Bridgestone 2004 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2004 Bridgestone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6

Bridgestone Annual Report 2004

The relationship between our expanded production and our trend line for earnings is complex. We

are confident, however, of translating sales gains into earnings growth.

Overall growth in unit demand is slowing in the industrialized nations, notwithstanding the

recent vigor in North American and European demand. We expect to maintain profitable sales

growth in those nations, however, by promoting high-value tires, such as high-performance tires,

large rim size tires, runflat tires, and studless snow tires; by expanding market share; and by raising

productivity. Our revolutionary new production system, BIRD, is especially promising in regard to

improving uniformity and other aspects of quality in high-value-added tires.

In emerging and newly emerged economies, sales growth will center on mass-market tires,

though demand for large rim size tires and other high-value-added products is also growing in those

markets. Economies of scale will be decisive in maintaining sound profit margins in mass-market

tires. The Bridgestone Group is the world’s largest manufacturer of tires and other rubber products,

and that position gives us a competitive edge in economies of scale.

Profitability in all tire categories will hinge on flexibility in allocating supplies. We have built a glob-

al production network that allows for (1) supplying each principal market mainly with locally pro-

duced tires and (2) shifting supplies among regions in response to changing demand trends.

New and expanded Bridgestone plants in Southeast Asia, for example, will supply tires mainly to

export markets. We will be able to direct their output to Europe, Japan, North America, the Middle

East, and other regions as market needs warrant. Our newest Chinese plant, in Wuxi, exports part of

Output and profitability

Flexibility

The biggest challenge we face

in regard to earnings is the

rising cost of raw materials.

Although the recent surge in

natural rubber prices has

abated, those prices remain

near their historic highs. And

prices for crude oil and steel

continue to rise, which raises

our costs for synthetic rubber,

carbon black, steel tire cord,

and other raw materials.

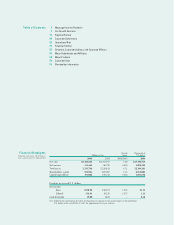

Our Growth Scenario

Expanding: 2

Our tire production volume worldwide increased an average of 4% a year over the 10 years

to 2004, and we expect to increase our production capacity at about that rate from 2005 to 2008.

Combined with the continued strengthening of our marketing and our product development

functions, that would support comparable growth in net sales.