Cathay Pacific 2014 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2014 Cathay Pacific annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT 2014

3

Chairman’s Letter

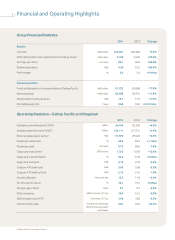

The Cathay Pacific Group reported an attributable profit of HK$3,150 million for 2014.

This compares to a profit of HK$2,620 million in 2013. Earnings per share were

HK80.1 cents compared to HK66.6 cents in 2013. Turnover for the year increased by

5.5% to HK$105,991 million.

In the first half of 2014 our business was affected by high

fuel prices, reduced passenger yield and continued

weakness and over-capacity in the air cargo market. Our

business is normally better in the second half than in the

first half. This was the case in 2014. For the full year,

passenger demand was reasonably firm, with high demand

during the peak summer and Christmas periods. After a

prolonged period of weakness, cargo demand started to

improve in the summer of 2014 and was strong in the fourth

quarter, which is the peak period for cargo. Our business

benefited from lower fuel prices in the fourth quarter, but

this was partially offset by fuel hedging losses.

The Group’s passenger revenue for 2014 increased by 5.4%

to HK$75,734 million. Capacity increased by 5.9% as a

result of the introduction of new routes (to Doha,

Manchester and Newark) and increased frequencies on

some existing routes. The load factor increased by 1.1

percentage points to 83.3% and the number of passengers

carried increased by 5.5% to 31.6 million. Yield decreased

by 1.8% to HK67.3 cents despite an improvement in the

second half compared to the first half of the year.

Passenger demand was strong in all classes of travel on

long-haul routes. However, the increase in passenger

numbers did not match the increase in capacity on North

American routes. Strong competition put downward

pressure on yield on regional routes.

After a prolonged period of weakness, cargo demand

started to improve in the summer of 2014 and was very

strong in the fourth quarter. The Group’s cargo revenue in

2014 increased by 7.3% to HK$25,400 million compared to

the previous year. Over-capacity in the air cargo market put

downward pressure on rates in the first half of the year. Yield

for the full year for Cathay Pacific and Dragonair decreased

by 5.6% to HK$2.19, despite improved cargo demand in the

second half. Capacity increased by 10.4%. The load factor

increased by 2.5 percentage points to 64.3%. We managed

capacity in line with demand in the first half of 2014, but

were able to operate an almost full freighter schedule for

most of the second half. Our new cargo terminal worked

effectively in its first full year of operation and made our

cargo operations more efficient.

Fuel is the Group’s most significant cost and our fuel costs

in 2014 (disregarding the effect of fuel hedging) increased

by 0.7% compared to 2013, significantly below the increase

in passenger and cargo capacity of 5.9% and 10.4%

respectively. Fuel consumption increased because more

flights were operated, but the introduction of more fuel-

efficient aircraft and the retirement of less fuel-efficient

aircraft moderated the increase. We also benefited from

lower fuel costs in the fourth quarter. Fuel accounted for

39.2% of our total operating costs, compared to 39.0% in

2013. Managing the risk associated with high and volatile

fuel prices is a priority. Our fuel hedging contracts extend to

2018. The sharp reduction in fuel prices in the fourth quarter

of 2014 caused a very welcome net benefit to overall

profits. However, it resulted in losses on our hedging

contracts. It also resulted in significant unrealised

hedging losses. These unrealised losses are reflected

in the consolidated statement of financial position at

31st December 2014 and caused a reduction in our

consolidated net assets.

We continue to invest heavily in our fleet. We took delivery

of 16 new aircraft in 2014: nine Boeing 777-300ER aircraft,

five Airbus A330-300 aircraft and (for Dragonair) two Airbus

A321-200 aircraft. Six Boeing 747-400 passenger aircraft

were retired during the period. In 2013, we agreed to sell our

six Boeing 747-400F freighters back to The Boeing

Company. One of them was delivered in November 2014.

Two of the remaining freighters are parked and all five of

them will have left the fleet by the end of 2016. At 31st

December 2014 we had 79 new aircraft on order for delivery

up to 2024. A total of nine new aircraft are scheduled for

delivery in 2015.

We continue to develop our passenger and cargo networks.

In 2014, Cathay Pacific introduced passenger services to

Doha, Manchester and Newark. We will introduce passenger

services to Zurich in March 2015, to Boston in May 2015 and

to Dusseldorf in September 2015. We reorganised our

network in the Middle East in 2014. We stopped flights to

Abu Dhabi and Jeddah but improved our schedules on

other Middle Eastern routes. We stopped flying to Karachi.

The Los Angeles service was increased to four-times-daily