Bank of Montreal 2000 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2000 Bank of Montreal annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

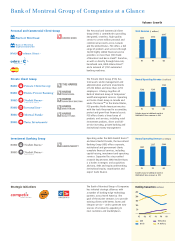

Bank of Montreal Group of Companies Annual Review 2000 ■5

If the editors of the respected Global Finance magazine are correct, we have moved

considerably closer to becoming the best North American financial institution.

In last October’s issue they chose Bank of Montreal as “Canada’s best bank.”

when it comes to small business loans —the arrival of

Small Business Banking substantially increases our

ability to provide more customized service to valued

customers. It also improves our capacity for tapping

into credit relationships in order to cross-sell innova-

tive non-lending products and services.

A new division for Commercial Banking takes on

responsibility for ensuring a deeper focus on busi-

nesses with annual revenues of $100-to-$300 million,

another priority market where we are building

from strength. In fact, since we first started targeting

upper-end commercial businesses in Canada just

over three years ago, we have boosted lending authori-

zations by 74%, establishing us as the leader in this

largely underserved Canadian market.

Emphasizing Emfisys

The other critical move we announced in the last

week of fiscal 2000 was that Emfisys (the brand name

for our technology and operations group) would

be assuming responsibility for emerging e-businesses

that have the potential to extend across multiple

customer segments. What this means is that most of

our e-businesses are now folded into a new entity

called Emfisys and E-Business.

Bank of Montreal has a decades-old legacy of

being first and being great at technological innovation

—up to and beyond being the first bank in North

America to offer wireless banking and brokerage to

customers. Our new alignment is designed to con-

tinue that legacy. With an enterprise-wide perspective

on all our technology investments, we will maximize

the potential of our existing leadership in selected

e-businesses, and provide more focus and pace to the

incubation of new e-businesses.

Getting It Right

Whatever we accomplished in 2000, and whatever

future accomplishments we set in motion, we also got

better at getting it right, both with our customers and

among ourselves.

When I call this the key to our success —especially

our success in maximizing shareholder value —I feel

I’m just stating the obvious. The more self-interested

and engaged and happy we are as a workforce, the

more likely we are to capture the hearts and minds of

customers, who in turn will reward us with more of

their business plus referrals.

So getting it right with customers, with each

other and with our many communities is not just one

of those nice ideas at Bank of Montreal. It is the rock

upon which our strategy is built.

My Bank is Best

I cannot leave my review of the last year of the

20th century or the first year of the 21st without a few

words on how well we’re progressing in turning our-

selves back into “my bank” —the place where, among

other important things, customer needs are so well

understood, and indeed anticipated, that we are there

with solutions before these needs are even articulated.

As I hope that I have demonstrated, every move

that we made last year was made with this end

front-and-centre in mind. The closer we get to “my

bank” —the kind of organization this was decades

ago when I first signed on —the closer we get to our

goal of becoming not just a top-tier North American

financial services organization, but the best North

American financial institution.

If the editors of the respected Global Finance

magazine are correct (and I certainly have every reason

to believe they are), we have moved considerably closer

to that goal. In last October’s issue they chose Bank of

Montreal as “Canada’s best bank.” And, I cannot resist

adding, a bank that’s getting better all the time.

Tony Comper (signed)

Chairman and Chief Executive Officer