BP 2005 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2005 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12 Making energy more

receive their dividend in the form of shares rather than

cash. The BP Direct Access Plan for US and Canadian

shareholders also includes a dividend reinvestment feature.

We remain committed to returning all free cash flows in

excess of investment and dividend needs to our shareholders.

During 2005, the company repurchased 1,060 million of its

own shares at a cost of $11,597 million. Of these, 77 million

were cancelled and the remainder are held in treasury. The

repurchased shares had a nominal value of $265 million and

represented 4.9% of the ordinary shares in issue at the

end of 2004. Since the inception of the share repurchase

programme in 2000, we have repurchased 2,662 million

shares at a cost of $25.2 billion. BP intends to continue its

programme of share buybacks, subject to market conditions

and constraints and to renewed authority at the April 2006

annual general meeting.

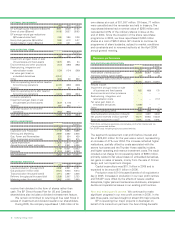

Business performance

EXPLORATION AND PRODUCTION

$ million

2005 2004 2003

Profit before interest and taxa25,508 18,087 15,084

Inventory holding (gains) losses (17) (10) (3)

Replacement cost profit before interest

and tax 25,491 18,077 15,081

Results include:

Impairment and gain (loss) on sale

of business and fixed assets 893 (469) 175

Environmental and other provisions –––

Restructuring, integration and

rationalization costs – – (117)

Fair value gain (loss) on

embedded derivatives (1,688) – –

Other (203) (27) –

Total non-operating items (998) (496) 58

Total hydrocarbon production (mboe/d) 4,014 3,997 3,606

Net proved reserves (million barrels)b18,271 18,583 18,338

Reserves replacement ratiob100% 110% 109%

aProfit from continuing operations and includes profit after interest and tax

of equity-accounted entities.

bUK SORP basis including equity-accounted entities.

The segment’s replacement cost profit before interest and

tax of $25,491 million for the year was a record, representing

an increase of 41% over 2004. The increase reflected higher

realizations, partially offset by costs associated with the

severe hurricanes and the Thunder Horse stability incident,

and higher operating and revenue investment costs. The result

included a net charge for non-operating items of $998 million,

primarily related to fair value losses on embedded derivatives,

net gains on sales of assets, mainly from the sale of Ormen

Lange, and net impairment charges.

Capital expenditure was $10.1 billion in 2005 and is

expected to be around $11 billion in 2006.

Production was 4,014 thousand barrels of oil equivalent a

day in 2005. Increases in production in our new profit centres

and TNK-BP were offset by the effects of severe weather

disruptions, higher planned maintenance shutdowns, anticipated

decline and operational issues in our existing profit centres.

New and existing profit centres We continued to make

significant progress in our new profit centres in 2005. In the

past three years, we have brought on stream 20 major projects.

BP is operating four major projects in Azerbaijan on

behalf of its consortium partners: the Azeri-Chirag-Gunashli

EXTERNAL ENVIRONMENT

2005 2004 2003

BP average liquids realizations ($/barrel) 48.51 35.39 27.25

Brent oil price ($/barrel) 54.48 38.27 28.83

BP average natural gas realizations

($/thousand cubic feet) 4.90 3.86 3.39

Henry Hub gas price ($/mmBtu) 8.65 6.13 5.37

Global indicator margin ($/barrel) 8.60 6.31 4.08

NON-OPERATING ITEMS

$ million

2005 2004 2003

Impairment and gain (loss) on sale

of businesses and fixed assets 1,070 295 94

Environmental and other provisions (412) (489) (582)

Restructuring, integration and

rationalization costs (134) (134) (399)

Fair value gain (loss) on

embedded derivatives (2,047) – –

Other (668) 39 559

Total non-operating items before taxation

for continuing operations (2,191) (289) (328)

Taxation 717 83 94

Total non-operating items after taxation

for continuing operations (1,474) (206) (234)

Innovene operations

Impairment and gain (loss) on sale

of businesses and fixed assets (647) (1,119) –

Taxation 367 253 –

Total after taxation for Innovene

operations (280) (866) –

Total after taxation (1,754) (1,072) (234)

CAPITAL INVESTMENT

$ million

2005 2004 2003

Exploration and Production 10,149 9,654 9,398

Refining and Marketing 2,669 2,692 2,945

Gas, Power and Renewables 235 524 439

Other businesses and corporate 885 940 815

Capital expenditure 13,938 13,810 13,597

Acquisitions and asset exchanges 211 2,841 6,026

14,149 16,651 19,623

Disposals (11,200) (4,961) (6,356)

Net investment 2,949 11,690 13,267

OPERATING STATISTICS

2005 2004 2003

Liquids production (thousand b/d) 2,562 2,531 2,121

Gas production (million cf/d) 8,424 8,503 8,613

Total production (thousand boe/d) 4,014 3,997 3,606

Refinery throughputs (thousand b/d) 2,399 2,607 2,723

Marketing sales (thousand b/d) 3,942 4,002 3,969