Chevron 2003 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2003 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

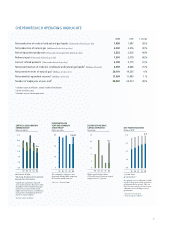

CHEVRONTEXACO FINANCIAL HIGHLIGHTS

Millions of dollars, except per-share amounts 2003 2002 % Change

Net income $ 7,230 $ 1,132 539 %

Sales and other operating revenues $ 120,032 $ 98,691 22 %

Capital and exploratory expenditures* $ 7,363 $ 9,255 (20)%

Total assets at year-end $ 81,470 $ 77,359 5 %

Total debt at year-end $ 12,597 $ 16,269 (23)%

Stockholders’ equity at year-end $ 36,295 $ 31,604 15 %

Cash fl ow from operating activities $ 12,315 $ 9,943 24 %

Common shares outstanding at year-end (Thousands) 1,069,148 1,068,137 –

Per-share data

Net income before cumulative effect

of changes in accounting principles – diluted $ 7.14 $ 1.07 567 %

Net income – diluted $ 6.96 $ 1.07 550 %

Cash dividends $ 2.86 $ 2.80 2 %

Stockholders’ equity $ 33.95 $ 29.59 15 %

Common stock price at year-end $ 86.39 $ 66.48 30 %

Total debt to total debt-plus-equity ratio 25.8% 34.0%

Return on average stockholders’ equity 21.3% 3.5%

Return on average capital employed (ROCE) 15.7% 3.2%

* Includes equity in affi liates

0.0

8.0

6.0

4.0

2.0

0099 01 02 03

$7.2

NET INCOME

Billions of dollars

Net income rose sharply on the strength

of upstream operations and much-

improved results from the downstream

businesses in 2003. Special-item charges

in 2002 reduced earnings more than

$3 billion.

0.0

120.0

100 .0

80.0

60.0

40.0

20.0

0099 01 02 03

$120.0

SALES & OTHER

OPERATING REVENUES

Billions of dollars

Sales and other operating revenues

increased 22 percent on higher prices

for crude oil, natural gas and refined

products.

0.0

15.0

12.0

9.0

6.0

3.0

0099 01 02 03

$12.3

CASH PROVIDED BY

OPERATING ACTIVITIES

Billions of dollars

Higher earnings helped boost the

company’s operating cash flow by

24 percent.

0.00

3.00

2.50

2.00

1.50

1.00

0.50

0099 01 02 03

$2.86

ANNUAL CASH DIVIDENDS

Dollars per share

The company increased its annual

dividend payout for the 16th con-

secutive year.