Chesapeake Energy 1999 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 1999 Chesapeake Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART I

ITEM 1. Business

General

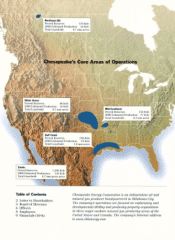

Chesapeake Energy Corporation ("Chesapeake" or the "Company") is an independent oil and gas company

engaged in the development, exploration, acquisition and production of onshore natural gas and oil reserves in the

United States and Canada. Chesapeake began operations in 1989 and completed its initial public offering in 1993.

Its common stock trades on the New York Stock Exchange under the symbol CHK. The Company's principal

offices are located at 6100 North Western Avenue, Oklahoma City, Oklahoma 73118 (telephone 405/848-8000 and

website address of chkenergy.com).

Chesapeake owns interests in approximately 4,700. producing oil and gas wells concentrated in three primary

operating areas: the Mid-Continent region of Oklahoma, western Arkansas, southwestern Kansas and the Texas

Panhandle; the Gulf Coast region consisting primarily of the Austin Chalk Trend in Texas and Louisiana and the

Tuscaloosa Trend in Louisiana; and the Helmet area of northeastern British Columbia. During 1999, the Company

produced 133.5 Bcfe, making Chesapeake one of the 15 largest public independent oil and gas producers in the

United States.

Business Strategy. From inception .as a start-up in 1989 through today, Chesapeake's business strategy has been

to aggressively build and develop one of the largest onshore natural gas resource bases in the U.S. The Company

has executed its strategy through a combination of active drilling and acquisition programs during the past 10 years.

Based on its view that natural gas will become the fuel of choice in the 2l century to meet growing power demand

and increasing environmental concerns, Chesapeake believes its strategy will deliver attractive returns and

substantial growth opportunities in the years ahead.

1999 Highlights. In the challenging oil and gas environment of 1999, the Company focused its efforts on drilling

lower risk developmental wells, acquiring reserves at the lowest possible cost, divesting of higher cost and non-

strategic properties and maintaining a capital expenditure budget closely tied to operating cash flow and proceeds

from asset sales. Despite experiencing 20-year lows in oil and gas pricing during the first half of 1999, Chesapeake

achieved considerable operating and financial progress during the year. Listed below are a few of Chesapeake's

accomplishments in 1999 compared to 1998's results:

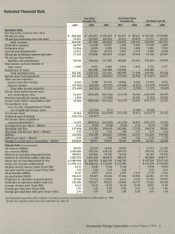

net income of $33 million, compared to a net loss of $934 million

-cash flow from operations (before changes in working capital) of $139 million, an increase of 18%

proved oil and gas reserves of 1,206 Bcfe, an increase of 11%

-oil and natural gas production of 133.5 Bcfe, an increase of 3%

reserve replacement of 186% at a cost of $0.65 per Mcfe

In addition, Chesapeake's operating cost structure remained among the lowest of all publicly traded independent

energy producers during 1999. The Company's per unit operating costs (consisting of general and administrative

expenses, production expenses, production taxes, and depreciation, depletion and amortization of oil and gas

properties) were $1.26 per Mcfe of production, resulting in an operating margin of $0.84 per Mcfe. The Company's

low costs are attributable to its focus on developing highly productive natural gas properties, its efficient and

motivated employees, and the successful integration of advanced drilling and completion expertise with its large

inventory of undeveloped leasehold.

During 1999 and early 2000, Chesapeake was successful in defeating two material pieces of litigation against the

Company. First, in the 1996 Union Pacific Resources Corporation patent infringement litigation involving

horizontal drilling, the U.S. District Court in Ft. Worth dismissed the lawsuit, ruling in September 1999 that a patent

previously granted to UPRC was invalid and therefore Chesapeake could not have infringed upon it. Second, in

March 2000, the U.S. District Court in Oklahoma City dismissed a class action securities suit which had been

pending against the Company since 1997.

-2-