BP 2005 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2005 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BP Annual Report and Accounts 2005 145

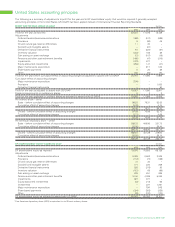

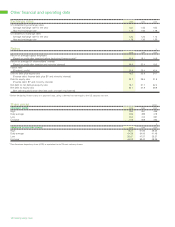

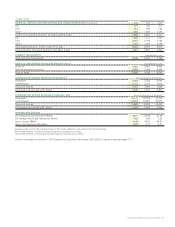

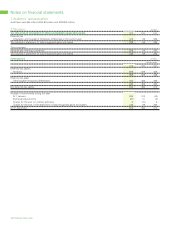

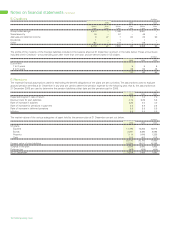

Accounting policies continued

A credit representing the expected return on the scheme assets

during the year is included within other finance expense. This credit is

based on the market value of the scheme assets and expected rates

of return at the beginning of the year.

Actuarial gains and losses may result from differences between the

expected return and the actual return on scheme assets; differences

between the actuarial assumptions underlying the scheme liabilities

and actual experience during the year; or changes in the actuarial

assumptions used in the valuation of the scheme liabilities. Actuarial

gains and losses, and taxation thereon, are recognized in the

statement of total recognized gains and losses.

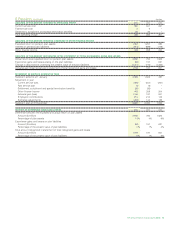

DEFERRED TAXATION

Deferred tax is recognized in respect of all timing differences that

have originated but not reversed at the balance sheet date where

transactions or events have occurred at that date that will result in

an obligation to pay more, or a right to pay less, tax in the future.

In particular:

••• Provision is made for tax on gains arising from the disposal of fixed

assets that have been rolled over into replacement assets, only to

the extent that, at the balance sheet date, there is a binding

agreement to dispose of the replacement assets concerned.

However, no provision is made where, on the basis of all available

evidence at the balance sheet date, it is more likely than not that

the taxable gain will be rolled over into replacement assets and

charged to tax only where the replacement assets are sold.

••• Provision is made for deferred tax that would arise on remittance of

the retained earnings of overseas subsidiaries, joint ventures and

associated undertakings only to the extent that, at the balance

sheet date, dividends have been accrued as receivable.

Deferred tax assets are recognized only to the extent that it is

considered more likely than not that there will be suitable taxable

profits from which the underlying timing differences can be deducted.

Deferred tax is measured on an undiscounted basis at the tax rates

that are expected to apply in the periods in which timing differences

reverse, based on tax rates and laws enacted or substantively enacted

at the balance sheet date.

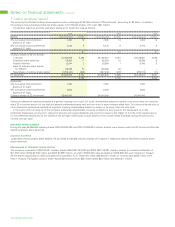

USE OF ESTIMATES

The preparation of accounts in conformity with generally accepted

accounting practice requires management to make estimates and

assumptions that affect the reported amounts of assets and liabilities

at the date of the accounts and the reported amounts of revenues and

expenses during the reporting period. Actual outcomes could differ

from these estimates.