Bank of Montreal 2000 Annual Report Download

Download and view the complete annual report

Please find the complete 2000 Bank of Montreal annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

bmo.com/annualreview2000

Table of contents

-

Page 1

bmo.com/annualreview2000 -

Page 2

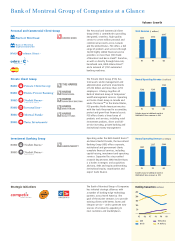

... Group of Companies Founded in 1817, Bank of Montreal is Canada's first bank and one of the largest financial institutions in North America. It offers clients a broad range of f inancial services across Canada and in the United States, both directly and through Chicago-based subsidiary, Harris Bank... -

Page 3

... service to seven million personal and commercial accounts across Canada and the United States. P&C offers a full range of products and services through 16,000 highly skilled financial service providers in more than 1,100 Bank of Montreal and Harris Bank ®2 branches, as well as directly through bmo... -

Page 4

... Canada Post. Announced a new company in partnership with Royal Bank that will offer retail and online business merchants across North America one-stop, card-based transaction processing for credit card, debit card and stored value payments. â- Increase credit investment management assets under... -

Page 5

... strengths in intellectual capital and technological innovation while embracing new ideas, synergistic alliances and emerging opportunities. It's a strategy that places our customers at the centre of our business - where they belong. Bank of Montreal Group of Companies Annual Review 2000 â- 1 -

Page 6

..." with customers and by implementing an aggressive growth strategy, Bank of Montreal meets target expectations. Net income increased The governing objective at the Bank Last year we continued to drive volume growth in personal banking, commercial and small business banking and wealth management. The... -

Page 7

... In January BMO Nesbitt Burns launched Canada's first full-service online brokerage; in August we added Canada's first fixed-income online capability. We also introduced a new investment Tony Comper Chairman and Chief Executive Officer Bank of Montreal Group of Companies Annual Review 2000 â- 3 -

Page 8

...in high-return businesses. We lowered risk-weighted assets by $11.2 billion, mostly in our corporate lending book. At the same time, we increased the flow of resources to fee-based businesses where we already held strong leadership positions - North American cash and credit portfolio management, for... -

Page 9

... closer to that goal. In last October's issue they chose Bank of Montreal as "Canada's best bank." And, I cannot resist adding, a bank that's getting better all the time. Tony Comper (signed) Chairman and Chief Executive Officer Bank of Montreal Group of Companies Annual Review 2000 â- 5 -

Page 10

... highly trained mortgage professionals are available seven days a week, 24 hours a day. Using the Harris Bank expertise, our mid-market corporate banking specialists expanded asset-based lending to our Canadian commercial clients. Currently worth $4 billion, we estimate that the Canadian asset-based... -

Page 11

... as Canada's number one research firm in 2000. BMO Nesbitt Burns made a major commitment to media and telecommunications with the addition of a team of specialists based in New York and the creation of the US$450 million BMO Nesbitt Burns Halyard Capital Fund for investment in the sector. Harris... -

Page 12

...investment professionals located in Bank of Montreal branches offer clients access to a wide range of BMO wealth management products and services. up 101% We are rapidly expanding our wealth management business throughout North America by capitalizing on the combined synergies of BMO Nesbitt Burns... -

Page 13

... Arizona and Florida). We are intensely focused on developing stronger relationships with all our customers, offering a richer suite of innovative retail, investment and mid-market products and services, including e-commerce options. Bank of Montreal Group of Companies Annual Review 2000 â- 9 -

Page 14

... a global transaction processing business for trade services such as letters of credit and collections. The wireless financial services market is forecast to grow to 40 million potential customers by 2003. Over 6,000 Bank of Montreal and Harris customers use Veev, the wireless banking and investing... -

Page 15

... processes and dispose of low-value, capital-intensive businesses, we are also making strategic investments of capital and resources in areas with the greatest [bmo.com] potential to best serve our customers - and maximize shareholder value. Bank of Montreal Group of Companies Annual Review 2000... -

Page 16

... people management skills. We will introduce two new programs, delivered both electronically and in the classroom, to supplement the learning needs of employees at all levels of our organization. Such initiatives foster positive results. Saratoga Institute Canada recently reported that annual... -

Page 17

... the campaign to build a new and Dividends to shareholders 19% Government taxes and levies 42% Reinvested in the business 39% *Net income before taxes, levies and goodwill In 2000, we continued to build on tradition. Overall, the Bank of Montreal Group of Companies contributed $19.8 million to... -

Page 18

... and Chief Executive Officer Rexel Canada Inc. John F. Fraser, O.C. , LL.D. Winnipeg, Man. Chairman Air Canada David A. Galloway Toronto, Ont. President and Chief Executive Officer Torstar Corporation Eva Lee Kwok Vancouver, B.C. Chair and Chief Executive Officer Amara International Investment Corp... -

Page 19

... mbanx Direct and Customer Value Management Personal & Commercial Banking Distribution Personal & Commercial Client Group Timothy J. O'Neill Executive Vice-President and Chief Economist R. Jeffrey Orr* Vice-Chair, Investment Banking Group and Chairman and Chief Executive Officer BMO Nesbitt Burns... -

Page 20

...B Level North Montreal, Quebec H2Y 1L6 General Information For general inquiries about company news and initiatives please contact our Corporate Communications Department. Bank of Montreal's news releases are available on our web site at bmo.com Annual Meeting The Annual Meeting of Shareholders will... -

Page 21

...-Service Online is a trade mark of BMO Nesbitt Burns Corporation Limited Halyard Capital Fund is a trade mark of BMO Nesbitt Burns Corporation Limited Registered trade mark of AIR MILES International Trading B.V. Used under licence by Loyalty Management Group Canada Inc. and Bank of Montreal Trade... -

Page 22

-

Page 23

bmo.com/annualreport2000 -

Page 24

...Burns-Full Service Online is a trade mark of BMO Nesbitt Burns Corporation Limited TM5 * Halyard Capital Fund is a trade mark of BMO Nesbitt Burns Corporation Limited ®4 Registered trade mark of AIR MILES International Trading B.V. Used under licence by Loyalty Management Group Canada Inc. and Bank... -

Page 25

... Group of Companies Founded in 1817, Bank of Montreal is Canada's first bank and one of the largest financial institutions in North America. It offers clients a broad range of financial services across Canada and in the United States, both directly and through Chicago-based subsidiary, Harris Bank... -

Page 26

... Risk Management Enterprise-Wide Capital Management Review of Client Groups Performance Personal and Commercial Client Group Private Client Group Investment Banking Group Harris Bank Corporate Support Economic and Financial Services Developments Bank of Montreal Group of Companies Annual Report 2000... -

Page 27

... Loans and Acceptances as a % of Equity and Allowance for Credit Losses Cash and Securities-to-Total Assets Tier 1 Capital Ratio Credit Rating Financial Performance Objectives Fully Diluted Earnings per Share Growth (EPS growth) Return on Common Shareholders' Equity (ROE) Financial Condition... -

Page 28

... revenue-driven compensation and strategic initiatives spending, partially offset by cost reduction initiatives and the effects of business disposals. *Non-recurring items are detailed in Table 19 of the Supplemental Information on page 82. 4 â- Bank of Montreal Group of Companies Annual Report... -

Page 29

... can be found on page 15. 96 97 98 99 00 96 97 98 99 00 Bank of Montreal Canadian Peer Group Average North American Peer Group Average *Non-recurring items are detailed in Table 19 of the Supplemental Information on page 82. Bank of Montreal Group of Companies Annual Report 2000 â- 5 -

Page 30

... sheet management, partially offset by the effect of common share buy-backs. Credit Rating â- The composite credit rating remained unchanged. *Non-recurring items are detailed in Table 19 of the Supplemental Information on page 82. 6 â- Bank of Montreal Group of Companies Annual Report 2000 -

Page 31

... Our Tier 1 Capital Ratio of 8.83% was above the Canadian peer group average of 8.40%. On a U.S. basis, our Tier 1 Capital Ratio of 8.47% was above the North American peer group average of 7.68%. â- More information can be found on page 28. 96 97 98 99 00 96 97 98 99 00 Credit Rating... -

Page 32

... NA NA NA NA NA Primary Financial Condition Measures (%) Gross impaired loans and acceptances as a % of equity and allowance for credit losses 10.51 Cash and securities-to-total assets 27.8 Tier 1 Capital Ratio 8.83 8.47 Tier 1 Capital Ratio - U.S. basis Credit rating AA- 3 11.81 4 28.4 1 8.40 na... -

Page 33

... organizational changes in the Private Client and Investment Banking Groups. 96 97 98 99 00 Five-Year Total Shareholder Return 22.9 18.6 (%) 19.7 BMO TSE 300 Index S&P 500 Index 1 Defined in the glossary on page 88. Bank of Montreal Group of Companies Annual Report 2000 â- 9 -

Page 34

... by cost reduction initiatives, the effect of business dispositions during the year and the impact of an additional month of results of BMO Nesbitt Burns®3 in 1999 as a result of the change in its year-end. Further information on expense growth can be found on page 15. Basic Cash Basis Reporting... -

Page 35

... The decline reflected a lower earnings growth rate relative to the increase in average common shareholders' equity in 1999. The earnings growth rate was adversely affected by non-recurring items. 1 Defined in the glossary on page 88. Bank of Montreal Group of Companies Annual Report 2000 â- 11 -

Page 36

...year ended October 31 2000 1999* % change 2000 1999* % change 2000 1999* Change Personal and Commercial Client Group (P&C) P&C Canada P&C Harris P&C, excluding Bancomer Bancomer Total Personal and Commercial Client Group Private Client Group Investment Banking Group Corporate Support Total... -

Page 37

...effect BMO Nesbitt Burns additional month Foregone revenues from disposed businesses Total other income growth 17.5 2.6 1.0 (0.5) (2.3) (2.5) 15.8 (2.1) 8.2 4.2 0.6 2.6 - 13.5 8.8 (7.9) 1.7 2.0 - - 4.6 1 Defined in the glossary on page 88. Bank of Montreal Group of Companies Annual Report 2000... -

Page 38

...1996 97 98 99 00 Deposit and payment service charges Lending fees Capital market fees Card services Investment management and custodial fees Mutual fund revenues Trading revenues Securitization revenues Investment securities gains (losses) Other fees and commissions Total 646 322 1,069 216 373... -

Page 39

... in centralized services and distribution. Outlook We are targeting an expense-to-revenue ratio in 2001 consistent with the 2000 ratio. Expense Growth (%) (excluding non-recurring items) 15.5 9.5 6.5 7.6 3.0 96 97 98 99 00 Bank of Montreal Group of Companies Annual Report 2000 â- 15 -

Page 40

... it â- Commercial line of business redesign â- Direct Bank - improving commercial client access through new telephone and web offerings â- Face to face - enhancing employee tools and processes to improve efficiency and customer service â- In-store openings - extending our reach in key markets... -

Page 41

... gain or loss in our deposit portfolio. The value of trading securities at October 31, 2000 was $21,994 million, an increase of $4,748 million from 1999. 98 99 00 Investment securities Trading securities Loan substitute securities Bank of Montreal Group of Companies Annual Report 2000 â- 17 -

Page 42

...are provided in note 16 to the consolidated financial statements. Refer to note 23 to the consolidated financial statements for future changes in United States accounting policies. 4.9 4.8 98 99 00 Share capital Retained earnings 18 â- Bank of Montreal Group of Companies Annual Report 2000 -

Page 43

... approved by the Bank's Management Board Executive Committee. â- Group level strategies must be approved by the Board of Directors once a year or when material changes occur. â- Significant line of business strategies, as well as significant new business and change management initiatives, are also... -

Page 44

... and operational risk management), by the Chief Executive Officer's Counterparty Risk Council and by the Risk Management Group; â- Risk Management Group reports directly to the Chief Executive Officer and also provides reports to the Risk Review Committee of the Board of Directors. The group brings... -

Page 45

...capital to those businesses that can most advantageously deploy the capital to maximize shareholder value. This provides a framework for measuring risk in relation to return at each level of our activity. 1 Defined in the glossary on page 88. Bank of Montreal Group of Companies Annual Report 2000... -

Page 46

... loan basis. A number of factors are considered when determining the general allowance, including statistical analysis of past performance, the level of allowance already in place and management's judgement regarding portfolio quality, business mix and economic as well as credit market conditions... -

Page 47

... agreements and international loans and investments Investments: Securities investments in investment portfolios Trading and underwriting: Instruments designated as trading and marked-to-market. 1 Defined in the glossary on page 88. Bank of Montreal Group of Companies Annual Report 2000... -

Page 48

...model calculates the impact on earnings over the next 12 months and on the value of our assets and liabilities of a one-time change in rates. At a 99% confidence level, it reflects the maximum expected interest rate change in each portfolio during the estimated period required to close our positions... -

Page 49

... in 2000 were undertaken to reduce our market value exposure. Our earnings at risk exposure was relatively stable during 2000. Further details regarding derivative exposures are provided in note 21 to the consolidated financial statements. Bank of Montreal Group of Companies Annual Report 2000... -

Page 50

... funding base is diversified by customer, type, market, maturity term and currency. Wholesale deposits are largely short-term in nature and primarily support our money market and trading assets and investment securities. Wholesale funding activities are performed by professional teams accessing... -

Page 51

... in the future due to the nature of the risks. In relation to the year 2000 transition, our objective that our business operations run accurately and without disruption before, during and after the calendar change was fully achieved. Bank of Montreal Group of Companies Annual Report 2000 â- 27 -

Page 52

...our objective to maintain a Tier 1 Capital Ratio of at least 8.0%. We reduced the level of riskweighted assets by $2.6 billion. Risk-weighted assets were lowered in the Investment Banking Group, mostly in the corporate lending portfolio, and redeployed in higher-yielding retail loans in the Personal... -

Page 53

... of the Harris client relationship with BMO Nesbitt Burns investment banking and capital markets capabilities in Chicago. In addition, the Canadian term deposit business and Private Client Services Centre were transferred from P&C to the Private Client Group in order to bring our wealth management... -

Page 54

... service to seven million personal and commercial accounts across Canada and in the United States. P&C offers a full range of products and services through 16,000 highly skilled financial service providers in more than 1,100 Bank of Montreal and Harris Bank branches as well as directly through bmo... -

Page 55

...of our personal clients. Through various channels, including branches, telephone, Internet, wireless services and ABMs, Everyday Banking customers can access products ranging from chequing and savings accounts to retail and travel services. 2000 Objectives Consumer Finance Committed to meeting the... -

Page 56

..., Electronic Banking Services provides MasterCard brand credit card products and services to individuals. Across North America, this line of business provides corporate card end-to-end payment solutions as well as credit and debit card processing services to commercial and corporate clients. 2000... -

Page 57

...75,200 53,015 69,905 22,260 19.7 68.0 *Restated to give effect to the current year's organization structure and presentation changes as outlined on page 29. (a) Excludes assets under administration related to Global Custody. NA - Not available Bank of Montreal Group of Companies Annual Report 2000... -

Page 58

... and institutional markets. Clients can access PCG's services through a variety of channels including Bank of Montreal branches, BMO Nesbitt Burns branches, BMO InvestorLine® service and BMO Harris Private Banking locations in Canada, and, in the United States, through Harris InvestorLine service... -

Page 59

... money management services for pension funds, endowments, trusts, insurance company reserves, corporate surpluses and BMO-affiliated mutual funds in both Canada and the United States. This line of business also makes managed futures available to retail and institutional clients. 2000 Objectives... -

Page 60

...tax Net Income Average assets Risk-weighted assets Average current loans (including securities purchased under resale agreements) Average deposits Assets under administration Assets under management Full-time equivalent staff Basic return on equity (%) Expense-to-revenue ratio (%) ($ millions except... -

Page 61

...The group also serves institutional and government clients in the United Kingdom, Europe and Asia. 2000 Accomplishments â- 2001 Objectives â- â- â- â- â- Brought together the corporate banking business of Harris Bank and the Chicago-based investment banking operations of Nesbitt Burns to... -

Page 62

... in the Canadian market. Create custom-engineered financial products and services that address the risks inherent in international business. 2000 Accomplishments â- Merchant Banking BMO Nesbitt Burns Equity Partners® 3** supports businesses in Canada and the United States through private equity... -

Page 63

...Risk-weighted assets Average current loans (including securities purchased under resale agreements) Average securities purchased under resale agreements Average deposits Assets under administration Assets under management Full-time equivalent staff Basic return on equity (%) Expense-to-revenue ratio... -

Page 64

... Bank's retail funding base now totals more than US$10 billion. Launched Harris Wireless service, making Harris one of the first banks in the United States to provide banking services via digital mobile phones. Established Harris Nesbitt to serve corporate and investment banking mid-market clients... -

Page 65

... or revenue improvements and increase market competitiveness of its businesses, products and service offerings. Emfisys also established a disciplined costing, pricing and billing schedule for its internal clients while successfully attracting and recruiting several hundred information technology... -

Page 66

... gains in personal and business income kept loan quality at a high level. The U.S. economy accelerated in 2000, with real GDP growth likely topping 5%. Rapid growth in jobs and incomes spurred consumer spending. Business investment in communications and computing equipment soared in the year. The... -

Page 67

...of Changes in Shareholders' Equity Consolidated Statement of Cash Flow Notes to Consolidated Financial Statements Statement of Management's Responsibility for Financial Information Shareholders' Auditors' Report Bank Owned Corporations Bank of Montreal Group of Companies Annual Report 2000 â- 43 -

Page 68

...' Equity The accompanying notes to consolidated financial statements are an integral part of this statement. $ 233,396 (signed) F. Anthony Comper Chairman and Chief Executive Officer (signed) Jeremy H. Reitman Chairman, Audit Committee 44 â- Bank of Montreal Group of Companies Annual Report... -

Page 69

... for credit losses Net Interest Income After Provision for Credit Losses Other Income Deposit and payment service charges Lending fees Capital market fees Card services Investment management and custodial fees Mutual fund revenues Trading revenues Securitization revenues (note 6) Other fees and... -

Page 70

...of Year Number of Shares 2000 1999 1998 $ 1,668 - - 13 1,681 $ 1,958 - (272) (18) 1,668 $ 1,274 650 - 34 1,958 Common Shares (note 13) Balance at beginning of year Issued under the Shareholder Dividend Reinvestment and Share Purchase Plan Issued under the Stock Option Plan Issued on the exchange... -

Page 71

... payable on derivative contracts Net (increase) decrease in trading securities Net increase (decrease) in current income taxes payable Changes in other items and accruals, net Net Cash Provided by (Used in) Operating Activities Cash Flows from Financing Activities Net increase (decrease) in deposits... -

Page 72

...occur and are included in our Consolidated â- We did not own any securities issued by a single non-government entity where the book value, as at October 31, 2000 or October 31, 1999, was greater than 10% of our shareholders' equity. 48 â- Bank of Montreal Group of Companies Annual Report 2000 -

Page 73

... which time we no longer had significant influence and began accounting for the investment on a cost basis. Unrealized Gains and Losses Book value Interest income and gains and losses from securities are: 2000 1999 1998 Reported in: Interest, dividend and fee income Investment securities Trading... -

Page 74

... amount 2000 1999 Specific allowance 2000 1999 Net amount 2000 1999 Residential mortgages $ 39,485 Credit card, consumer instalment and other personal loans 19,445 Loans to businesses and governments 60,176 Securities purchased under resale agreements 16,308 Acceptances Non-sectoral Total 135... -

Page 75

... as impaired: Canada 2000 1999 United States 2000 1999 Other countries 2000 1999 2000 Total 1999 Residential mortgages Consumer instalment and other personal loans Loans to businesses and governments Acceptances Total impaired loans and acceptances Allowance for credit losses Total net impaired... -

Page 76

... transactions as sales when the significant risks and rewards of the ownership of the loans have been transferred and we can estimate the amount of cash to be received. We record these sales based upon the market value of the loans sold. 52 â- Bank of Montreal Group of Companies Annual Report... -

Page 77

... the assets to their fair value when the undiscounted cash flows are not expected to allow for recovery of the carrying value. Goodwill Income tax (benefit) Goodwill net of applicable tax $ 54 (5) $ 49 $ 49 (6) $ 43 $ 48 (6) $ 42 Bank of Montreal Group of Companies Annual Report 2000 â- 53 -

Page 78

... to personal and commercial customers in Canada and the United States; our Private Client Group provides wealth management services; and our Investment Banking Group offers corporate, institutional and government clients comprehensive financial services including advisory, investment and operating... -

Page 79

... convertible at the shareholder's option starting November 25, 2008 into our common shares; however, we have the right to pay $25.00 cash per share instead. The shares carry a non-cumulative quarterly dividend of $0.296875 per share. Bank of Montreal Group of Companies Annual Report 2000 â- 55 -

Page 80

...branches in the Personal and Commercial Client Group; $16 for costs to realign investment and corporate banking activities, including certain businesses in our London, England branch in the Investment Banking Group; $6 for strategic repositioning of our wealth management business into six new lines... -

Page 81

... Consolidated Statement of Income Provision for income taxes Income tax (benefit) related to amortization of goodwill Shareholders' Equity Income tax expense (benefit) related to foreign currency translation and costs of proposed merger Total Components of Total Income Taxes Canada: Current income... -

Page 82

... Consolidated Statement of Income as a component of salaries and employee benefits. It is determined as the cost of employee pension benefits for the current year's service, interest expense on the pension liability, expected investment return on the market value of plan assets and the amortization... -

Page 83

... pension plan assets consisted of equities (67%) and fixed income investments (33%). The cost of post-retirement life insurance, health and dental care benefits reported in employee benefits expense was $16 in 2000, $18 in 1999 and $11 in 1998. Bank of Montreal Group of Companies Annual Report 2000... -

Page 84

... change. Compensation expense related to these plans was $3 for the year ended October 31, 2000. We provide banking services to our joint ventures and equityaccounted investments on the same terms that we offer to our customers. In addition, we make loans to current and former directors, officers... -

Page 85

... derivative portfolio and related credit exposure: Notional amount: represents the amount to which a rate or price is applied in order to calculate the exchange of cash flows. Replacement cost: represents the cost of replacing, at current market rates, all contracts which have a positive fair value... -

Page 86

... management derivatives which we include in the Consolidated Balance Sheet on an accrual rather than market basis. The excess of market value over book value for these items was $90 as at October 31, 2000 and $181 as at October 31, 1999. 62 â- Bank of Montreal Group of Companies Annual Report... -

Page 87

... Offered Rate. Basis swaps are floating interest rate swaps where amounts paid and received are based on different indices or pricing periods. Other swaps are contracts where the fixed side is denominated in a source currency other than Canadian $ or US $. Bank of Montreal Group of Companies Annual... -

Page 88

... them or entered into a contract. Interest rate changes are the main cause of change in the fair value of our financial instruments. As a financial institution we record trading assets at market values and non-trading assets and liabilities at their original amortized cost less allowances or write... -

Page 89

... as defined in note 4, is based on quoted market rates; â- Fair value of performing loans is calculated by adjusting the original value of the loan for changes in credit risk and interest rates since the time we granted the loan; and â- Fair value of impaired loans is equal to the book value which... -

Page 90

... when the securities are sold. (i) Under United States GAAP, Statement of Financial Accounting Standards No. 115, "Accounting for Certain Investments in Debt and Equity Securities", we have designated as available for sale securities 66 â- Bank of Montreal Group of Companies Annual Report 2000 -

Page 91

... to be reported in net income as incurred. Under Canadian GAAP, we treated these expenses as a reduction in retained earnings. (iii) Under United States GAAP, Statement of Financial Accounting Standards No. 87, "Employers' Accounting for Pensions", we use a market discount rate to value our pension... -

Page 92

... of Directors and its committees to discuss audit, financial reporting and related matters. (signed) F. Anthony Comper Chairman and Chief Executive Officer (signed) Karen E. Maidment Executive Vice-President and Chief Financial Officer Shareholders' Auditors' Report To the Shareholders of Bank of... -

Page 93

... plc Bank of Montreal Mortgage Corporation BMRI Realty Investments Bankmont Financial Corp. BMO Financial, Inc. BMO Global Capital Solutions, Inc. and subsidiary BMO Managed Investments Corporation BMO Nesbitt Burns Corp. BMO Nesbitt Burns Equity Group (U.S.), Inc. and subsidiaries BMO Nesbitt Burns... -

Page 94

... Information Table 1 Shareholder Value 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 As at or for the year ended October 31 Market Price per Common Share ($) (a) High Low Close Common Dividends Dividends declared ($) (a) Dividends paid ($) (a) Dividend payout ratio (%) Dividend yield (%) Total... -

Page 95

...U.S. dollar and other currencies margin (%) Other Income Deposit and payment service charges Lending fees Capital market fees Card services Investment management and custodial fees Mutual fund revenues Trading revenues Securitization revenues Other fees and commissions Revenue from insurance-related... -

Page 96

...card loans Loans to businesses and governments (a) Total loans Other non-interest bearing assets Total Canadian dollars U.S. Dollar and Other Currencies Deposits with other banks Securities Loans Residential mortgages Non-residential mortgages Consumer instalment and other personal loans Credit card... -

Page 97

... rate For the year ended October 31 Total Total Assets Canadian Dollars Deposits with other banks Securities Loans Residential mortgages Non-residential mortgages Consumer instalment and other personal loans Credit card loans Loans to businesses and governments (a) Total loans Change in Canadian... -

Page 98

... respective year. It represents the position outstanding at the close of the business day and may change significantly in subsequent periods based upon customer preferences and the application of the Bank's asset and liability management policies. The assumptions for 2000 are as follows: Deposits... -

Page 99

... (b) Government levies are included in various non-interest expense categories. (c) The adjusted expense-to-revenue ratio excludes non-recurring expenses and non-recurring revenues from total revenue as detailed in Table 19 on page 82. Bank of Montreal Group of Companies Annual Report 2000 â- 75 -

Page 100

...) United States (a) Other countries (a) 1997 1996 2000 1999 1998 1997 1996 1996 2000 1999 1998 Individuals Residential mortgages (b) Cards Personal loans Total loans to individuals Commercial, corporate and institutional Diversified commercial Securities purchased under resale agreements Total... -

Page 101

... Cards Personal loans Total individuals Diversified commercial Financial institutions Commercial mortgages Construction (non-real estate) Commercial real estate Manufacturing Mining/Energy Service industries Retail trade Wholesale trade Agriculture Transportation/Utilities Communications Other Total... -

Page 102

... for Credit Losses - Segmented Information ($ millions except as noted) Canada (a) 2000 1999 1998 1997 1996 2000 United States (a) 1999 1998 1997 1996 2000 Other countries (a) 1999 1998 1997 1996 Individuals Residential mortgages Consumer instalments and other personal loans Total individuals... -

Page 103

... Net Impaired Loans by Industry Financial institutions Commercial mortgages Construction (non-real estate) Commercial real estate Manufacturing Mining/Energy Service industries Retail trade Wholesale trade Agriculture Transportation/Utilities Communications Other (d) (f) Total diversified commercial... -

Page 104

... Bank of this alliance include access to necessary channel technology for delivery of financial services in an e-commerce environment. (g) Excludes unrealized losses in translation of net investment in foreign operations. NA - Not available 80 â- Bank of Montreal Group of Companies Annual Report... -

Page 105

... Other assets Total balance sheet items Off-balance sheet items Guarantees and standby letters of credit Securities lending Documentary and commercial letters of credit Commitments to extend credit: Original maturity of one year and under Original maturity of over one year Derivative financial... -

Page 106

...Items ($ millions) 2000 1999 1998 1997 1996 For the year ended October 31 Other Income Gain on sale of Global Custody Write-down of the distressed securities portfolio Gain on sale of Partners First, a U.S. credit card issuing business Gain on sale of U.S. Corporate Trust Gain on sale of branches... -

Page 107

...2000 Jan. 31 2000 As at or for the three months ended Information per Common Share ($) Dividends declared Net income before goodwill Basic Fully diluted Net income Basic (m) Fully diluted (m) Cash EPS Book value Market price High Low Close Primary Financial Measures (%) Five-year total shareholder... -

Page 108

... and Management Compensation Committee of the Board. This planning is based on predetermined quantitative and qualitative criteria. The commitment to fair treatment of shareholders irrespective of the size of their individual holdings. 84 â- Bank of Montreal Group of Companies Annual Report 2000 -

Page 109

...purview of management, which are reported to the Board after the fact. Accountability and Compensation of Directors â- â- â- An annual corporate governance survey on Board effectiveness has taken place since 1991, using outside consultants to compile results. In addition, this year a separate... -

Page 110

... and Chief Executive Officer Rexel Canada Inc. John F. Fraser, O.C., LL.D. Winnipeg, Man. Chairman Air Canada David A. Galloway Toronto, Ont. President and Chief Executive Officer Torstar Corporation Eva Lee Kwok Vancouver, B.C. Chair and Chief Executive Officer Amara International Investment Corp... -

Page 111

... mbanx Direct and Customer Value Management Personal & Commercial Banking Distribution Personal & Commercial Client Group Timothy J. O'Neill Executive Vice-President and Chief Economist R. Jeffrey Orr* Vice-Chair, Investment Banking Group and Chairman and Chief Executive Officer BMO Nesbitt Burns... -

Page 112

... cost to the bank/enterprise. Risk Adjusted Return on Capital (RAROC) A measurement tool that enables management to allocate capital, and the related cost of capital, in respect of credit, market and operational risk by type of transaction, 88 â- Bank of Montreal Group of Companies Annual Report... -

Page 113

... fiscal year. Full details of the plan are available from The Trust Company of Bank of Montreal or Shareholder Services. Direct Dividend Deposit Shareholders may choose to have dividends deposited directly to an account in any financial institution in Canada that provides electronic funds transfer... -

Page 114