Baker Hughes 2007 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2007 Baker Hughes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Completion and Production revenues grew 18% and the segment’s

operating profits also were up 18% from 2006. Rapid growth in the

Completion and Production segment is consistent with the industry’s

increased emphasis on maximizing recovery from oil and natural

gas reservoirs.

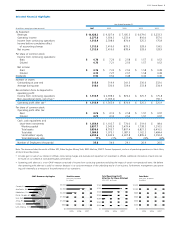

Europe, Africa, Russia, Caspian Revenues

2005–2007, by Quarter

(In millions)

$900

$800

$700

$600

$500

$400

$300

$200

$100

$0

2005 2006 2007

6 Baker Hughes Incorporated

ProductionQuest installed fiber optic well

monitoring systems in two wells for the

national oil company.

North America

North America remains our largest region.

Revenues of $4,358 million in 2007 were up

9% compared to $4,000 million in 2006.

The average North America rotary rig

count was essentially flat from 2006 to 2007

at 2,111 rigs. While the total U.S. rig count

was up 7%, the average offshore rig count

dropped 19% year to year, ending the year at

64 rigs. Historically high gas storage levels

slowed the growth in natural gas-directed

drilling, while high oil prices prompted an

increase in drilling for oil.

Baker Hughes participated in unconven-

tional gas development activities by drilling

and completing horizontal wells in the Barnett

and Woodford shale plays in North Texas and

Oklahoma. Business for Baker Petrolite and

Centrilift was generally strong throughout

North America as demand for their production-

related products and services grew despite a

flat rig count. In the Rocky Mountains, Baker

Petrolite foamer treatments and Centrilift

pump technology were utilized to remove

water from gas wells to enable them to

produce efficiently.

In the Gulf of Mexico, Baker Hughes

participated in the deepwater market with a

wide range of services. Baker Hughes Drilling

Fluids introduced its new RHEO-LOGIC™

synthetic based system on wells as deep as

29,500 feet. Baker Oil Tools installed several

Intelligent Well Systems including five at

water depths greater than 8,000 feet.

Centrilift provided ESP systems for subsea

boosters and riser lift systems in waters up

to 8,960 feet deep.

Development drilling activity in Canada

dropped significantly in 2007, as the Alberta

government imposed higher royalties and the

average rig count fell 27% from 2006 levels.

In response, Baker Hughes adjusted its oper-

ating structure and staffing levels, and relo-

cated key personnel to other markets, while

preserving our ability to respond when activity

rebounds. Baker Petrolite’s business in the

Canadian tar sands grew as the division

provided chemicals and services for Steam

Assisted Gravity Drainage (SAGD) and oil

mining operations.

Investing in Infrastructure

As a leading global service company,

Baker Hughes recognizes the need to invest

for growth in three areas: infrastructure, tech-

nology and people.

We are investing in our infrastructure to

establish and reinforce our global presence

and to support our engineering and manufac-

turing programs.

In 2007, we invested $130 million in

new and upgraded facilities. During the year,

we added or expanded 25 operations facilities

in 12 countries, including a major support

base in Macaé, Brazil. In Dubai, we recently

opened a new complex that includes our

Middle East, Asia Pacific region headquarters,

our Eastern Hemisphere Education Center, a

Middle East operations office and repair facil-

ity, and a well screen manufacturing plant.

We also have completed the first phase

of our Center for Technology Innovation in

Houston, a world-class facility focused on the

development of completion and production

technologies. The center has unique capabili-

ties for testing well completion components

at extremely high pressures and temperatures.

During the year, we also expanded our tech-

nology center in Celle, Germany and added

manufacturing capacity for our completions

product lines in the United States.

Our investment in infrastructure will

continue through 2008 as we build our

global platform for accelerated growth in

2009 and beyond.

Investing in Technology

As a key element in our growth strategy,

we also increased our investment in technol-

ogy during the year. Research and Engineer-

ing (R&E) spending in 2007 was $372 million,

up 10% from $339 million in 2006. More

than 60% of R&E activity was directed at

new product development. Baker Hughes

teams also conducted joint research projects