Baker Hughes 2007 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2007 Baker Hughes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

To Our Stockholders

In the fourth year of the current growth

cycle, Baker Hughes achieved record reve-

nues, exceeding $10 billion for the first time,

while also earning its highest annual operat-

ing profit. We are pleased with the progress

we have made in growing our business in key

geographic markets, particularly in the East-

ern Hemisphere, which contributed $879 mil-

lion in incremental revenue during the year.

At the same time, market growth in North

America slowed as natural gas inventories

reached record high levels and changes in

the Canadian royalty structure discouraged

drilling activity.

In 2008, we will continue to grow glob-

ally. To drive growth in 2007, we invested in

infrastructure at our technology centers and

in operations facilities in emerging markets;

in technology, through increased Research &

Engineering spending and capital expendi-

tures for rental equipment; and in people, both

through recruiting and development programs.

We also understand the need to optimize

our organization for improved profitability in

an increasingly competitive market.

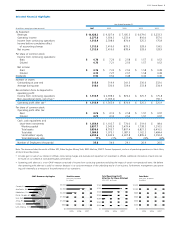

Record Financial Results

Baker Hughes had revenues of $10.4 billion

in 2007, up from $9.03 billion in 2006. Our

operating profit was $1.514 billion or $4.73 per

diluted share, compared to $1.363 billion or

$4.10 per diluted share in 2006.

For the full year in 2007, the company’s

net income was $1.514 billion or $4.73 per

diluted share, compared to $2.419 billion

or $7.27 per diluted share in 2006, which

included a $1.035 billion after tax gain from

the sale of our 30% interest in the Western

Geco seismic business to Schlumberger Ltd.

Capital investment of $1.127 billion in

2007 was up 22% from $922 million in 2006.

Of the total investment, 49% was devoted

to rental tools and equipment in global oper-

ations, 12% was used to build new facilities

as part of our worldwide expansion, and 39%

was spent on expanding engineering and

manufacturing capacity.

Baker Hughes also repurchased 6.4 mil-

lion shares of common stock in 2007, at

an average price of $81.25, for a total of

$521.5 million. At the end of 2007, the

company had authorization remaining to

repurchase approximately $824.0 million

in common stock. On December 31, 2007,

Baker Hughes had 315.4 million shares out-

standing and $1.054 billion in cash and

short-term investments.

Segment Results

Drilling and Evaluation revenues were

$5,293 million in 2007, up 14% from

$4,661 million in 2006. Operating profits

before tax of $1,396 million in 2007 were

12% higher than the $1,242 million for

this segment in 2006. Highest growth was

achieved by the directional drilling, logging-

while-drilling and wireline logging product

lines at INTEQ and formation evaluation prod-

uct line at Baker Atlas. Drilling and Evaluation

segment pre-tax operating margin was 26%

for 2007 and 27% in 2006.

Completion and Production revenues

grew by 18% to $5,135 million in 2007 from

$4,367 million in 2006. The segment’s oper-

ating profits in 2007 were $1,112 million, up

18% from $942 million in 2006. The pre-tax

operating margin for both 2007 and 2006

was 22%. Growth in the Completion and

Production segment is consistent with the

industry’s increased emphasis on maximizing

recovery from oil and natural gas reservoirs.

Our completions and electrical submersible

pump (ESP) product lines at Baker Oil Tools

and Centrilift, respectively, had the highest

growth rates, while the specialty chemical

business at Baker Petrolite also achieved

steady gains. The ProductionQuest production

optimization business unit, which was formed

in 2006, achieved solid revenue growth in 2007.

Regional Performance

In 2007, Baker Hughes continued to

implement our strategy of increasing our

presence and growing our business in key

countries where the long-term growth poten-

tial is the highest. In 2005, we organized our

operations into four geographic regions to

Chad C. Deaton

2 Baker Hughes Incorporated