BP 2005 Annual Report Download - page 172

Download and view the complete annual report

Please find page 172 of the 2005 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

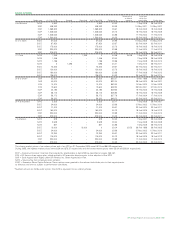

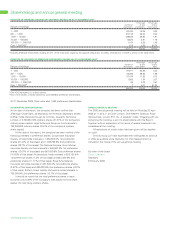

SHARE ELEMENT OF EDIP AND LONG TERM PERFORMANCE PLANS

Under the share element of the EDIP and the Long Term Performance

Plans (LTPPs), performance units were until 2004 granted at the

beginning of the three-year period and converted into an award of

shares at the end of the period, depending on performance. There is

a maximum of two shares per performance unit. For 2005 and future

years, grants of performance shares are made, being the maximum

number of shares that could vest (as described on pages 165-167). In

the table below, performance units that have yet to convert to shares

are expressed as the maximum number of shares into which they

could convert (based on the maximum 2:1 ratio). This achieves

consistency of disclosure between the two periods.

For the 2003-2005 share element of the EDIP and the LTPPs,

BP’s performance was assessed in terms of SHRAM, ROACE and

EPS growth. BP’s three-year SHRAM was measured against the

companies in the FTSE All World Oil & Gas Index. Companies within

the index are weighted according to their market capitalization at

the beginning of each three-year period in order to give greatest

emphasis to oil majors. BP’s ROACE and EPS were measured against

ExxonMobil, Shell, Total and Chevron. Based on a performance

assessment of 75 points out of 200 (0 for SHRAM, 50 for ROACE

and 25 for EPS growth), the committee expects to make awards

of shares to executive directors as highlighted in the 2003-2005 lines

of the table below.

SHARE ELEMENT OF EDIP AND LTPPs

Share element/LTPP interests Interests vested in 2005

Market price Potential maximum

of each share performance sharesaMarket price

Date of at date of award Number of each share

award of of performance of ordinary at vesting

Performance performance shares At 1 Jan Awarded At 31 Dec shares Vesting date

period shares £ 2005 2005 2005 vestedbdate £

Lord Browne 2002–2004 18 Feb 2002 5.73 951,112 – – 356,667 9 Feb 2005 5.49

2003–2005 17 Feb 2003 3.96 1,265,024 – 1,265,024 74,384 expected to vest Feb 2006

2004–2006 25 Feb 2004 4.25 1,268,894 – 1,268,894 – – –

2005–2007 28 April 2005 5.33 – 2,006,767 2,006,767 – – –

Dr D C Allen 2002–2004 6 Mar 2002 5.99 160,000 – – 60,000 9 Feb 2005 5.49

2003–2005 17 Feb 2003 3.96 394,088 – 394,088 147,783 expected to vest Feb 2006

2004–2006 25 Feb 2004 4.25 376,470 – 376,470 – – –

2005–2007 28 Apr 2005 5.33 – 436,623 436,623 – – –

I C Connc2002–2004 6 Mar 2002 5.99 138,000 – – 51,750 9 Feb 2005 5.49

2003–2005 17 Feb 2003 3.96 182,000 – 182,000 68,250 expected to vest Feb 2006

2004–2006 25 Feb 2004 4.25 182,000 – 182,000 – – –

2005–2007 28 Apr 2005 5.33 – 415,832 415,832 – – –

Dr B E Grote 2002–2004 18 Feb 2002 5.73 365,226 – – 136,960 9 Feb 2005 5.49

2003–2005 17 Feb 2003 3.96 467,276 – 467,276 175,229 expected to vest Feb 2006

2004–2006 25 Feb 2004 4.25 425,338 – 425,338 – – –

2005–2007 28 Apr 2005 5.33 – 501,782 501,782 – – –

Dr A B Hayward 2002–2004 6 Mar 2002 5.99 147,000 – – 55,125 9 Feb 2005 5.49

2003–2005 17 Feb 2003 3.96 394,088 – 394,088 147,783 expected to vest Feb 2006

2004–2006 25 Feb 2004 4.25 376,470 – 376,470 – – –

2005–2007 28 Apr 2005 5.33 – 436,623 436,623 – – –

J A Manzoni 2002–2004 6 Mar 2002 5.99 160,000 – – 60,000 9 Feb 2005 5.49

2003–2005 17 Feb 2003 3.96 394,088 – 394,088 147,783 expected to vest Feb 2006

2004–2006 25 Feb 2004 4.25 376,470 – 376,470 – – –

2005–2007 28 Apr 2005 5.33 – 436,623 436,623 – – –

Former directors

R L Olver 2002–2004 18 Feb 2002 5.73 392,592 – – 147,222 9 Feb 2005 5.49

2003–2005 17 Feb 2003 3.96 548,276 – 548,276 205,604 expected to vest Feb 2006

aBP’s performance is measured against the oil sector. For the periods 2003-2005 and 2004-2006, the performance measure is SHRAM, which is measured against

the FTSE All World Oil & Gas Index, and ROACE and EPS growth, which are measured against ExxonMobil, Shell, Total and Chevron. For the 2005-2007 period,

the performance condition is TSR measured against ExxonMobil, Shell, Total and Chevron. Each performance period ends on 31 December of the third year.

bRepresents awards of shares made, or expected to be made, at the end of the relevant performance period based on performance achieved under rules of the plan.

cMr Conn elected to defer to 2006 the determination of whether LTPP awards should be made for the 2000-2002 performance period. As this period ended prior to his

appointment as a director, the expected award is not included in this table.

170 Making energy more