Barnes and Noble 2005 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2005 Barnes and Noble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17

2005 Annual Report Barnes & Noble, Inc.

[MANAGEMENT’S DISCUSSION AND

ANALYSIS OF FINANCIAL CONDITION AND RESULTS

OF OPERATIONS continued ]

Borrowings made pursuant to the New Facility as

committed loans will bear interest, payable quarterly or,

if earlier, at the end of any interest period, at either (a)

the base rate, described in the New Facility as the higher

of Bank of America N.A.’s prime rate (7.25% as of

January 28, 2006) or the federal funds rate (4.38% as

of January 28, 2006) plus 0.50%, or (b) the Eurodollar

rate (a publicly published rate which was 4.57% as of

January 28, 2006) plus a percentage spread (ranging

from 0.750% to 1.375%) based on the Company’s

consolidated fixed charge coverage ratio. Swing line

loans bear interest at the base rate. Under the New

Facility, the Company agrees to pay a commitment

facility fee, payable quarterly, at rates that range from

0.150% to 0.300% depending on the Company’s

consolidated fixed charge coverage ratio. The payments

under the New Facility are guaranteed by material

subsidiaries of the Company.

The New Facility contains customary affirmative and

negative covenants for credit facilities of this type,

including limitations on the Company and its subsidiaries

with respect to indebtedness, liens, investments,

distributions, mergers and acquisitions, disposition of

assets, sale-leaseback transactions, and transactions with

affiliates. The New Facility permits the Company to use

proceeds of the credit loans and letters of credit for

working capital and capital expenditures and for all other

lawful corporate purposes, including payment of

dividends, acquisitions of assets, capital stock of other

companies and share repurchases, in each case to the

extent permitted in the New Facility. The New Facility also

contains financial covenants that require the Company to

maintain a minimum consolidated fixed charge coverage

ratio of 1.75 and a maximum consolidated funded debt to

earnings ratio of 2.00.

The New Facility provides for customary events of default

with corresponding grace periods, including failure to pay

any principal or interest when due, failure to comply with

covenants, any material representation or warranty made

by the Company proving to be false in any material

respect, certain bankruptcy, insolvency or receivership

events affecting the Company or its subsidiaries, defaults

relating to certain other indebtedness, imposition of

certain judgments and a change in control of the

Company (as defined in the New Facility).

On June 28, 2004, the Company completed the

redemption of its $300.0 million outstanding 5.25%

convertible subordinated notes due 2009. Holders of

the notes converted a total of $17.7 million principal

amount of the notes into 545,821 shares of common

stock of the Company, plus cash in lieu of fractional

shares, at a price of $32.512 per share. The Company

redeemed the balance of $282.3 million principal

amount of the notes at an aggregate redemption price,

together with accrued interest and redemption

premium, of $295.0 million. The write-off of the

unamortized portion of the deferred financing fees from

the issuance of the notes and the redemption premium

resulted in a charge of $14.6 million.

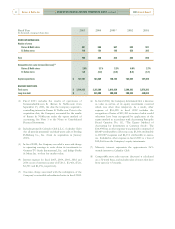

Selected information related to the Company’s term

loan, convertible subordinated notes and the New and

Prior Facilities:

Fiscal Year 2005 2004 2003

Revolving credit facility

$— — —

Term loan

— 245,000 —

Convertible subordinated notes

— — 300,000

Balance at end of year

$ — 245,000 300,000

Average balance outstanding

during the year

$ 121,915 276,043 342,469

Maximum borrowings outstanding

during the year

$ 245,000 392,700 474,150

Weighted average interest rate

during the year

6.91% 5.25% 6.33%

Interest rate at end of year

— 3.78% 5.25%

Fees expensed with respect to the unused portion of the

New and Prior Facilities were $1.3 million, $1.0 million

and $1.2 million, during fiscal 2005, 2004 and 2003,

respectively.

The amounts outstanding under the New and Prior

Facilities, if any, have been classified as long-term debt

based on the Company’s ability to continually maintain

principal amounts outstanding.

The Company has no agreements to maintain

compensating balances.

Capital Investment

Capital expenditures totaled $187.2 million, $184.9

million and $130.1 million during fiscal 2005, 2004

and 2003, respectively. Capital expenditures in fiscal

2006, primarily for the opening of 30 to 40 new Barnes

& Noble stores, the maintenance of existing stores and

system enhancements for the retail stores and the Web

site, are projected to be in the range of $190.0 million

to $200.0 million, although commitment to many of

such expenditures has not yet been made.

Based on current operating levels and the store

expansion planned for the next fiscal year, management