Baker Hughes 2007 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2007 Baker Hughes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

have a consistent approach in each market

across our product lines and to place decision-

making authority closer to our customers. This

organization, in combination with our signifi-

cant investments in infrastructure, equipment

and people, resulted in significant growth in

our targeted markets.

Latin America

Revenues in the Latin America region,

which includes Mexico, Central and South

America, increased 20% in 2007 to $990 mil-

lion from $827 million in 2006.

Increased business in Brazil, where reve-

nues were up 65% for the year, was the most

important factor in the region’s growth during

the year. A significant project to provide high-

end directional drilling and logging-while-

drilling services to Petrobras in its Marlim

Sul and Roncador deepwater fields started

up during the year. To support this activity,

Baker Hughes built a new, larger facility at

the Macaé service base, invested in field

equipment and hired and trained 134 local

engineers and technicians.

Also in Brazil, Centrilift has applied its

advanced ESP subsea booster system tech-

nology to help Petrobras produce efficiently

from its Jubarte, Espadarte and Golfinho

deepwater fields.

Baker Hughes also gained business in

Colombia through increased industry activity

and Mexico through increased market share.

Revenue in Venezuela was up slightly during

the year even though international oil com-

panies were re-evaluating their positions

in the country in light of contract revisions

imposed by the government and the national

oil company.

Europe, Africa, Russia, Caspian

Revenue in the Europe, Africa, Russia,

Caspian (EARC) region was $3,066 million

for 2007, up 24% from $2,473 million

in 2006. While the North Sea and other Euro-

pean markets still accounted for about 50%

of the region’s revenues during the year, a

major contributor in the region’s growth dur-

ing the year was an 80% increase in revenue

in Russia.

In late 2006, Baker Hughes placed all its

operations in Russia under the leadership of

a senior Baker Hughes executive in the role

of President, Baker Hughes Russia. Though it

was a departure from the Baker Hughes divi-

sional business model, the country manage-

ment structure was considered the most

effective way for us to operate in the Russian

market. To support the new organization,

Baker Hughes increased its investment in facil-

ities, equipment and people in Russia. Subse-

quently, Baker Hughes has provided services

for all the major Russian production asso-

ciations and national companies, including

Gazprom and Rosneft, as well as interna-

tional companies operating in the country.

During the year, Baker Hughes gained

integrated project management business,

serving a national oil company on nine rigs

with sidetracking services using drill bits,

directional drilling and measurement-while-

drilling technology, as well as casing exit

and completion equipment and services.

Our Russian operations also received orders

for INTEQ directional drilling services, sand

control completions, and Centrilift ESP sys-

tems for horizontal wells in the newly devel-

oped Vankor field in Eastern Siberia. Our

production optimization experts from Baker

Oil Tools and ProductionQuest installed two

Intelligent Well Systems in the Valdelp field in

Western Siberia. Hughes Christensen began

servicing a drill bit management program for

TNK-BP’s Orenburg, Nyagan and Samotlor

business units. The Russian wireline logging

and perforating business grew rapidly in

Western Siberia and from Sakhalin Island,

with services conducted both by Baker Atlas

and our ONGF subsidiary. In addition, Baker

Petrolite gained production chemical business

in Siberia and in the Arctic region.

In Astrakhan in southern Siberia, Baker

Hughes Russia helped Gazprom and its

drilling subsidiary Burgas drill a well below

13,000 feet, through difficult formations

where vertical drilling is extremely challeng-

ing. Baker Hughes provided integrated opera-

tions on the project, which included INTEQ’s

VertiTrak™ vertical drilling system, Baker

Hughes Drilling Fluids PERFORMAX™ and

This Annual Report to Stockholders, including the letter

to stockholders from Chairman Chad C. Deaton, contains

forward-looking statements within the meaning of Section 27A

of the Securities Act of 1933, as amended, and Section 21E

of the Securities Exchange Act of 1934, as amended. The

words “will,” “expect,” “should,” “scheduled,” “plan,” “aim,”

“ensure,” “believe,” “promise,” “anticipate,” “could” and

similar expressions are intended to identify forward-looking

statements. Baker Hughes’ expectations regarding these

matters are only its forecasts. These forecasts may be sub-

stantially different from actual results, which are affected

by many factors, including those listed in ”Risk Factors“ and

“Management’s Discussion and Analysis of Financial Condi-

tion and Results of Operations” contained in Items 1A and 7

of the Annual Report on Form 10-K of Baker Hughes Incor-

porated for its year ended December 31, 2007. The use

of “Baker Hughes,” “our,” “we” and similar terms are

not intended to describe or imply particular corporate

organizations or relationships.

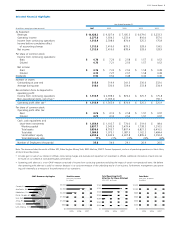

Baker Hughes achieved record revenues, exceeding $10 billion for the

first time, while also earning its highest annual operating profit. We

are pleased with the progress we have made in growing our business

in key geographic markets, which contributed $879 million in incre-

mental revenue during the year.

2007 Annual Report 3