Avnet 2013 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2013 Avnet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

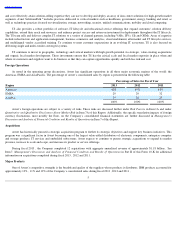

Market price per share

The Company’

s common stock is listed on the New York Stock Exchange under the symbol AVT. Quarterly high and low sales closing

prices (as reported for the New York Stock Exchange composite transactions) for the last two fiscal years were:

The Company did not pay any dividends on its common stock during the last two fiscal years. Any future decision to declare or pay

dividends will be at the discretion of the Board of Directors and will be dependent upon the Company's financial condition, results of operations,

capital requirements, and such other factors as the Board of Directors deems relevant. In addition, certain of the Company's debt facilities

contain restrictions on the declaration and payment of dividends.

Record Holders

As of July 26, 2013 , there were 3,330 registered holders of record of Avnet’s common stock.

Equity Compensation Plan Information as of June 29, 2013

______________________

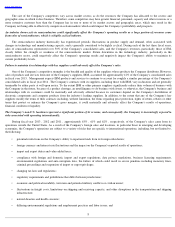

Stock Performance Graphs and Cumulative Total Returns

The graph below compares the cumulative 5-year total return of holders of Avnet, Inc.’

s common stock with the cumulative total returns of

the S&P 500 index and certain of Avnet’

s peer companies in the electronics distribution industry. The graph tracks the performance of a $100

investment in Avnet’s common stock, in the peer group, and the index (with the reinvestment of all dividends) from June 28, 2008 to

June 29,

2013

. The companies comprising the peer group that Avnet has historically used are: Agilysys, Inc., Anixter International, Inc., Arrow

Electronics, Inc., Ingram Micro, Inc., Insight Enterprises, Inc., Scansource, Inc., Synnex Corp. and Tech Data Corp. Brightpoint, Inc. terminated

its registration with the SEC as a result of it being acquired and, therefore, is not included in the graph below.

13

2013

2012

Fiscal Quarters High

Low

High

Low

1st

$

33.51

$

28.91

$

32.86

$

24.19

2nd

31.62

27.01

31.73

24.77

3rd

36.86

30.61

36.83

31.02

4th

35.39

31.54

36.65

29.23

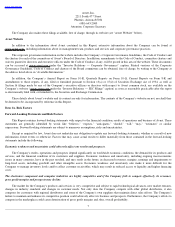

Plan Category

Number of

Securities

to be Issued Upon

Exercise of

Outstanding

Options, Warrants

and Rights

Weighted-Average

Exercise Price of

Outstanding

Options, Warrants

and Rights

Number of Securities

Remaining Available

for

Future Issuance

Under Equity

Compensation Plans

(Excluding Securities

Reflected in Column

(a))

(a) (b)

(c)

Equity compensation plans approved by security holders

5,559,753

(1)

$26.65

2,995,588

(2)

(1) Includes 2,579,188 shares subject to options outstanding and 2,009,510 stock incentive shares and 971,055

performance shares awarded

but not yet delivered. Included in the performance shares is the number of shares anticipated to be issued in the first quarter of fiscal 2014

relating to the level of achievement reached under the performance share program,that ended on June 29, 2013 (see Note 12 in the

Notes to

Consolidated Financial Statements included in Item 15 of this Report)

(2) Does not include 432,789 shares available for future issuance under the Employee Stock Purchase Plan, which is a non-

compensatory plan.