BP 2005 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2005 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BP Annual Report and Accounts 2005 15

and trading and NGLs businesses. The volumes of gas

supplied into liquefaction plants rose by 1%. Our solar

and power businesses continued to grow profitably.

Gas Our intent is to grow the business in the medium

term by 2-3% a year, in line with global gas demand. North

America, where we continue to hold the largest market

share, is our most important gas market. This position is

anchored by our strong upstream positions around the Gulf

of Mexico, the mid-continent, the Rockies, Canada and

Trinidad & Tobago. We have strong positions in the North

Sea, the Caspian and North Africa that, together with

imports of LNG, give us the opportunity to support Europe’s

move towards cleaner gas-fired heat and power. We have

significant gas sales via pipeline and LNG in Asia.

Our LNG plans remain on track. Our Atlantic basin

LNG business is underpinned by our upstream positions

in Trinidad & Tobago, Egypt and, in future, Angola. We

are bringing this gas to market through investment in

downstream regasification and logistics assets. In the US,

we have long-term capacity agreements in place at Cove

Point, Maryland, for 250 million standard cubic feet per

day (mmscfd) and Elba Island, Georgia, for 150mmscfd.

We are continuing to seek approval to develop a

regasification facility at Crown Landing in New Jersey,

where important progress was made in relation to

associated shipping, environmental and legal matters.

BP also has a long-term contract to supply LNG into the

Dominican Republic.

LNG POSITIONS AND MARKETS

LNG resources Major LNG markets

Major trade flow

In the UK, we began to supply LNG cargoes to the

new Isle of Grain terminal where, with Sonatrach, we have

rights to 450mmscfd of capacity. Despite tightness in world

LNG supplies, we were able to source cargoes of LNG

successfully from Trinidad & Tobago and Algeria in response

to increases in UK market prices. In Spain, we are partners

(BP 25%) in the 700mmscfd Bilbao regasification plant and

800MW gas-fired power station. BP supplies LNG cargoes

into the Pacific Basin, including Japan and Taiwan. We have

also started LNG supply into the Gwangyang regasification

terminal in South Korea since its start-up in mid-2005.

Sales into this terminal will be sourced from Tangguh after

will be extended to other countries during 2006. We

formed a joint venture between Castrol and the Dong

Feng group, a Chinese automobile manufacturer, to

supply lubricants to the Chinese market. Our strength in

fast-growth emerging markets depends on strong brands

and focused technological innovation.

BP enjoys strong market shares and leading technologies

in the high-growth A&A business. In Asia, we continue to

develop a strong position in PTA (the main component of

polyester fibres and packaging) and acetic acid (commonly

used for paints, adhesives and inks). Our investment is

biased towards this high-growth region, especially China.

Capital expenditure in our A&A business increased slightly

in 2005 as we invested to maintain our leadership position.

BP and Sinopec Corporation of China signed a joint-

venture contract to build a world-scale acetic acid plant

in Nanjing, Jiangsu province. The 500,000-tonnes-a-year

operation is planned to come on stream in the second half

of 2007. The sale of BP’s 70% shareholding in BP Malaysia

Sdn Bhd to Lembaga Tabung Angkatan (LTAT), announced

in 2004, was successfully concluded during the third quarter

of 2005. We also announced plans for a second PTA plant

at the BP Zhuhai Chemical Company’s site in China’s

Guangdong province, subject to government approval.

The new plant is designed to have an operating capacity

of 900,000 tonnes a year and will be the first plant to

use BP’s new-generation proprietary PTA technology.

In October 2005, we signed a letter of intent with

Hindustan Petroleum Corporation to form a 50:50 strategic

joint venture in the refining and marketing sector in India.

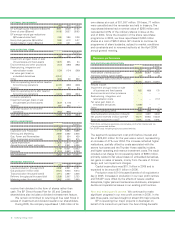

GAS, POWER AND RENEWABLES

$ million

2005 2004 2003

Profit before interest and taxa1,104 954 578

Inventory holding (gains) losses (95) (39) (6)

Replacement cost profit before interest

and tax 1,009 915 572

Results include:

Impairment and gain (loss) on sale of

business and fixed assets 55 56 (6)

Environmental and other provisions 6––

Restructuring, integration and

rationalization costs –––

Fair value gain (loss) on

embedded derivatives (346) – –

Other 265––

Total non-operating items (20) 56 (6)

aProfit from continuing operations and includes profit after interest and tax

of equity-accounted entities.

Replacement cost profit before interest and tax for the

segment for the year was $1,009 million, compared with

$915 million in 2004. The result includes a net charge for

non-operating items of $20 million (2004 $56 million gain),

which primarily comprises fair value losses on embedded

derivatives of $346 million and compensation of $265 million

received on cancellation of an intra-group gas supply

contract. The operating business result has increased by

20% over 2004, with higher margins from gas marketing