Chesapeake Energy 1999 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 1999 Chesapeake Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We built Chesapeake's balance sheet to withstand

the downturns that periodically occur in our

industry. Other than a small working capital facil-

ity, none of Chesapeake's debt is owed to banks.

Instead, our capital providers have been high-yield

mutual funds and insurance companies that do not

require repayment for years to come (2004 is our

earliest maturity, 2012 the latest). With their

understanding of the ups and downs of the energy

industry, these capital providers do not require

collateral or other rigid lending provisions

imposed by traditional lenders. This flexibility

enabled us to carry on through last year's turbu-

lent cycle so our shareholders could enjoy this

year's resurgent oil and gas prices.

Chesapeake's low costs lead the industry

In addition to a resilient balance sheet and a

strategically focused emphasis on natural gas, we

also enjoy an industry-leading cost structure. This

attractive cost structure reflects the high quality of

our properties and the strong work ethic of our

employees and hence, our motto Energy At Work.

As a young company in a rapidly aging industry

(50% of the industry's technical talent will reach

retirement age in the next 12 years), we believe we

can stay a step ahead of the competition. And with

all of Chesapeake's employees owning stock (man-

agement and directors together own 25% of the

total shares), we are motivated to work especially

hard to create shareholder value.

In addition, our wells' average productivity is 50%

higher than the industry's average and their close

proximity to a well-developed service infrastruc-

ture provides for lower current and future main-

tenance costs.

Growth capital used to build Chesapeake's

premier natural gas franchise

The debt we incurred and assets we acquired during

the past 10 years have enabled us to build

Chesapeake into one of the largest natural gas fran-

chises in the U.S. The providers of Chesapeake's

growth capital (ultimately the individual investors in

the mutual funds, 401-K plans, and insurance poli-

cies who invest in high yield debt) entrusted their

investment to us for extended periods so that we

would have time to execute our strategy and create

value for investors.

Our wells' average produc-

tivity is 50% higher than

the industry average and

their close proximity to a

well-developed service

infrastructure provides for

lower current and future

maintenance costs.

And create value we have. By our calculation,

Chesapeake is one of only three public U.S. oil and

gas producers founded in the past 10 years that is

now valued at over $1 billion. From a $50,000 invest-

ment in 1989, we have built Chesapeake into one of

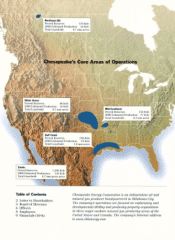

the 15 largest gas producers in the U.S. and among

the four largest gas producers in the Mid-Continent.

Looking ahead

As we look forward to 2000 and beyond, we are

excited about several developing trends. First, we

have reestablished Chesapeake's long-term growth

potential. As we think about 2004, the year of our

first senior note maturity, we believe we can

Chesapeake Energy Corporation Annual Report 1999 3