Barnes and Noble 2005 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2005 Barnes and Noble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15

2005 Annual Report Barnes & Noble, Inc.

[MANAGEMENT’S DISCUSSION AND

ANALYSIS OF FINANCIAL CONDITION AND RESULTS

OF OPERATIONS continued ]

inclusion of Barnes & Noble.com’s selling and

administrative expenses for the full period in fiscal 2004

compared with a partial period in fiscal 2003. As a

percentage of sales, selling and administrative expenses

increased to 21.6% in fiscal 2004 from 20.8% in fiscal

2003. This increase was partially due to the inclusion of

Barnes & Noble.com’s selling and administrative

expenses for the full period in fiscal 2004 compared

with a partial period in fiscal 2003.

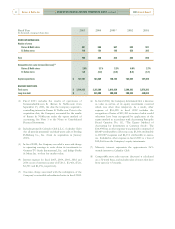

Depreciation and Amortization

Depreciation and amortization increased $14.7 million,

or 8.8%, to $181.6 million in fiscal 2004 from $166.8

million in fiscal 2003. This increase was due to the

inclusion of Barnes & Noble.com’s depreciation and

amortization for the full period in fiscal 2004 compared

with a partial period in fiscal 2003, offset by a

reduction in depreciation and amortization in the

Barnes & Noble stores.

Pre-Opening Expenses

Pre-opening expenses increased $0.2 million, or 2.2%,

in fiscal 2004 to $8.9 million from $8.7 million in fiscal

2003. The slight increase in pre-opening expenses was

primarily the result of opening 32 new Barnes & Noble

stores during fiscal 2004, compared with 31 new Barnes

& Noble stores during fiscal 2003.

Operating Profit

The Company’s consolidated operating profit increased

$18.4 million, or 8.2%, to $244.2 million in fiscal 2004

from $225.8 million in fiscal 2003. Operating profit

increased $45.6 million, or 19.6%, in fiscal 2004

excluding the operating losses of Barnes & Noble.com

for the full period in fiscal 2004 compared with a

partial period in fiscal 2003.

Interest Expense, Net and Amortization of

Deferred Financing Fees

Interest expense, net of interest income, and

amortization of deferred financing fees, decreased $9.9

million, or 47.4%, to $11.0 million in fiscal 2004 from

$20.9 million in fiscal 2003. The decrease was primarily

the result of the redemption of the Company’s $300.0

million 5.25% convertible subordinated notes, which

resulted in a reduction of the Company’s average

borrowings and interest rate.

Debt Redemption Charge

In the second quarter of fiscal 2004, the Company

completed the redemption of its $300.0 million

outstanding 5.25% convertible subordinated notes due

2009. Holders of the notes converted a total of $17.7

million principal amount of the notes into 545,821

shares of common stock of the Company, plus cash in

lieu of fractional shares, at a price of $32.512 per share.

The Company redeemed the balance of $282.3 million

principal amount of the notes at an aggregate

redemption price, together with accrued interest and

redemption premium, of $295.0 million. The write-off

of the unamortized portion of the deferred financing

fees from the issuance of the notes and the redemption

premium resulted in a charge of $14.6 million.

Equity in Net Loss of Barnes & Noble.com

The Company accounted for its approximate 38%

economic interest in Barnes & Noble.com under the

equity method through September 15, 2003. Equity

losses in Barnes & Noble.com were $14.3 million in

fiscal 2003.

Income Taxes

Barnes & Noble’s effective tax rate in fiscal 2004

increased to 43.00% compared with 41.35% during

fiscal 2003. The increase in the effective tax rate was

primarily due to adjustments in fiscal 2004 related to

prior year taxes.

Minority Interest

Minority interest was $1.2 million in fiscal 2004

compared with $0.5 million in fiscal 2003, and relates

to the approximate 26% outside interest in Calendar

Club L.L.C. (Calendar Club).

Income From Discontinued Operations

On October 1, 2004, the Board of Directors of the

Company approved an overall plan for the complete

disposition of all of its Class B common stock in

GameStop, the Company’s former video game

operating segment. This disposition was completed in

two steps. The first step was the sale of 6,107,338

shares of GameStop Class B common stock held by the

Company to GameStop (Stock Sale) for an aggregate

consideration of $111.5 million, consisting of $37.5

million in cash and a promissory note in the principal

amount of $74.0 million, bearing interest at a rate of

5.5% per annum, payable when principal installments

are due. The Stock Sale was completed on October 1,

2004. The second step in the disposition was the spin-

off by the Company of its remaining 29,901,662 shares

of GameStop’s Class B common stock (Spin-Off). The

Spin-Off was completed on November 12, 2004 with

the distribution of 0.424876232 of a share of

GameStop Class B common stock as a tax-free

distribution on each outstanding share of the

Company’s common stock to the Company’s