Baker Hughes 2007 Annual Report Download

Download and view the complete annual report

Please find the complete 2007 Baker Hughes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2007 Annual Report

To Stockholders

Global Growth.

Local Performance.

Table of contents

-

Page 1

2007 Annual Report To Stockholders Global Growth. Local Performance. -

Page 2

... superior tools and integrated systems to solve the toughest oilfield challenges. Our experts apply this technology to deliver unmatched results during the drilling, evaluation, completion and production processes. During the year, we increased our investments in research and engineering while... -

Page 3

..., technology and a new operations facility. Innovative ESP subsea booster systems were successfully deployed in three deepwater fields. Drilling and Evaluation Segment Baker Atlas Baker Atlas provides wireline-conveyed well logging, data analysis and perforating services for formation evaluation... -

Page 4

... to achieve maximum contact with the reservoir and increase recovery from new and existing fields. Qatar Baker Hughes' strengths in drilling and completing large diameter wells helped operators in Qatar develop the country's substantial natural gas reserves. Intelligent Well Systemsâ„¢ technology... -

Page 5

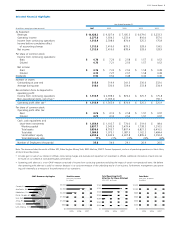

... Region Total Revenues 2005-2007, by Quarter (In millions) Total Operating Profit After Tax Per Share (Diluted) 2005-2007, by Quarter Total Debt 2005-2007, by Quarter (In millions) Canada, 5% Asia Pacific, 9% Middle East, 10% Russia, Caspian, 6% USA, 36% Africa, 9% Europe, 15% Latin America, 10... -

Page 6

... growth was achieved by the directional drilling, loggingwhile-drilling and wireline logging product lines at INTEQ and formation evaluation product line at Baker Atlas. Drilling and Evaluation segment pre-tax operating margin was 26% for 2007 and 27% in 2006. Completion and Production revenues grew... -

Page 7

... country. During the year, Baker Hughes gained integrated project management business, serving a national oil company on nine rigs with sidetracking services using drill bits, directional drilling and measurement-whiledrilling technology, as well as casing exit and completion equipment and services... -

Page 8

4 Baker Hughes Incorporated Latin America » Centrilift demonstrated that its ESP technology can create value in subsea applications with the successful startup of booster systems in three of Brazil's deepwater fields. INTEQ expanded operations significantly in Brazil as it began operations on a... -

Page 9

... Annual Report 5 Drilling and Evaluation revenues were up 14% in 2007 compared to 2006, and operating profits were 12% higher as pre-tax operating margins averaged 26% for the year. Highest growth was achieved by the directional drilling, logging-while-drilling and wireline logging product lines... -

Page 10

... our Middle East, Asia Pacific region headquarters, our Eastern Hemisphere Education Center, a Middle East operations office and repair facility, and a well screen manufacturing plant. We also have completed the first phase of our Center for Technology Innovation in Houston, a world-class facility... -

Page 11

2007 Annual Report 7 Europe, Africa, Russia and the Caspian » Baker Hughes Drilling Fluids applied its MICRO-WASH ™ remediation fluid to restore significant oil production from two damaged wells in Angola. INTEQ helped Exxon Neftegaz Limited set the world record for the deepest extended reach ... -

Page 12

8 Baker Hughes Incorporated Middle East and Asia Pacific » INTEQ has provided advanced directional drilling services and Baker Oil Tools has delivered sand control completions on hundreds of wells in China's Bohai Bay and South China Sea. Hughes Christensen drill bits have set drilling records ... -

Page 13

... in their fields. This program is designed to develop and retain creative minds whose contributions are critical to the company's future. In April 2007, Baker Hughes reached parallel settlements with the United States Department of Justice (DOJ) and the Securities and Exchange Commission (SEC) to... -

Page 14

...East, Asia Pacific region and the Europe, Africa, Russia, Caspian region and will office in Dubai for six months of each year. Martin will lead the North America and Latin America regions. Our finance function was reorganized so that division finance vice presidents now report directly to the chief... -

Page 15

2007 Annual Report 11 North America » Baker Petrolite made steady gains in North America, obtaining new contracts for its FATHOM ™ deepwater flow assurance programs in the Gulf of Mexico and providing innovative FOAM™ solutions for dewatering gas wells in the Rocky Mountains. In Canada, ... -

Page 16

... Resources; and Martin S. Craighead, Vice President and Group President, Drilling and Evaluation. Opportunities for Growth producing hydrocarbons from new and existing reservoirs. While the long-term projections for E&P spending are strong, we expect the growth rate to moderate this year. In North... -

Page 17

...; Ratification of Deloitte & Touche LLP as the Company's Independent Registered Public Accounting Firm for Fiscal Year 2008; Approval of the Performance Criteria for Awards under the 2002 Director & Officer Long-Term Incentive Plan; and Such other business as may properly come before the meeting and... -

Page 18

... ...Executive Compensation ...Summary Compensation ...Grants of Plan-Based Awards ...Outstanding Equity Awards at Fiscal Year-End ...Option Exercises and Stock Vested ...Pension Benefits ...NonQualified Deferred Compensation ...Potential Payments Upon Termination or Change in Control ...Director... -

Page 19

2007 Proxy Statement 1 PROXY STATEMENT This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Baker Hughes Incorporated, a Delaware corporation ("Company," "Baker Hughes," "we," "us" and "our"), to be voted at the Annual Meeting of Stockholders... -

Page 20

... bearing a later date. The executive offices of the Company are located at 2929 Allen Parkway, Suite 2100, Houston, Texas 77019. For a period of at least ten days prior to the Annual Meeting of Stockholders, a complete list of stockholders entitled to vote at the Annual Meeting will be available for... -

Page 21

...'s Latin America/West Africa Division from 1992 to 1994. In 1992, he was named Vice President, Texaco. He is a director and Executive Committee member of both the U.S. Saudi Arabian Business Council and the American Petroleum Institute. Chairman of the Board, President and Chief Executive Officer of... -

Page 22

... predecessor company (high technology venture capital firm) since 1982. Former First Selectman, Greenwich, Connecticut (city government) from 2003 to 2007. Mr. Lash also served as Chairman and Chief Executive Officer of Reading Tube Corporation from 1982 to 1996. Mr. Lash is a director of the East... -

Page 23

... SEC rules. The Governance Guidelines are posted under the "About Baker Hughes" section of the Company's website at www.bakerhughes.com and are also available upon request to the Company's Corporate Secretary. Board of Directors During the fiscal year ended December 31, 2007, the Board of Directors... -

Page 24

... salary and bonus awards to key executives; recommending incentive compensation and stock award plans for approval by stockholders; and reviewing management succession plans. Governance Committee. The Governance Committee held four meetings during fiscal year 2007. The Board of Directors has... -

Page 25

... the Company's Corporate Secretary. Business Code of Conduct The Company has a Business Code of Conduct that applies to all officers, directors and employees, which includes the code of ethics for the Company's chief executive officer, chief financial officer, chief accounting officer or controller... -

Page 26

8 Baker Hughes Incorporated SECURITY OWNERSHIP OF MANAGEMENT Set forth below is certain information with respect to beneficial ownership of the Common Stock as of February 25, 2008 by each director nominee, the persons named in the Summary Compensation Table below and the directors and executive ... -

Page 27

...the Board regarding all employment agreements, severance agreements, change in control provisions and agreements and any special supplemental benefits applicable to the Executives; (vi) assuring that the Company's incentive compensation program, including the annual and long-term incentive plans, is... -

Page 28

...and Weatherford International Limited. An analysis based on recent financial data shows that amongst our Peer Group we ranked fifth in revenue as of June 30, 2007 and sixth in market capitalization as of September 30, 2007. The Compensation Committee reviews the Survey Data annually. The Survey Data... -

Page 29

... driving company financial success. While both short and long-term incentives drive the final compensation levels for Senior Executives, the Committee encourages a balance between short and long term business goals by employing both types of compensation programs. If Senior Executives make business... -

Page 30

...Compensation Committee reviews Survey Data and evaluates the Senior Executive's level of responsibility and experience as well as Company performance. The Compensation Committee also considers the Senior Executive's success in achieving business results, promoting our core values and keys to success... -

Page 31

2007 Proxy Statement 13 Annual Incentive Plan The Annual Incentive Plan provides Senior Executives with the opportunity to earn cash bonuses based on the achievement of specific Company-wide, business unit, division or function and individual performance goals. The Compensation Committee designs ... -

Page 32

... over a number of years as stockholder value is increased as a result of a higher stock price or sustained improvements in financial performance over multiple years. Long-term incentives comprise the largest portion of a Senior Executive's compensation package and are consistent with our at-risk pay... -

Page 33

... stockholder value creation. The objectives of the performance units are to (i) insure a long-term focus on capital employment; (ii) develop human resource capability; (iii) enable long-term growth opportunities; (iv) motivate accurate financial forecasting; and (v) reward long-term goal achievement... -

Page 34

... life insurance may be paid from a Senior Executive's perquisite allowance. We offer retirement programs that are intended to supplement the employee's personal savings and social security. The programs include the Baker Hughes Incorporated Thrift Plan ("Thrift Plan"), which is a 401(k) plan... -

Page 35

...the Company. The following are the quarterly pay crediting rates under the Pension Plan: Pay Credit as a Percentage of Quarterly Eligible Compensation Accordingly, Executive contributions include amounts calculated from an Executive's Thrift Plan pre-tax election on file as of the prior year-end on... -

Page 36

... in control of the Company), severance benefits may be paid to the Senior Executives. Additional severance benefits payable to our PEO are addressed in his employment agreement discussed below. The Senior Executives are covered under a general severance plan known as the Baker Hughes Incorporated... -

Page 37

... the Board of Directors or the Compensation Committee: •฀ a฀base฀salary; •฀ the฀opportunity฀to฀earn฀annual฀cash฀bonuses฀in฀amounts฀ that may vary from year to year and that are based upon achievement of performance goals; •฀ long-term฀incentives฀in฀the฀form... -

Page 38

20 Baker Hughes Incorporated According to the Change in Control Agreements, we pay severance benefits to a NEO if the NEO's employment is terminated following, or in connection with, a Change in Control during the term unless: •฀ the฀NEO฀resigns฀without฀"good฀reason"; •฀ the฀... -

Page 39

... Incorporation, Bylaws and applicable law. We believe these indemnification agreements enhance our ability to attract and retain knowledgeable and experienced Senior Executives and independent, non-management directors. Stock Ownership Policy The Board of Directors, upon the Compensation Committee... -

Page 40

22 Baker Hughes Incorporated Exercise of Stock Options Upon exercise of a stock option and after netting down the shares to pay the taxes due as a result of exercise, the Senior Executive is required to hold 50% of the net profit shares until the applicable Stock Ownership Level is met. Net profit ... -

Page 41

... Statement 23 EXECUTIVE COMPENSATION SUMMARY COMPENSATION The following table sets forth the compensation earned by the PEO and other NEOs for services rendered to the Company and its subsidiaries for the fiscal years ended December 31, 2007 and 2006. Bonuses are paid under the Company's applicable... -

Page 42

... shown on the second line represent amounts under the Long-Term Performance Unit plan, which awards are paid in cash. Amounts shown represent the number of shares granted in 2006 and 2007 for RSAs. Our practice is that the exercise price for each stock option is the fair market value on the date of... -

Page 43

... of Management" table in this Proxy Statement. Represents performance awards that were granted under the 2005 performance plan and may be paid in the form of target shares at the end of fiscal year 2007. For a more detailed discussion, see the section titled "Long-Term Incentive Compensation... -

Page 44

26 Baker Hughes Incorporated OPTION EXERCISES AND STOCK VESTED The following table sets forth certain information regarding options and stock awards exercised and vested, respectively, during 2007 and 2006 for the persons named in the Summary Compensation Table above. Option Exercises and Stock ... -

Page 45

... the remaining term of the employment agreement; b. we will pay him or his beneficiary a lump sum in cash equal to his expected value incentive bonus for the year of termination; and c. the substantial risk of forfeiture restrictions applicable to 40,000 restricted shares of our stock granted by us... -

Page 46

... Agreement or in connection with any tax audit or proceeding relating to the application of parachute payment excise taxes to any payment or benefit under the Change in Control Agreement. Chad C. Deaton Mr. Deaton's options to purchase an aggregate of 218,776 of our shares, with a value of $81.10... -

Page 47

... by 39,109 of our shares subject to Mr. Ragauss' unvested restricted stock awards). We estimate that if a Change in Control were to have occurred on December 31, 2007, but Mr. Ragauss had not incurred a termination of employment, the value of the parachute payment tax gross-up payment that would be... -

Page 48

30 Baker Hughes Incorporated Payments in the Event of a Change in Control and Termination of Employment by the Executive for Good Reason or by the Company or its Successor Without Cause Pursuant to the Change in Control Agreements, the Company or its successor pays severance benefits to a NEO if ... -

Page 49

... This benefit is discussed in detail above under the heading "Payments in the Event of a Change in Control Absent a Termination of Employment". Baker Hughes Incorporated Executive Severance Plan On November 1, 2002, we adopted an executive severance program, the Baker Hughes Incorporated Executive... -

Page 50

... Baker Hughes Incorporated If the NEO meets the criteria for payment of severance benefits due to an Involuntary Termination, we (or our successor) will pay him the following benefits in addition to any benefits he is due under our employee benefit plans and equity and incentive compensation plans... -

Page 51

... 2002 D&O Plan Change in Control which is material to his total compensation; or (vi) our failure to continue to provide the NEO with benefits substantially similar to those enjoyed by him under any of our pension, savings, life insurance, medical, health and accident, or disability plans in which... -

Page 52

34 Baker Hughes Incorporated Alan R. Crain The substantial risk of forfeiture restrictions applicable to 21,297 shares of our stock granted to Mr. Crain would have lapsed on December 31, 2007, if (i) on December 31, 2007, we or one of our affiliates sold a business unit, (ii) on December 31, 2007, ... -

Page 53

... employment on December 31, 2007, due to the disability of the NEO (as determined by the 2002 D&O Plan committee) or due to the death of the NEO, all of the NEO's then outstanding stock options granted by us would have become fully vested and exercisable. For each NEO, the number of our shares... -

Page 54

...of the 2002 D&O Plan) prior to a 2002 D&O Plan Change in Control, or (ii) the NEO terminated his employment with us for good reason (within the meaning of the 2002 D&O Plan) and, in the case of (i) or (ii), the circumstance or event occurred at the request or direction of the person who entered into... -

Page 55

...employment with us on December 31, 2007 due to retirement, we would have paid Mr. Barr, in cash, the sums of $275,014 and $180,082 in complete settlement of his performance unit award granted under the 2002 D&O Plan on January 25, 2006 and on January 24, 2007, respectively. Baker Hughes Incorporated... -

Page 56

...-management directors during the fiscal years ended 2007 and 2006. For a description of the fees and other awards payable to the Company's directors, please refer to the section titled "Corporate Governance - Board of Directors" contained elsewhere in this proxy statement. Non-Equity Incentive Plan... -

Page 57

... 30, 2007 Form 10-Qs prior to their being filed with the SEC. The Audit/Ethics Committee also reviewed and discussed the Company's audited financial statements for the year ended December 31, 2007 with management, the Company's internal auditors and Deloitte & Touche. Deloitte & Touche informed the... -

Page 58

40 Baker Hughes Incorporated recommended to the Board of Directors, and the Board has approved, that the financial statements be included in the Company's Annual Report on Form 10-K for the year ended December 31, 2007. James F. McCall (Chairman) Larry D. Brady Clarence P. Cazalot, Jr. Anthony G. ... -

Page 59

...Code. In 2002 the Board of Directors adopted, and the stockholders approved, the 2002 D&O Plan, which provides for, among other compensation, performance-based compensation for corporate officers, directors and key employees of the Company based upon the achievement of performance goals for the year... -

Page 60

... Directors recommends a vote "FOR" approval of the material terms of the performance criteria for performance awards under the 2002 D&O Plan. ANNUAL REPORT The 2007 Annual Report on Form 10-K of the Company (the "Annual Report"), which includes audited financial statements for the fiscal year ended... -

Page 61

... Statement and form of proxy relating to that meeting. Such proposals should be mailed to the Company's Corporate Secretary, c/o Baker Hughes Incorporated 2929 Allen Parkway, Suite 2100, Houston, Texas 77019. Nominations of directors by stockholders must be received by the Chairman of the Governance... -

Page 62

... the Company's present executives serve on that company's compensation committee is not "independent" until three years after the end of such service or the employment relationship. 5. A director who is an executive officer or an employee, or whose immediate family member is an executive officer, of... -

Page 63

... financial officer, principal accounting officer, controller, public accountant, auditor or person performing similar functions; (c) Experience overseeing or assessing the performance of companies or public accountants with respect to the preparation, auditing or evaluation of financial statements... -

Page 64

...(i) all critical accounting policies and practices being used; (ii) all alternative treatments of financial information within generally accepted accounting principles that have been discussed with management, and the treatment The Board of Directors of Baker Hughes Incorporated (the "Company") has... -

Page 65

... registered public accounting firm management's report on internal control prior to the filing of the company's annual report on Form 10-K. •฀ Establish฀guidelines฀with฀respect฀to฀earnings฀releases฀and฀ financial information and earnings guidance provided to analysts and rating... -

Page 66

... the audited financial statements with both management and the independent registered public accounting firm, the Committee recommended to the Board of Directors that the audited financial statements be included in the Company's Annual Report on Form 10-K for the last fiscal year for filing with the... -

Page 67

...of the Board of Directors or the Chairman of the Committee. The Committee may create subcommittees who shall report to the Committee. The Committee may ask employees, the independent registered public accounting firm, corporate auditors or others whose advice and counsel the Committee deems relevant... -

Page 68

... Committee, Compensation Committee, Finance Committee or with the non-management directors of the Company as a group, by sending such written communication to the following address: Corporate Secretary c/o Baker Hughes Incorporated 2929 Allen Parkway, Suite 2100 Houston, TX 77019-2118 Stockholders... -

Page 69

.... Baker Hughes Incorporated, a Delaware corporation (the "Company"), hereby establishes an incentive compensation plan to be known as the "Baker Hughes Incorporated 2002 Long-Term Incentive Plan" (this "Plan"), to reward certain directors, corporate officers and key employees of the Company by... -

Page 70

...-3 of the General Rules and Regulations under the Exchange Act. "Board" or "Board of Directors" means the Board of Directors of the Company. "Cash-based Award" means an Award granted to a Participant as described in Article 9. "Cause" for termination by the Company of the Employee's employment means... -

Page 71

...Employee with benefits substantially similar to those enjoyed by the Employee under any of the Company's pension, savings, life insurance, medical, health and accident, or disability plans in which the Employee was participating immediately prior to the Change in Control (except for across the board... -

Page 72

E-4 Baker Hughes Incorporated Company to provide the Employee with the number of paid vacation days to which the Employee is entitled on the basis of years of service with the Company in accordance with the Company's normal vacation policy in effect at the time of the Change in Control; or (g) if ... -

Page 73

... issued pursuant to Awards granted under this Plan. Shares approved pursuant to the Long Term Incentive Plan of Baker Hughes Incorporated, as amended, the Baker Hughes Incorporated 1993 Stock Option Plan, as amended, and the Baker Hughes Incorporated 1998 Employee Stock Option Plan, as amended, that... -

Page 74

... the terms and conditions of, and the criteria included in, Awards in recognition of unusual or nonrecurring events affecting the Company or the financial statements of the Company, or in response to changes in applicable laws, regulations or accounting principles. The determination of the Board as... -

Page 75

... Price in the form and manner as the Committee (or Board with respect to Awards granted to Directors) shall determine, the Participant may pay the required fee and request a Share certificate based upon the number of Shares purchased under the Option through the third-party administrator designated... -

Page 76

... the Shares of Restricted Stock or Restricted Stock Units granted herein may not be sold, transferred, pledged, assigned or otherwise alienated or hypothecated until the end of the applicable Period of Restriction established by the Committee (or the Board with respect to Awards granted to Directors... -

Page 77

.... Subject to the terms of this Plan, after the applicable Performance Period has ended, the holder of Performance Units/Shares and Cash-Based Awards shall be entitled to receive payout on the number and value of Performance Units/Shares and Cash-Based Awards the Employee earned over the Performance... -

Page 78

... No. 30 or in management's discussion and analysis of financial condition and results of operations appearing in the Company's annual report to stockholders for the applicable year; (f) acquisitions or divestitures and (g) foreign exchange gains and losses. Article 11. Beneficiary Designation. Each... -

Page 79

... Commission, any securities exchange or transaction reporting system upon which the Shares are then listed or to which they are admitted for quotation and any applicable federal or state securities law. The Committee (or the Board with respect to Awards granted to Directors) may cause a legend... -

Page 80

... by this Plan; (b) Determine which Employees employed outside the United States are eligible to participate in this Plan; (c) Modify the terms and conditions of any Award granted to Employees who are employed outside the United States to comply with applicable foreign laws; (d) Establish subplans... -

Page 81

2007 Proxy Statement E-13 AMENDMENT TO THE BAKER HUGHES INCORPORATED 2002 DIRECTOR & OFFICER LONG-TERM INCENTIVE PLAN THIS AGREEMENT by Baker Hughes Incorporated, a Delaware corporation (the "Company"), W I T N E S S E T H: WHEREAS, the Board of Directors of the Company previously adopted the plan ... -

Page 82

... as of the last business day of the registrant's most recently completed second fiscal quarter (based on the closing price on June 29, 2007 reported by the New York Stock Exchange) was approximately $26,845,000,000. As of February 19, 2008, the registrant has outstanding 309,397,947 shares of common... -

Page 83

.... Directors, Executive Officers and Corporate Governance ...Executive Compensation ...Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters...Certain Relationships and Related Transactions, and Director Independence ...Principal Accountant Fees and Services... -

Page 84

... drilling, formation evaluation, completion and production of oil and natural gas wells. We may conduct our operations through subsidiaries, affiliates, ventures and alliances. Baker Hughes was formed in April 1987 in connection with the combination of Baker International Corporation and Hughes Tool... -

Page 85

... Drilling Fluids' primary competitors include M-I SWACO, Halliburton Company ("Halliburton") and Newpark Resources, Inc. Key business drivers for Baker Hughes Drilling Fluids include the number of drilling rigs operating (especially the number of drilling programs targeting deep formations), total... -

Page 86

... pipe. Baker Atlas' primary formation evaluation and wireline completion and perforating competitors include Schlumberger, Halliburton and Weatherford. Key business drivers for Baker Atlas include the number of drilling and workover rigs operating, as well as the current and expected future price of... -

Page 87

...purchasing decisions in wellbore construction, cased-hole completions, sand control and wellbore intervention are superior wellsite service execution and value-adding technologies that improve production rates, protect the reservoir from damage and reduce cost. Specific opportunities for competitive... -

Page 88

... driver of customer purchasing decisions in specialty chemicals is superior application of technology and service delivery. Specific opportunities for competitive differentiation include: •฀ higher฀levels฀of฀production฀or฀throughput, •฀ lower฀maintenance฀costs฀and฀frequency... -

Page 89

... work outside the United States. The business operations of our divisions are organized around four primary geographic regions: North America, Latin America, Middle East and Asia Pacific, and Europe, Africa, Russia and the Caspian. Each region has a council comprised of regional vice presidents from... -

Page 90

...and Chief Executive Officer of Hanover Compressor Company from 2002 to 2004. Senior Advisor to Schlumberger Oilfield Services from 1999 to 2001. Executive Vice President of Schlumberger from 1998 to 1999. Employed by the Company in 2004. Alan R. Crain 56 Senior Vice President and General Counsel of... -

Page 91

.... Vice President, Middle East, Asia Pacific Region for Baker Atlas from 2005 to 2007; Asia Pacific Region Manager, Baker Atlas from 2001 to 2005 and Asia Pacific Region Operations Manager, Baker Atlas from 2000 to 2001. Employed by the Company in 1979. Alan J. Keifer 53 Group President of Drilling... -

Page 92

...2005. President of Baker Hughes Drilling Fluids from 2004 to 2005. Vice President, Business Process Development of the Company from 1998 to 2002; Vice President, Manufacturing, of Baker Oil Tools from 1990 to 1998 and Plant Manager of Hughes Tool Company from 1988 to 1990. Employed by the Company in... -

Page 93

... to estimate the additional potential cost to the Company. (h) In 2006, a settlement demand was received from the PRP Group for the Pulvair Superfund site located in Millington, Tennessee for waste sent to the site by Milchem, a predecessor to Baker Hughes Drilling Fluids. The matter has not yet... -

Page 94

... affect our business, financial condition, results of operations and cash flows and, thus, the value of an investment in our Company. Risk Factors Related to the Worldwide Oil and Natural Gas Industry Our business is focused on providing products and services to the worldwide oil and natural... -

Page 95

...contract terms and conditions with our customers, especially state-owned national oil companies, our ability to manage warranty claims and our ability to effectively manage our commercial agents can also impact our results of operations. Managing development of competitive technology and new product... -

Page 96

... lead time orders. People are a key resource to developing, manufacturing and delivering our products and services to our customers around the world. Our ability to manage the recruiting, training and retention of the highly skilled workforce required by our plans and to manage the associated costs... -

Page 97

...: Canada and South America Segment United States Europe Far East Total Completion and Production Drilling and Evaluation 16 13 4 1 7 4 1 1 28 19 ITEM 3. LEGAL PROCEEDINGS We are involved in litigation or proceedings that have arisen in our ordinary business activities. We insure against... -

Page 98

...investigations was provided to the SEC and DOJ. On April 26, 2007, the United States District Court, Southern District of Texas, Houston Division (the "Court") unsealed a three-count criminal information that had been filed against us as part of the execution of a Deferred Prosecution Agreement (the... -

Page 99

...2006, Baker Hughes Oilfield Operations, Inc. ("BHOO"), a subsidiary of the Company, was named as a defendant in a lawsuit in the United States District Court, Eastern District of Texas brought by Reed Hycalog against BHOO and other third parties arising out of alleged patent infringement relating to... -

Page 100

2007 Form 10-K 17 PART II ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES Our common stock, $1.00 par value per share, is principally traded on the New York Stock Exchange. Our common stock is also traded on the SWX Swiss Exchange... -

Page 101

... of total return on investment (change in year-end stock price plus reinvested dividends) assumes that $100 was invested on December 31, 2002 in Baker Hughes common stock, the S&P 500 Index and the S&P Oil and Gas Equipment and Services Index. The Corporate Performance Graph and related information... -

Page 102

... of accounting change Cumulative effect of accounting change, net of tax Net income Per share of common stock: Income from continuing operations: Basic Diluted Dividends Balance Sheet Data: Cash, cash equivalents and short-term investments Working capital Total assets Long-term debt Stockholders... -

Page 103

...the consolidated financial statements of "Item 8. Financial Statements and Supplementary Data" contained herein. EXECUTIVE SUMMARY We are a leading provider of drilling, formation evaluation, completion and production products and services to the worldwide oil and natural gas industry. We report our... -

Page 104

2007 Form 10-K 21 The business operations of our divisions are organized around four primary geographic regions: North America, Latin America, Middle East and Asia Pacific, and Europe, Africa, Russia and the Caspian. Each region has a council comprised of regional vice presidents from each division... -

Page 105

...oil companies ("NOCs"). Our ability to compete in the oilfield services market is dependent on our ability to differentiate our product and service offerings by technology, service and the price paid for the value we deliver. The primary driver of our business is our customers' capital and operating... -

Page 106

... Form 10-K 23 Our rig counts are summarized in the table below as averages for each of the periods indicated. 2007 2006 2005 (1) U.S. - land and inland waters U.S. - offshore Canada North America Latin America North Sea Other Europe Africa Middle East Asia Pacific Outside North America Worldwide... -

Page 107

... in developing and commercializing new technologies as well as investing in our core product offerings. During 2007, we opened the first phase of the Center for Technology and Innovation in Houston, Texas. This facility focuses on research and development of completion and production systems in... -

Page 108

... of accounting change in the consolidated statement of operations. In conjunction with the adoption, we recorded conditional asset retirement obligations of $1.6 million as the fair value of the costs associated with the special handling of asbestos related materials in certain facilities. OUTLOOK... -

Page 109

... 2007, we opened new or expanded facilities in many regions and/or countries including Latin America, the Middle East, and Russia. In addition, we opened the first phase of our Center for Technology and Innovation in Houston, a research and engineering facility to design advanced completion systems... -

Page 110

... Business Code of Conduct, as well as legal compliance standards, policies, procedures and processes. The CCO reports directly to the General Counsel and the Chairman of the Audit/Ethics Committee of our Board of Directors. The CCO has ready access to all of the other senior officers of the Company... -

Page 111

...assessments by the Corporate Ethics & Compliance Group in specified countries such as those which are rated high on Transparency International's Corruption Perception Index. LIQUIDITY AND CAPITAL RESOURCES Our objective in financing our business is to maintain adequate financial resources and access... -

Page 112

...in escrow related to our sale of Petreco International. In May 2005, we received $3.7 million from the initial release of this escrow. During 2006, we paid $66.2 million for acquisitions of businesses, net of cash acquired. In the first quarter of 2006, we acquired Nova Technology Corporation ("Nova... -

Page 113

... paying dividends of between $160.0 million and $165.0 million in 2008; however, the Board of Directors can change the dividend policy at anytime. In the U.S., we merged two pension plans effective January 1, 2007, resulting in one tax-qualified U.S. pension plan, the Baker Hughes Incorporated... -

Page 114

..., which totaled approximately $466.8 million at December 31, 2007. We also had commitments outstanding for purchase obligations related to capital expenditures and inventory under purchase orders and contracts of approximately $293.1 million at December 31, 2007. It is not practicable to estimate... -

Page 115

...long-term forecasts of future revenues and costs related to the assets subject to review. In turn, these forecasts are uncertain in that they require assumptions about demand for our products and services, future market conditions and technological developments. Significant and unanticipated changes... -

Page 116

... expected experience. The discount rate enables us to state expected future cash flows at a present value on the measurement date. The development of the discount rate for our U.S. plans was based on a bond matching model whereby a hypothetical bond portfolio of high-quality, fixed-income securities... -

Page 117

... of accounting for planned major maintenance activities in annual and interim financial reporting periods. We adopted FSP AUG AIR-1 on January 1, 2007 to change our method of accounting for repairs and maintenance activities on certain rental tools from the accrue-in-advance method to the direct... -

Page 118

... regarding our business outlook, including changes in revenue, pricing, capital spending, profitability, strategies for our operations, impact of any common stock repurchases, oil and natural gas market conditions, market share and contract terms, costs and availability of resources, economic and... -

Page 119

... We conduct operations around the world in a number of different currencies. A number of our significant foreign subsidiaries have designated the local currency as their functional currency. As such, future earnings are subject to change due to fluctuations in foreign currency exchange rates when... -

Page 120

... of financial statements for external purposes in accordance with generally accepted accounting principles. Our control environment is the foundation for our system of internal control and is embodied in our Business Code of Conduct, which sets the tone of our company and includes our Core Values of... -

Page 121

...PUBLIC ACCOUNTING FIRM To the Board of Directors and Stockholders of Baker Hughes Incorporated Houston, Texas We have audited the internal control over financial reporting of Baker Hughes Incorporated and subsidiaries (the "Company") as of December 31, 2007, based on criteria established in Internal... -

Page 122

... ACCOUNTING FIRM To the Board of Directors and Stockholders of Baker Hughes Incorporated Houston, Texas We have audited the accompanying consolidated balance sheets of Baker Hughes Incorporated and subsidiaries (the "Company") as of December 31, 2007 and 2006, and the related consolidated statements... -

Page 123

40 Baker Hughes Incorporated CONSOLIDATED STATEMENTS OF OPERATIONS Year Ended December 31, (In millions, except per share amounts) 2007 2006 2005 Revenues: Sales Services and rentals Total revenues Costs and expenses: Cost of sales Cost of services and rentals Research and engineering Marketing, ... -

Page 124

... employee compensation Income taxes payable Other accrued liabilities Total current liabilities Long-term debt Deferred income taxes and other tax liabilities Liabilities for pensions and other postretirement benefits Other liabilities Commitments and contingencies Stockholders' Equity: Common stock... -

Page 125

42 Baker Hughes Incorporated CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY Common Stock Capital in Excess of Par Value Retained Earnings Accumulated Other Comprehensive Loss Unearned Compensation (In millions, except per share amounts) Total Balance, December 31, 2004 Comprehensive income: Net... -

Page 126

... Dividends Excess tax benefits from stock-based compensation Net cash flows from financing activities Effect of foreign exchange rate changes on cash Increase in cash and cash equivalents Cash and cash equivalents, beginning of year Cash and cash equivalents, end of year Income taxes paid Interest... -

Page 127

... TO CONSOLIDATED FINANCIAL STATEMENTS NOTE 1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Nature of Operations Baker Hughes Incorporated ("Baker Hughes") is engaged in the oilfield services industry. Baker Hughes is a major supplier of products and technology services and systems to the worldwide oil... -

Page 128

... and tax credits. Changes in tax laws, regulations, agreements and treaties, foreign currency exchange restrictions or our level of operations or profitability in each tax jurisdiction could have an impact upon the amount of income taxes that we provide during any given year. Our tax filings for... -

Page 129

.... The change was the result of an internal review to improve management reporting. The reclassified expenses relate to selling and field service costs which are closely related to operating activities. In addition, we have renamed selling, general and administrative expenses on the statement of... -

Page 130

... 2009 for acquisitions on or after this date. NOTE 2. DISCONTINUED OPERATIONS In the fourth quarter of 2005, our management initiated and our Board of Directors approved a plan to sell the Baker Supply Products Division ("Baker SPD"), a product line group within the Completion and Production segment... -

Page 131

48 Baker Hughes Incorporated NOTE 3. ACQUISITIONS In January 2006, we acquired Nova Technology Corporation ("Nova") for $55.4 million, net of cash acquired of $3.0 million, plus assumed debt. Nova is a supplier of permanent monitoring, chemical injection systems, and multi-line services for ... -

Page 132

... is accelerated. Compensation cost related to stock options is recognized on a straight-line basis over the vesting or service period and is net of forfeitures. The fair value of each stock option granted is estimated on the date of grant using the Black-Scholes option pricing model. The following... -

Page 133

...-line basis over the vesting or service period and is net of forfeitures. A summary of our RSA and RSU activity and related information is presented below (in thousands, except per share/unit prices): RSA Number of Shares Weighted Average Grant Date Fair Value Per Share RSU Number of Units Weighted... -

Page 134

...NOTE 6. INCOME TAXES The provision for income taxes on income from continuing operations is comprised of the following for the years ended December 31: 2007 2006 2005 Current: United States Foreign Total current Deferred: United States Foreign Total deferred Provision for income taxes $ 365.8 380... -

Page 135

... Inventory Property Employee benefits Other accrued expenses Operating loss carryforwards Tax credit carryforwards Capitalized research and development costs Other Subtotal Valuation allowances Total Deferred tax liabilities: Goodwill Undistributed earnings of foreign subsidiaries Other Total... -

Page 136

... expirations in several taxing jurisdictions. The most significant uncertainties are due to possible transfer pricing adjustments related to goods and services provided across borders in various countries. At December 31, 2007, approximately $351.4 million of gross unrecognized tax benefits were... -

Page 137

... ASSETS The changes in the carrying amount of goodwill are detailed below by segment: Drilling and Evaluation Completion and Production 318.0 2.1 330.6 2.0 339.4 2.1 Balance as of December 31, 2005 Goodwill from acquisitions during the period Adjustments for final purchase price allocations of... -

Page 138

2007 Form 10-K 55 We perform an annual impairment test of goodwill as of October 1 of every year. There were no impairments of goodwill in 2007, 2006 or 2005 related to the annual impairment test. Intangible assets are comprised of the following at December 31: 2007 Gross Carrying Amount Gross ... -

Page 139

... such financial instruments at December 31, 2007 and 2006 approximates their carrying value as reflected in our consolidated balance sheets. The fair value of our debt and foreign currency forward contracts has been estimated based on quoted year end market prices. The estimated fair value of total... -

Page 140

... exceed federally insured limits. We periodically assess the financial condition of the institutions and believe that the risk of any loss is minimal. NOTE 13. SEGMENT AND RELATED INFORMATION We are a provider of drilling, formation evaluation, completion and production products and services to the... -

Page 141

58 Baker Hughes Incorporated The "Corporate and Other" column also includes assets of discontinued operations as of December 31, 2005. Summarized financial information is shown in the following table. Drilling and Evaluation Completion and Production Total Oilfield Corporate and Other WesternGeco... -

Page 142

2007 Form 10-K 59 The following table presents consolidated revenues by country based on the location of the use of the products or services for the years ended December 31: 2007 2006 2005 NOTE 14. EMPLOYEE BENEFIT PLANS Defined Benefit Plans We have noncontributory defined benefit pension plans ... -

Page 143

... Pension Benefits 2007 2006 Other Postretirement Benefits 2007 2006 Change in benefit obligation: Benefit obligation at beginning of year Service cost Interest cost Actuarial (gain) loss Benefits paid Plan amendments Other Exchange rate adjustments Benefit obligation at end of year Change in plan... -

Page 144

... net periodic benefit costs for these plans are as follows for the years ended December 31: U.S. Pension Benefits 2007 2006 2005 2007 Non-U.S. Pension Benefits 2006 2005 2007 Other Postretirement Benefits 2006 2005 Discount rate Expected rate of return on plan assets Rate of compensation increase... -

Page 145

... retirement plan ("SRP") for certain officers and employees whose benefits under the Thrift Plan and/or the U.S. defined benefit pension plan are limited by federal tax law. The SRP also allows the eligible employees to defer a portion of their eligible compensation and provides for employer... -

Page 146

..., and internal-controls provisions. As in the DPA, it requires that we retain the independent monitor to assess our FCPA compliance policies and procedures for the three-year period. Under the terms of the settlements with the DOJ and the SEC, the Company and BHSII paid in the second quarter of 2007... -

Page 147

64 Baker Hughes Incorporated We have retained, and the SEC and DOJ have approved, an independent monitor to assess our FCPA compliance policies and procedures for the specified three-year period. On May 4, 2007 and May 15, 2007, The Sheetmetal Workers' National Pension Fund and Chris Larson, ... -

Page 148

... practice is to conduct Foreign currency translation adjustments Pension and other postretirement benefits Total $ 11.9 (56.1) $ (60.3) (126.9) $ (44.2) $ (187.2) Other Supplemental consolidated statement of operations information is as follows for the years ended December 31: 2007 2006... -

Page 149

...our management included a report of their assessment of the design and effectiveness of our internal controls over financial reporting as part of this Annual Report on Form 10-K for the fiscal year ended December 31, 2007. Deloitte & Touche LLP, the Company's independent registered public accounting... -

Page 150

... Officers. Amended and Restated Executive Severance Plan. In order to comply with Section 409A of the Internal Revenue Code of 1986, as amended, and to establish severance benefits for a new salary grade, on February 7, 2008, the Company amended and restated the Baker Hughes Incorporated Executive... -

Page 151

... during fiscal year 2007 and approximately 3.7 million shares remained available for future options. Performance Shares and Units; Cash-Based Awards. Performance shares may be granted to employees in the amounts and upon the terms determined by the Compensation Committee of our Board of Directors... -

Page 152

... measures and total shareholder return) and Baker Value Added (our metric that measures operating profit after tax less the cost of capital employed). Restricted Stock and Restricted Stock Units. With respect to awards of restricted stock and restricted stock units, the Compensation Committee will... -

Page 153

... 25, 2007 (filed as Exhibit 10.2 to Quarterly Report of Baker Hughes Incorporated on Form 10-Q for the quarter ended September 30, 2007). 10.12+ Form of Change in Control Severance Plan (filed as Exhibit 10.8 to Annual Report of Baker Hughes Incorporated on Form 10-K for the year ended December 31... -

Page 154

... and each of the directors and executive officers (filed as Exhibit 10.4 to Annual Report of Baker Hughes Incorporated on Form 10-K for the year ended December 31, 2003). 10.15+ Baker Hughes Incorporated Director Retirement Policy for Certain Members of the Board of Directors (filed as Exhibit 10.10... -

Page 155

... Baker Hughes Services International, Inc. and the United States Department of Justice filed on April 26, 2007, with the United States District Court of Texas, Houston Division (filed as Exhibit 10.5 to Quarterly Report of Baker Hughes Incorporated on Form 10-Q for the quarter ended March 31, 2007... -

Page 156

...Texas and the United States Department of Justice (filed as Exhibit 99.1 to Quarterly Report of Baker Hughes Incorporated on Form 10-Q for the quarter ended March 31, 2007). Baker Hughes Services International, Inc. Information document filed on April 26, 2007, by the Untied States Attorney's Office... -

Page 157

... registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. BAKER HUGHES INCORPORATED Date: February 21, 2008 /s/CHAD C. DEATON Chad C. Deaton Chairman of the Board, President and Chief Executive Officer KNOWN ALL PERSONS BY THESE PRESENTS, that... -

Page 158

2007 Form 10-K 75 BAKER HUGHES INCORPORATED SCHEDULE II - VALUATION AND QUALIFYING ACCOUNTS Deductions Balance at Beginning of Period Additions Charged to Cost and Expenses Reversal of Prior Deductions (1) Charged to Other Accounts (3) Balance at End of Period (In millions) Write-offs (2) Year ... -

Page 159

...Business฀Code฀of฀ Conduct and Foreign Corrupt Practices Act policies. The Baker Hughes Business Code of Conduct and Code of Ethical Conduct Certifications are available on our website; •฀ prepares฀an฀annual฀report฀to฀stockholders฀which฀is฀published฀ in our proxy statement... -

Page 160

... and profitability, and that executive compensation supports both company and stockholder interests; •฀ reviews฀our฀long-term฀equity฀incentive฀plans฀(and฀makes฀ grants thereunder), employee retirement income plans, the employee thrift plan and the employee stock purchase plan... -

Page 161

... of income, payroll, value added and other tax returns. AllianceBernstein Capital Research Global Investors Dodge & Cox Capital World T. Rowe Price State Street Goldman Sachs Vanguard Group Barclays Fidelity Management Top 10 investors Other institutional investors Other holders (12/07, 13F... -

Page 162

... 10-K Additional copies of the company's Annual Report to the Securities and Exchange Commission (Form 10-K) are available by writing to Baker Hughes Investor Relations. Corporate Office Location and Mailing Address 2929 Allen Parkway, Suite 2100 Houston, Texas 77019-2118 Telephone: (713) 439-8600... -

Page 163

Baker Hughes Incorporated 2929 Allen Parkway, Suite 2100 Houston, Texas 77019-2118 P.O. Box 4740 Houston, TX 77210-4740 (713) 439-8600 www.bakerhughes.com