Barnes and Noble 2005 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2005 Barnes and Noble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

[MANAGEMENT’S DISCUSSION AND

ANALYSIS OF FINANCIAL CONDITION AND RESULTS

OF OPERATIONS continued ]

16

2005 Annual ReportBarnes & Noble, Inc.

SEASONALITY

The Company’s business, like that of many retailers, is

seasonal, with the major portion of sales and operating

profit realized during the fourth quarter which includes

the holiday selling season.

LIQUIDITY AND CAPITAL RESOURCES

Working capital requirements are generally at their

highest in the Company’s fiscal quarter ending on or

about January 31 due to the higher payments to vendors

for holiday season merchandise purchases. In addition,

the Company’s sales and merchandise inventory levels

will fluctuate from quarter to quarter as a result of the

number and timing of new store openings.

Cash and cash equivalents on hand, cash flows from

operating activities, funds available under its senior

credit facility and short-term vendor financing continue

to provide the Company with liquidity and capital

resources for store expansion, seasonal working capital

requirements and capital investments.

Cash Flow

Cash flows provided from operating activities were

$499.7 million, $532.4 million and $471.3 million

during fiscal 2005, 2004 and 2003, respectively. In

stockholders of record as of the close of business on

November 2, 2004. As a result of the Stock Sale and

the Spin-Off, GameStop is no longer a subsidiary of the

Company and, accordingly, the Company will present

all historical results of operations of GameStop as

discontinued operations.

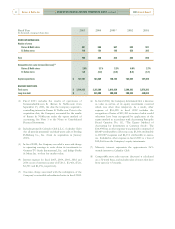

Earnings

As a result of the factors discussed above, the

Company reported consolidated net earnings of $143.4

million (or $1.93 per share) during fiscal 2004

compared with net earnings of $151.8 million (or

$2.07 per share) during fiscal 2003. Components of

diluted earnings per share (EPS) are as follows:

Fiscal Year 2004 2003

EPS from continuing operations

(a) $ 1.68 1.57

EPS from discontinued operations

0.25 0.50

Consolidated EPS

(a) $ 1.93 2.07

(a) Includes a one-time charge of $0.11 per share associated

with the redemption of the convertible notes in fiscal

2004.

fiscal 2005, the decrease in cash flows from operating

results was primarily due to the timing of rent

payments. In fiscal 2004 and 2003, the increase in cash

flows from operating activities was primarily

attributable to improved working capital management

and an increase in net earnings.

The weighted-average age per square foot of the

Company’s 681 Barnes & Noble stores was 7.7 years as

of January 28, 2006 and is expected to increase to

approximately 8.2 years by February 3, 2007. As the

Barnes & Noble stores continue to mature, and as the

number of new stores opened during the fiscal year

decreases as a percentage of the existing store base, the

increasing operating profits of Barnes & Noble stores

are expected to generate a greater portion of the cash

flows required for working capital, including new store

inventories, capital expenditures and other initiatives.

Capital Structure

Strong cash flows from operations and a continued

emphasis on working capital management strengthened

the Company’s balance sheet in fiscal 2005.

On June 17, 2005, the Company, together with certain

of its subsidiaries, entered into a Credit Agreement (the

New Facility) with a syndicate led by Bank of America,

N.A. and JPMorgan Chase Bank, N.A. The New

Facility replaces the Amended and Restated Credit and

Term Loan Agreement, dated as of August 10, 2004

(the Prior Facility), which consisted of a revolving credit

facility and a term loan. The revolving credit facility

portion was due to expire in May 2006 and the term

loan had a maturity date of August 10, 2009. The Prior

Facility was terminated on June 17, 2005, at which time

the prior outstanding term loan of $245.0 million was

repaid. Letters of credit issued under the Prior Facility,

which totaled approximately $30.0 million as of June

17, 2005, were transferred to become letters of credit

under the New Facility.

The New Facility provides for a maximum aggregate

borrowing amount of $850.0 million (which under

certain circumstances may be increased to $1.0 billion

at the option of the Company) and terminates on June

16, 2010. The maximum aggregate borrowing amount

may be reduced from time to time according to the

terms of the New Facility. Borrowings made pursuant to

the New Facility may be committed loans or swing line

loans, the combined sum (including any outstanding

letters of credit) of which may not exceed the maximum

borrowing amount.