Barnes and Noble 2005 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2005 Barnes and Noble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

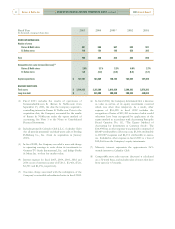

[MANAGEMENT’S DISCUSSION AND

ANALYSIS OF FINANCIAL CONDITION AND RESULTS

OF OPERATIONS continued ]

10

2005 Annual ReportBarnes & Noble, Inc.

acquisition of all of Bertelsmann AG’s (Bertelsmann)

interest in barnesandnoble.com inc. (bn.com) and

Barnes & Noble.com. As a result of the acquisition,

the Company increased its economic interest in Barnes

& Noble.com from approximately 38% to

approximately 75%. On May 27, 2004, the Company

completed a merger (the Merger) of bn.com with a

wholly owned subsidiary of the Company. The Merger

was approved by the shareholders of bn.com at a

special meeting held on May 27, 2004. As a result of

the Merger, bn.com became a privately held company,

wholly owned by the Company.

Barnes & Noble.com sells books, music and movies,

and, to a lesser extent, used books, gifts, educational

games, toys and video games. With access to one of the

industry’s largest in-stock inventories of new books,

Barnes & Noble.com can offer fast delivery throughout

the U.S. Barnes & Noble.com’s unique service,

“Fast&Free Delivery,” enables customers in the

continental U.S. to receive their deliveries within three

business days, with no delivery charge on purchases of

$25 and over. Visited by millions of users each month,

Barnes & Noble.com has shipped products to

customers in 230 countries since its inception in 1997.

Barnes & Noble.com provides exclusive content

features such as “Meet the Writers,” “What America’s

Reading,” and audio and video author interviews,

online reading groups, as well as third-party reviews,

first chapters and table of contents, and thousands of

music clips and video trailers.

In the fourth quarter 2005 American Customer

Satisfaction Index compiled by the University of

Michigan, Barnes & Noble.com received the highest

rating in the e-commerce category for the second year in

a row. This annual survey is recognized as the industry’s

leading indicator of customer satisfaction. According

to the comScore MediaMetrix December 2005 report,

Barnes & Noble.com’s site was the twenty-first most-

trafficked shopping destination, as measured by the

number of unique visitors.

The Company’s subsidiary Sterling is a leading general

trade book publisher. Sterling’s active title list comprises

over 5,000 titles, and publishes several hundred new titles

each year. Sterling’s publication list is particularly extensive

in “books for enthusiasts,” categories that include mind

enhancement, puzzles and games, crafts, home repair and

remodeling, woodworking, photography, and wines and

spirits. Sterling’s list comprises books that it originates itself,

purchases from domestic and international book packagers

and those that it distributes for other publishers.

In fiscal 2004, the Company’s Board of Directors

approved an overall plan for the complete disposition of

all of its Class B common stock in GameStop Corp.

(GameStop), the Company’s former video game

operating segment. This disposition was completed in

two steps. The first step was the sale of 6,107,338

shares of GameStop Class B common stock held by the

Company to GameStop (Stock Sale) for an aggregate

consideration of $111.5 million. The Stock Sale was

completed on October 1, 2004. The second step in the

disposition was the spin-off by the Company of its

remaining 29,901,662 shares of GameStop’s Class B

common stock (Spin-Off). The Spin-Off was completed

on November 12, 2004 with the distribution of

0.424876232 of a share of GameStop Class B common

stock as a tax-free distribution on each outstanding

share of the Company’s common stock to the

Company’s stockholders of record as of the close of

business on November 2, 2004. As a result of the Stock

Sale and the Spin-Off, GameStop is no longer a

subsidiary of the Company. The disposition of all of the

Company’s stockholdings in GameStop resulted in the

Company presenting all historical results of operations

of GameStop as discontinued operations.