Avnet 2013 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2013 Avnet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

part of a publicly announced plan, and purchases made on the open market to obtain shares for the Company's Employee Stock Purchase Plan

(“ESPP”), which is not part of a publicly announced plan:

______________________

Item 6. Selected Financial Data

______________________

15

Period

Total Number

of Shares

Purchased

(1)

Average Price

Paid per Share

Total Number of

Shares Purchased

as Part of Publicly

Announced Plans

or Programs

Approximate Dollar

Value of Shares That

May Yet Be Purchased

Under the Plans

or Programs

April

5,600

$33.86

—

$224,475,000

May

5,500

$32.82

—

$224,475,000

June

4,400

$33.05

—

$224,475,000

(1) Consists entirely of purchases of Avnet’s common stock associated with the Company’

s ESPP.

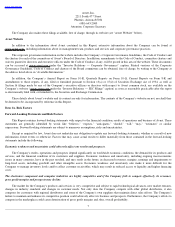

Years Ended

June 29, 2013

June 30, 2012

July 2, 2011 July 3, 2010 June 27,

2009

(a)

(Millions, except for per share and ratio data)

Income:

Sales

$

25,458.9

$

25,707.5

$

26,534.4

$

19,160.2

$

16,229.9

Gross profit

2,979.8

3,050.6

3,107.8

2,280.2

2,023.0

Operating income (loss)

626.0

(b)

884.2

(c)

930.0

(d)

635.6

(e)

(1,019.0

) (f)

Income tax provision

99.2

(b)

223.8

(c)

201.9

(d)

174.7

(e)

34.7

(f)

Net income (loss)

450.1

(b)

567.0

(c)

669.1

(d)

410.4

(e)

(1,129.7

) (f)

Financial Position:

Working capital

(g)

3,535.4

3,455.7

3,749.5

3,190.6

2,688.4

Total assets

10,474.7

10,167.9

9,905.6

7,782.4

6,273.5

Long-term debt

1,207.0

1,272.0

1,273.5

1,243.7

946.6

Shareholders’ equity

4,289.1

3,905.7

4,056.1

3,009.1

2,760.9

Per Share:

Basic earnings (loss)

3.26

(b)

3.85

(c)

4.39

(d)

2.71

(e)

(7.49

) (f)

Diluted earnings (loss)

3.21

(b)

3.79

(c)

4.34

(d)

2.68

(e)

(7.49

) (f)

Book value per diluted share

30.64

26.12

26.28

19.66

18.30

Ratios:

Operating income (loss) margin

on sales

2.5

%

(b)

3.4

%

(c)

3.5

%

(d)

3.3

%

(e)

(6.3

)%

(f)

Net income (loss) margin on

sales

1.8

%

(b)

2.2

%

(c)

2.5

%

(d)

2.1

%

(e)

(7.0

)%

(f)

Return on capital

10.6

%

(b)

12.9

%

(c)

15.2

%

(d)

14.0

%

(e)

(26.6

)%

(f)

Quick

1.2:1

1.2:1

1.2:1

1.4:1

1.5:1

Working capital

1.7:1

1.7:1

1.8:1

1.9:1

2.1:1

Total debt to capital

32.3

%

35.4

%

27.2

%

29.8

%

26.0

%

(a)

As adjusted for the retrospective application of an accounting standard. The Financial Accounting Standards Board issued authoritative

guidance that requires the issuer of certain convertible debt instruments that may be settled in cash (or other assets) on conversion to

separately account for the debt and equity (conversion option) components of the instrument. The standard requires the convertible debt to

be recognized at the present value of its cash flows discounted using the non-

convertible debt borrowing rate at the date of issuance. The

resulting debt discount from this present value calculation is to be recognized as the value of the equity component and recorded to

additional paid in capital. The discounted convertible debt is then required to be accreted up to its face value and recorded as non-

cash

interest expense over the expected life of the convertible debt. In addition, deferred financing costs associated with the convertible debt are

required to be allocated between the debt and equity components based upon relative values. During the first quarter of fiscal 2010, the

Company