Bridgestone 2004 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2004 Bridgestone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7

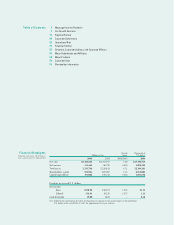

Our Growth Scenario

Raw material costs

its output. The tire plant scheduled for construction in Monterrey, Mexico, will supply tires mainly

to the North American market. And the new Brazilian plant will be able to export some of its output

as necessary.

In Japan, we are focusing our production capacity on high-value-added tires. That includes high-

performance tires, large rim size tires, runflat tires, and studless winter tires for passenger cars. It

also includes truck and bus tires and off-the-road tires. Japanese export capacity in these and other

tires will remain a strategic resource for us in serving global demand flexibly.

Pushing up raw material costs is the same economic expansion that is increasing demand for our

products in emergent economies. Supplies are somewhat flexible in natural rubber, and increased

planting on rubber estates will help restore the supply-and-demand balance over time. Supplies are

less flexible in oil- and steel-based raw materials, however, and users of those materials appear likely

to continue to bid prices upward.

We will recoup part of the higher costs for raw materials through price increases for our tires and

other products. We will also work to offset the higher costs by promoting high-value-added prod-

ucts and by raising productivity. But some adverse effect on our operating profit margins will pre-

sumably be unavoidable.

Previous page:

Our new plant for truck and bus tires in

Thailand’s Chonburi Province augments our

flexibility in serving demand worldwide.

Bridgestone Group plants in Japan, Spain,

Brazil, and other nations are also expanding

production capacity for truck and bus tires.

Our price increases

for replacement tires in

Japan in June 2004 were our

first there in 13 years. They

followed price increases for

our tires in every other main

market. We will consider

further price increases as

necessary to offset the

continuing upward trend

in raw material costs.

2004

HIGHLIGHTS

Right:

A competitive edge in technological

development underlies our compet-

itiveness in off-the-road tires for

earthmoving equipment and other

large machinery. The Bridgestone

Group is a world leader in the

largest sizes of off-the-road tires,

and we are expanding our

Japanese production capacity for

off-the-road tires of small and

medium size.

The São Paulo Plant, in Brazil, produces tires

for passenger cars and for trucks and buses.

Its production capacity for truck and bus tires

is undergoing expansion, and a second

Bridgestone Group tire plant in Brazil—for

producing passenger car tires—is under

construction in the state of Bahia.

Our new tire plant in the city of Wuxi, in

China’s Jiangsu Province, is our third tire

plant in China and the first that we have built

there from the ground up. It began operation

in July 2004.