Cemex 2012 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2012 Cemex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We also continued to successfully access the global

capital markets. In March, we completed separate of-

fers to exchange our 2014 Eurobonds and our out-

standing series of perpetual debentures for new senior

secured notes denominated in dollars and euros. Ap-

proximately 53% of the outstanding 2014 Eurobonds

and 48% of the outstanding perpetual debentures were

exchanged into new senior secured notes, maturing in

2019, resulting in a reduction of our company’s overall

indebtedness of approximately US$131 million. Ad-

ditionally, in October, we issued US$1.5 billion of new

9.375% senior secured notes, maturing in 2022. We

used the proceeds from these notes and CLH’s initial

share offering to prepay debt under the new Facilities

Agreement and the Financing Agreement. As a result

of these prepayments, we reduced the spread over

three-month LIBOR on the new Facilities Agreement to

450 basis points, the same spread we had under the

original Financing Agreement.

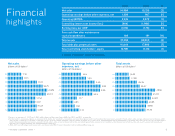

Under this year’s successful financial plan, we reduced

the amount of debt maturing through March 2015 to

about US$750 million of which approximately US$600

million matures during the first quarter of 2014. We

addressed all of our required amortizations under the

new Facilities Agreement until February 2017. We fur-

ther increased the average life of our debt to 5.0 years,

from 3.8 years at the beginning of the year, with no

significant change in our annual interest expense.

5.0

3.8

US$750

million as part of this year’s

financial plan

Debt maturing through March

2015, reduced to

Today, we are not only in better

shape financially, but also we

are much more agile and flex-

ible operationally. We are work-

ing on all of the main drivers

to regain an investment-grade

capital structure: reducing our

debt while improving our oper-

ating EBITDA generation.

20112012

Average life of debt

as of December 31

Double U Oce Building, Germany

16

< previous I contents I next >