Aviva 2013 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2013 Aviva annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Aviva plc

Annual report and accounts 2013

6

Group Chief Executive Ofcer’s statement

Key statistics

in 2013

17

Aviva operates in

17 countries

318

Aviva is a 318-year-old

business

31.4m

Customers worldwide

27,700

Employees

The turnaround at

Aviva is intensifying

We are back in the game but still have much to do.

We have focused the business on ‘cash ow plus

growth’ and are beginning to see the benets of this

reected in our performance.

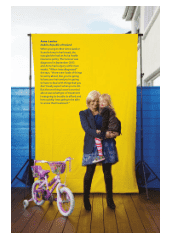

Mark Wilson

Group Chief Executive Ofcer

Overview

Cash ows are up 40%, operating expenses are

down 7%, operating prot is up 6% and Value

of New Business (VNB) is up 13%. After a £2.9

billion loss after tax last year, Aviva has delivered

a £2.2 billion prot after tax.

To deliver our investment thesis of ‘cash ow

plus growth’ we need to be nancially robust.

In 2013, we increased economic capital surplus

from £7.1 billion¹ to £8.3 billion and liquidity

at the Group centre has increased signicantly

to £1.6 billion at the end of February 2014.

With reference to earnings and cash ow

improvements, the Board has proposed a

9.4 pence dividend.

Reducing the intercompany loan has been a

key priority in 2013. Over the past 12 months,

we have reduced the loan by £1.7 billion to £4.1

billion². We have agreed a comprehensive plan

to reduce the intercompany loan to £2.2 billion,

utilising £450 million of existing cash resources

and £1.45 billion of other actions. We have

reached agreement with the Prudential

Regulation Authority (PRA) and I believe the

execution of this plan will take the issue of our

intercompany loan off the table.

We have also completed signicant disposals in

the US, Aseval in Spain, Malaysia, Netherlands

and announced a disposal in Italy. I believe Aviva

is now more focused and better managed.

Aviva has an extraordinary depth of talented

people who understand the core insurance

businesses and this depth means we have strong

core underwriting businesses. Nevertheless, we

needed to strengthen some aspects of our skill set

and since the start of 2013, Aviva’s senior

management pool has been deepened with key

appointments in nance, asset management,

human resources, IT and transformation,

together with numerous internal promotions.

Although we have made progress in 2013,

turnarounds are rarely linear and the improving

results should be tempered by the realism that

the business still has issues to address and is

performing nowhere near its full potential.

Cash ow

The rst part of our ‘cash ow plus growth’

investment thesis is to convert more of our

prots into cash remitted to Group. Higher cash

remittances allow for optimal capital allocation

and dividend exibility. In 2013, cash remittances

were £1,269 million³, a 40% increase over the

2012 comparative. This represents a remittance

ratio of 72% of Operating Capital Generation

(OCG) and is progress towards my ambition to

get the remittance ratio above 80%.

Our cash generators, UK, France and Canada,

generated a 59% increase in cash remittances,

making up 80% of the total cash remitted to

Group. Following the resumption of dividends

from Ireland and Italy, all our turnaround

businesses are now remitting cash to Group.

Operating prot

2013 operating prot increased 6% to £2,049

million (2012: £1,926 million). The stability of

our prot stream underlines our ‘cash ow plus

growth’ investment proposition. After a £2.9

billion loss last year principally due to the write-

down of Aviva USA, our prot after tax increased

to £2.2 billion.

1 The pro forma economic capital surplus at 31 December 2012 included the benet of disposals and an increase in pension scheme risk allowance from ve to ten years of stressed contributions. The

capital requirement is based on Aviva’s own internal assessment and capital management policies, measuring the amount of economic capital at risk in a 1-in-200 year loss event over a one year time

horizon. The term ‘economic capital’ does not imply capital as required by regulators or other third parties.

2 At end of February 2014.