Additional written or oral forward

looking statements may be made by the Company from time to time, in filings with the Securities Exchange Commission or otherwise.

Statements contained herein that are not historical facts are forward looking statements made pursuant to the safe harbor provisions referenced

above. Forward looking statements may include, but are not limited to, projections of revenue, income or loss and capital expenditures,

statements regarding future operations, financing needs, compliance with financial covenants in loan agreements, plans for acquisition or sale

of assets or businesses and consolidation of operations of newly acquired businesses, and plans relating to products or services of the Company,

assessments of materiality, predictions of future events and the effects of pending and possible litigation, as well as assumptions relating to the

foregoing. In addition, when used in this discussion, the words "anticipates", "believes", "estimates", "expects", "intends", "plans" and

variations thereof and similar expressions are intended to identify forward looking statements.

Forward looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified based on current

expectations. Consequently, future events and actual results could differ materially from those set forth in, contemplated by, or underlying the

forward looking statements contained in this report. Statements in this report, particularly in "Item 1. Business", "Item 3. Legal Proceedings",

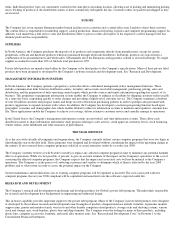

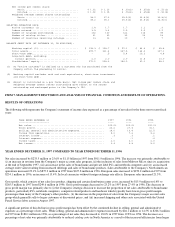

Net sales...................................... $ 218.7 $ 213.7 $ 225.9 $ 253.6

Gross profit................................... 65.0 60.1 60.3 64.2

Income from operations......................... 18.3 15.5 16.8 18.9

(1) Includes approximately $62 million of net sales from Midwest Micro acquired

on September 30, 1997.