Bridgestone 2004 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2004 Bridgestone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2

Bridgestone Annual Report 2004

This is a time of tremendous opportunity for Bridgestone,

and we are moving aggressively to capitalize on that opportunity

even while addressing huge challenges. Global demand for tires is

growing, and demand for passenger car tires in the industrialized

nations is shifting toward high-performance tires and tires of

large rim sizes. Our global production network and our unex-

celled capabilities in product development position us better than

any other tire manufacturer to serve both of these trends.

In 2004, our fiscal performance reflected the positive trends

in our markets. Net income rose 29%, to ¥114.5 billion ($1.1

billion), its highest level ever, on a 5% increase in net sales, to

¥2,416.7 billion ($23.2 billion), also a record. The growth in sales

reflected the global growth in tire demand and our success in

increasing supply capacity to meet that growth. It also reflected

a strong performance in diversified products, led by automotive

components and—in North America—by roofing materials.

The growth in net income reflected the growth in sales, but it

also reflected the challenges that we face. Chief among those chal-

lenges is an upturn of unprecedented magnitude and persistence

in prices for raw materials. That upturn diminished our operat-

ing income about ¥49 billion ($470 million) in 2004.

Another challenge is the continuing appreciation of the yen

against the dollar. The average yen/dollar exchange rate in 2004

was $1= ¥108, compared with $1= ¥116 in the previous year.

Movement in currency exchange rates diminished our operating

income about ¥6 billion ($58 million) in 2004.

We reinforced our profitability in 2004 by achieving unit sales

growth, by raising prices, by shifting our sales portfolio toward

higher-value-added products, and by employing a tax credit

available in Japan for R&D expenditures. Raw material prices

and exchange rates, however, will continue to weigh on earnings.

High and rising raw material prices, especially, are a pressing

issue of long-term ramifications for our entire industry.

While dealing with opportunity and adversity, we continued

to demonstrate a strong commitment to maximizing shareholder

value. We have repurchased shares worth approximately ¥100

billion since 2003, and we have retired shares worth about ¥50

billion. Our plans call for repurchasing shares worth ¥50 billion

in 2005.

Dividends are another important way of rewarding share-

holders. We raised our dividends for 2004 by ¥3 ($0.03), to ¥19

($0.18), and we plan a further dividend increase in 2005, to ¥20.

Management policy at Bridgestone emphasizes steady dividends.

The dividend increase for 2004 and the one planned for 2005

reflect what we regard as a fundamental improvement in our

structure of earnings.

Capitalizing on Opportunity

Our management policy centers on pursuing strategic, qualitative

growth. In that spirit, we launched a capital spending program of

unprecedented scope in 2003, and we announced a broadening

of that program in February 2005. Our tire production volume

increased an average of 4% annually over the 10 years to 2004.

To maintain that growth momentum, we have earmarked ¥227

billion for capital spending over the five years from 2003 to 2007.

That capital spending addresses the overall growth in global unit

demand for tires and the shift in industrialized-nation demand

toward high-performance tires and large rim diameter tires.

We began producing tires in 2004 at two new plants in

Thailand and China. Bridgestone Group companies are building

or preparing to build two more tire plants in Brazil and Mexico,

and we will expand our Chinese production capacity further.

The Poznan Plant, in Poland, became the Bridgestone Group’s

first plant to produce runflat tires outside Japan in late 2004,

and we are preparing to produce runflat tires in South Africa.

Runflats continue to operate safely for up to specified maximum

distances and speeds after a loss of air pressure. We have estab-

lished a de facto standard for runflat tires with our sidewall-rein-

forcement technology, and we anticipate huge growth in global

demand for those tires.

Our revolutionary BIRD production system for tires began

operation in January 2005 at our Hikone Plant, in Japan.

BIRD, which stands for Bridgestone Innovative and Rational

Development, is the world’s first tire production system that

automates the entire manufacturing sequence from the process-

ing of materials to the final inspection of the finished tires. The

new Bridgestone Group plant in Mexico will also use BIRD.

Raw materials are another emphasis in our capital spending.

We recently agreed to purchase our second rubber estate in

Indonesia. In carbon black, we reinforced our production capac-

ity in Japan in the past year and opened a plant in Thailand. We

are building a steel cord plant in China, and our U.S. production

capacity for synthetic rubber is also undergoing expansion.

A Technological Edge

Asserting a technological edge is essential to the strategic, quali-

tative growth that we seek. I have already cited our leadership

in runflat tires and our revolutionary BIRD production system.

Another example is our success in motorsports. Bridgestone tires

have carried drivers and teams to seven consecutive titles in

Formula One racing, and our tires also demonstrate convincing

performance in IndyCar and Champ Car racing, where we are

the sole tire supplier.

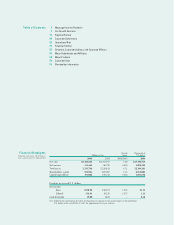

Message from the President

A Time of Unprecedented Opportunity (and huge challenges)