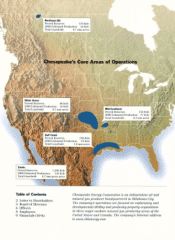

Chesapeake Energy 1999 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 1999 Chesapeake Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

What a difference a year makes! Rarely does the

outlook for an industry change so dramatically in

the course of a year. Early in 1999, oil and natural

gas prices collapsed to near 20-year lows of $10 per

barrel and $1.50 per mcf. Observers such as The

Economist magazine dramatically proclaimed that

the world was drowning in what soon would be $5

oil. They also predicted that all commodity prices,

particularly oil and gas, were likely to stay low for

the foreseeable future. Looking back, that predic-

tion in March 1999 in fact marked the bottom of the

pricing cycle. Energy prices are today near 20-year

highs of $30 per barrel and almost $3 per mcf.

The dramatic pricing swings of the past year high-

light oil and natural gas as the most volatile com-

modities in the world. As a consequence, investing

in oil and gas companies is not for the faint of heart

and requires a willingness to ride out challenging

times. However, America's growing demand for

energy, particularly clean-burning natural gas, has

set the stage for what is likely to be a sustained

period of strong energy pricing and substantial

rewards for Chesapeake's shareholders.

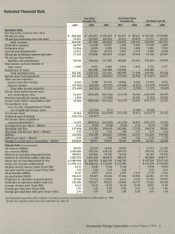

Excellent results in 1999

Despite a very tough operating environment in 12 of

the past 18 months, Chesapeake has continued to

overcome challenges and achieve our goal of creat-

ing value-added growth for our investors. Listed

below are a few of Chesapeake's accomplishments

in 1999 compared to 1998's results:

net income of $33 million, compared to a loss of

$934 million

operating cash flow of $138 million, an increase

of 20%

ebitda (cash flow plus interest expense) of $219

million, up 20%

2

Letter to Shareholders

proved oil and gas reserves of 1,206 bcfe, an

increase of 11%

oil and gas production of 134 bcfe, up 3% even

after property sales

reserve replacement of 186% at a cost of only

$0.65 per mcfe

In achieving these results, we stayed true to

Chesapeake's single-minded focus on developing

onshore natural gas reserves, generated a terrific

year in replacing reserves with the drillbit, and

delivered the highest return to shareholders in our

peer group with a stock price increase of 153%.

Balance sheet resiliency -

the key to surviving tough times

While we could not have predicted the strength or

timing of the current oil and gas price recovery, we

did correctly anticipate that industry supply and

demand fundamentals would improve and, in time,

cause oil and gas prices to increase. Accordingly,

we managed our way through the challenges of late

1998 and the first half of 1999 by focusing on

strategically exploiting our asset base while still

maintaining balance sheet liquidity. Our balance

sheet, though more leveraged than we would pre-

fer, proved to be very resilient during these tough

times. Many other companies with less flexibility

were forced by their creditors to sell properties at

the bottom of the pricing cycle.