Cemex 2012 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2012 Cemex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Over the course of the year, we took decisive steps to

improve our debt maturity profile, strengthen our capi-

tal structure, and regain our financial flexibility. In the

process, we appreciably increased the average life of

our debt, deleveraged our balance sheet, reduced our

refinancing risk, and enhanced our liquidity.

Among our noteworthy achievements, we refinanced

close to US$6.7 billion of debt under the Financing

Agreement, dated as of August 14, 2009, as amended,

with the support of over 55 banks and institutions.

Specifically, creditors representing approximately

92.7% of the aggregate principle amount outstanding

under the Financing Agreement agreed to exchange

their loans and private placement notes. The results of

the refinancing process were:

First, the issuance of US$6.2 billion of new loans and

new private placement notes pursuant to a new Facili-

ties Agreement and a new Note Purchase Agreement.

The final maturity of the new Facilities Agreement is

February 2017.

Second, the issuance of US$500 million of new 9.5%

senior secured notes due in 2018.

Third, approximately US$525 million remained under

the original Financing Agreement.

As a result of this milestone transaction, we not only

extended the final maturity of this debt by three years,

but also gained more financial and operational flexibil-

ity, which provides us with more time to benefit from

the recovery of our markets and more opportunity to

further consolidate our transformation efforts.

In addition, we completed the initial share offering of

a 26.65% minority position in CEMEX Latam Holdings

(CLH). CLH comprises our business units in Colombia,

Panama, Costa Rica, Nicaragua, Guatemala, El Salvador,

and Brazil. Through this transformational transaction,

we not only received approximately US$960 million

to pay down debt, but also—for the first time ever—we

enabled minority stockholders to participate in the fu-

ture growth and upside potential of a developing region

through their equity stake in an operating subsidiary.

We further unlocked untapped value, broadened our

overall base of stockholders, and enhanced our finan-

cial flexibility.

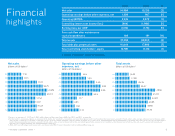

Financial

developments

US$960

US$6.7

million in net proceeds from the initial

share offering of a 26.65% minority posi-

tion in CEMEX Latam Holdings

billion of debt under the Financing Agree-

ment refinanced into a new Facilities

Agreement, extending final maturity of

this debt to February 2017

LATAM

HOLDINGS

Cultural Center Library, Colombia

15

< previous I contents I next >