Chevron 2003 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2003 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2

Last year, I wrote of the challenge ChevronTexaco faced to improve its

fi nancial performance. I am pleased to report that we are succeeding.

Not only was 2003 one of our best years ever, but we also built a

solid foundation that should enable us to deliver sustained, strong

performance into the future and continue to achieve our long-stated

goal to be No. 1 in total stockholder return among our peer group.

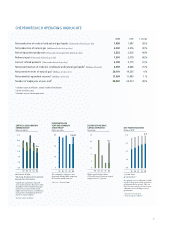

In 2003, net income was $7.2 billion, resulting in a 15.7 percent annual return on capital employed. Our strong cash

fl ow enabled us to reduce debt $3.7 billion, ending the year with a total debt to total debt-plus-equity ratio of

25.8 percent. For the 16th consecutive year, we increased our annual dividend payment. Our fi nancial performance

was refl ected in our total stockholder return of 35.2 percent in 2003. Since 2000, we have led our largest three com-

petitors in total stockholder return.

Other signifi cant achievements included:

• continuing successes in exploration, with major new discoveries in the deepwater U.S. Gulf of Mexico and Nigeria;

• replacing more than 100 percent of production for the 11th consecutive year;

• achieving signifi cant progress in major upstream projects in Angola, Canada, Chad, Kazakhstan, Nigeria and Venezuela;

• establishing a global natural gas business and achieving milestones in the commercialization of our vast Australian

and West African gas resources;

• signifi cantly improving performance in refi ning and marketing.

OUR STRATEGIES – STEPPING UP THE PACE Our global upstream strategy is to grow profi tability in our core

areas and build new legacy positions. We are well positioned to do both. Our crude oil and natural gas production

is located in large basins around the globe where we have existing infrastructure and are typically one of the top

three producers. We have a queue of projects that will add to production throughout the decade and beyond. We

hold exploratory acreage in some of the most promising regions of the world, and we are confi dent we can build on

an already successful exploratory program. In 2003, we established a business development group responsible for

identifying and developing new, large-scale resource opportunities throughout the world.

Our global natural gas strategy is to commercialize our large equity resource base by targeting the rapidly growing

North American and Asian markets. In the Atlantic Basin, we are pursuing several liquefi ed natural gas (LNG) projects

that would supply the fi rst offshore LNG regasifi cation terminal in the United States. In the Pacifi c Basin, we are

expanding our successful LNG business in Australia to supply markets in North America and Asia. We also are moving

forward on a gas-to-liquids project in Nigeria.

Our global downstream strategy is to improve future returns by focusing on areas of market and supply strength.

Our core areas of operation include the U.S. West Coast, U.S. Gulf of Mexico, Asia and Latin America. In 2003, we

initiated a major restructuring of our global downstream operations. We are committed to achieving before-tax

profi t improvements of $500 million by the end of 2005 through cost reductions, effi ciency improvements and the

standardization of key work processes.

DELIVERING TOP PERFORMANCE While we are proud of the value we have created, we recognize that the confi -

dence of stockholders rests in their expectation of future performance, not in past accomplishments.

TOOUR STOCKHOLDERS