Baker Hughes 2007 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2007 Baker Hughes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Most industry forecasts project that the world’s hydrocarbon demand

will grow by more than 50% in the next 20 years. To satisfy this grow-

ing energy need, oil and gas companies will require the innovation

and technologies from companies like Baker Hughes to meet the tech-

nical challenges of finding and producing hydrocarbons from new and

existing reservoirs.

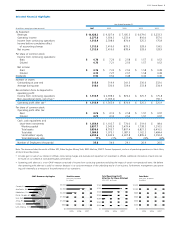

North America Revenues

2005–2007, by Quarter

(In millions)

$1,200

$1,000

$800

$600

$400

$200

$0

2005 2006 2007

10 Baker Hughes Incorporated

The significant steps we have taken over

the past few years to strengthen our global

compliance program will play an important

role in reinforcing this company’s strong

reputation for integrity and ethical behavior.

For example, all management employees

and employees working in financial roles have

undergone required training regarding busi-

ness ethics and legal compliance, with partic-

ular emphasis on meeting the requirements

of the Foreign Corrupt Practices Act (FCPA).

In addition, we launched a global “Completely

Compliant” campaign to remind all Baker

Hughes employees of their obligation to com-

ply with all policies, laws and health, safety

and environmental requirements.

Now that we have settled the investiga-

tions with the DOJ and SEC, we are able to

pursue acquisitions, and refocus on imple-

menting our strategy for growth and profit-

ability. At the same time, the Deferred

Prosecution Agreement and the costs associ-

ated with the independent monitor and rigor-

ous compliance program will have an ongoing

impact on our business.

Optimizing the Organization

The Baker Hughes business model has

been based on strong product line divisions

focused on providing specific products and

services to our customers. In 2005, we

enhanced this approach by establishing two

segments and by aligning our global opera-

tions into four consistent regions with man-

agement teams closer to our customers. In

2007, we took several other steps to optimize

the organization to improve bottom-line

results and sustain growth.

To strengthen management visibility over

global operations, I asked our Group Presi-

dents, David Barr and Martin Craighead, to

each take financial responsibility for two of

our operating regions in addition to oversee-

ing their product line segments. David will

provide leadership for the Middle East, Asia

Pacific region and the Europe, Africa, Russia,

Caspian region and will office in Dubai for

six months of each year. Martin will lead the

North America and Latin America regions.

Our finance function was reorganized

so that division finance vice presidents now

report directly to the chief financial officer

instead of the business unit presidents to

improve efficiency and consistency and to

enhance our ability to comply with account-

ing regulations.

After a six-month evaluation, we restruc-

tured our Human Resources organization to

provide stronger direction from the corporate

center and to shift resources to support

region operations.

Late in the year, we named a new presi-

dent for our ProductionQuest business unit

and expanded its production optimization

role to include responsibility for integrated

services. Previously, our integrated operations

and project management group was focused

primarily on well construction activities. With

our customers’ increasing emphasis on max-

imizing recovery from existing fields, there

is a growing demand for production-related

project management, as well.

In 2008, we will balance our investment

in growth with a renewed effort at cost man-

agement, keeping a tight reign on administra-

tive costs and discretionary spending. We will

manage our headcount to match activity, and

we will continue to develop our local work

force internationally to control costs and to

increase our local content in countries where

we do business. We expect our Eastern Hemi-

sphere Education Center in Dubai to have a

strong positive impact by improving our ability

to train and develop employees from emerg-

ing markets.

Outlook

Looking ahead, the global fundamentals

for the upstream oil and gas industry remain

strong. Most industry forecasts project that

the world’s hydrocarbon demand will grow

by more than 50% in the next 20 years. To

satisfy this growing energy need, oil and gas

companies will increase their spending on

exploration, development and production.

They will require the innovation and technolo-

gies from companies like Baker Hughes to

meet the technical challenges of finding and