Bank of Montreal 2000 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2000 Bank of Montreal annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

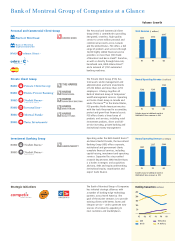

2■Bank of Montreal Group of Companies Annual Review 2000

Year in Review

The Year in Review

The governing objective at the Bank

of Montreal Group of Companies is

to create value for our shareholders.

In the year 2000, we successfully —

and decidedly

—

achieved that goal.

We earned net income of $1,857 mil

-

lion, an increase of $475 million or

34.4% over 1999. Meanwhile, return

on equity for the year was 18%, up

from 14.1% the previous year. Fully

diluted earnings per share were

$6.56, up 39% from $4.72 in 1999.

In two crucial areas, we met

our financial objectives. In 2000,

our target was to increase earnings

per share by at least 10% from

a 1999 adjusted base of $5.14, and

to increase return on equity by

between 1.0% and 1.5% from a base

of 15.4%. In fact, earnings per share

rose 27.6% to $6.56 while return

on equity increased by 2.6 percentage

points to 18%.

Our success is cumulative.

Bank of Montreal has now delivered

11 consecutive years of earnings

growth. During the same time period,

we have achieved a return on equity

of at least 14%.

Such progress, we believe, is

a testament to our aggressive growth

strategy —onedrivenbyapassionate

commitment to “get it right” with

our customers.

Last year we continued to drive

volume growth in personal banking,

commercial and small business

banking and wealth management.

The success of this thrust is reflected

in our strong earnings performance.

Our performance also benefited

from our commitment to focus on

high-growth-potential businesses

while divesting low-potential

businesses, and maintaining good

credit quality and expense control.

For our business and our share-

holders, the success we reaped

in the year 2000 is excellent news.

It translates into a prosperous

present and, we firmly believe, an

even brighter, richer tomorrow.

By “getting it right” with customers and by implementing an aggressive growth

strategy, Bank of Montreal meets target expectations.

Net income increased

34.4%

from $1,382 million in 1999

to $1,857 million in 2000

Return on equity increased to

18%

in 2000 from 14.1% in 1999

Fully diluted earnings

per share increased

39%

from $4.72 in 1999 to $6.56 in 2000