Aviva 2007 Annual Report Download

Download and view the complete annual report

Please find the complete 2007 Aviva annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Aviva plc

Annual Report and Accounts 2007

Forty five

million

customers.

Twenty seven

countries.

One Aviva.

Table of contents

-

Page 1

Aviva plc Annual Report and Accounts 2007 Forty five million customers. Twenty seven countries. One Aviva. -

Page 2

... our businesses in the USA and Ireland Achieved ratings upgrades in our US life business from AM Best and Standard & Poors Achieved savings of £250 million in the UK life and general insurance businesses Gained access to over 50 million potential new customers through bancassurance deals Completed... -

Page 3

... directors of Aviva plc on the alternative method of reporting long-term business profits 247 Alternative method of reporting long-term business profits Purpose 268 Aviva Group of Companies 270 Shareholder services Vision Strategic priorities Targets Aviva Investors UK Europe North America Asia... -

Page 4

...working together across our businesses, we will optimise our performance in the global marketplace and maximise the value we can generate for all our stakeholders. Andrew Moss Group chief executive Cover image: An overview of our international marketing campaigns that bring the Aviva brands to life... -

Page 5

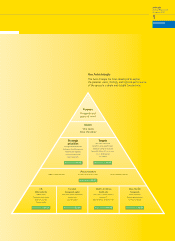

... 'One Aviva twice the value' Strategic priorities Manage composite portfolio Build global Asset Management Allocate capital rigorously Increase customer reach Boost productivity Targets 98% meet or beat COR Long-Term savings growth targets £350m cost savings by end 2009 Double IFRS EPS by 2012... -

Page 6

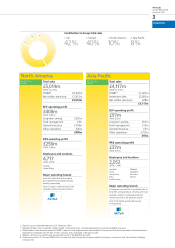

...a market leader in the UK long-term savings market Norwich Union Insurance is the leading general insurer in the UK and we also provide a wide range of motoring services through the RAC Morley is one of the UK's largest active fund managers and the largest fund management business in the Aviva group... -

Page 7

..., household, creditor, health, commercial motor, commercial property and commercial liability insurance. †Present value of new business premium (PVNBP) is equal to total single premium sales received in the year plus the discounted value of annual premiums expected to be received over the term of... -

Page 8

...the integration of AmerUs in the United States and Ark Life in Ireland, and undertaken a cost and efficiency review in the UK. We have also set new cost saving targets for our UK and European businesses totalling £350 million. Our number one priority is to manage our existing assets effectively and... -

Page 9

...These range from awards as "best general insurer" and "best property manager" to endorsements for product innovation, e-business, socially responsible investment, online financial education and online communications. Outlook We look forward to building on Aviva's achievements as we work towards our... -

Page 10

... say that Aviva delivered another robust performance in challenging circumstances in 2007. Strong growth across our long-term savings and asset management businesses more than offset weather-related losses from our UK general insurance operation. As group chief executive, my intention is to build on... -

Page 11

... in the UK in both our long-term savings and general insurance businesses. Europe continues to be a big success story. We are the number one writer of life and pensions business across Europe (including the UK), based on multi-distribution channels in the larger, more developed, markets, and through... -

Page 12

-

Page 13

... review Turkish Aviva advertising In 2007 Turkey launched the 'Touch the future' brand campaign. The campaign creates a link between the past and future by emphasising the 300 year old history of Aviva to reinforce Aviva as an established and trustworthy company to have the capability for building... -

Page 14

... profit (European Embedded Value basis) - Operating profit (International Financial Reporting Standards basis) - Long-term new business sales (PVNBP) - Proposed ordinary dividend per share and dividend cover - Return on equity shareholders' funds Management also use a variety of Other Performance... -

Page 15

... in the benefits of life insurance, general insurance and asset management as complementary parts of an overall business model that balances cashflow, returns and long-term value creation, and delivers prosperity and peace of mind to customers. 11 Business review Build global asset management: We... -

Page 16

...Asset Management GI & Health Long-term business Excludes corporate costs, other operations and group debt costs 2008 Priorities What we are focused on in 2008 - Manage GI for value and cash flow - Drive rapid profitable growth and long term value creation from the life and pensions business - Build... -

Page 17

... to build access to customers through bancassurance, partners, agencies, sales forces and direct distribution - Refresh brand positioning - Implement a variety of customer initiatives, including UK customer services improvement programme ("One and Done") - Roll out TCF (Treating Customers Fairly... -

Page 18

... Report and Accounts 2007 Business review continued: Key performance indicators In 2007, the group's strategy was underpinned by focusing on a number of key financial performance measures. The key measures that are used to assess performance at a group level are set out below: Earnings per share... -

Page 19

... dividend per share and dividend cover** Proposed ordinary dividend per share and dividend cover 15 Business review Return on equity shareholders' funds†We aim to deliver an after-tax operating return on opening equity shareholders' funds, including life profits on a European Embedded Value... -

Page 20

...and regional costs* Regional operating profit before tax Corporate centre Group debt costs and other interest IFRS operating profit before tax Group operating profit - EEV basis Restated** 12 months 12 months 2007 2006 £m £m Long-term business* Fund management* General insurance and health Other... -

Page 21

...variance in longer term investment return reflects long-term economic assumptions which are set with reference to bond yields. Dividend The Board has recommended a 10% increase in the final dividend to 21.10 pence per share (2006: 19.18 pence), payable on 16 May 2008 to shareholders on the register... -

Page 22

... ratio Return on equity shareholders' funds Earnings per share Basic - EEV operating profit after tax basis Basic - IFRS total profit after tax basis * Based on worldwide long-term savings new business sales, plus general insurance and health business net written premiums. Worldwide sales In... -

Page 23

...review Interests in and loans to joint ventures and associates 3,782 Financial investments Other assets Cash and cash equivalents Total assets Equity Capital and reserves Additional retained profit on an EEV basis Equity attributable to shareholders of Aviva plc Preference shares and direct capital... -

Page 24

...locations. We also have overseas operations in India and Sri Lanka Morley our fund management business is based in the UK and has offices spread across the globe Major operating brands Norwich Union is a market leader in the UK long-term savings market Norwich Union Insurance is the leading general... -

Page 25

...product range UK life - Winning combination of balanced distribution and broad product mix - Top three by market share across all product categories - Legacy simplification with service, cost and retention improvements UK general insurance - Managing through the cycle by: - Premium rating leadership... -

Page 26

... presence in the corporate market, putting Norwich Union products directly into customers' workplaces; maintained a strong presence in the financial adviser market; and launched a distribution deal with the Post Office, offering innovative products such as our simplified life insurance product. In... -

Page 27

... and generating capital for the Aviva group. Returns to customers also improved and holders of with profits products saw the value of their policies increase between 5.4% and 5.8%, while holders of unit-linked funds and collective investments benefited from improved returns with 60% of funds in the... -

Page 28

Aviva plc Annual Report and Accounts 2007 Business review continued: UK - Long-term savings continued Norwich Union launches "Paying for It" We remain committed to providing a broad product offering to meet the needs of a wide range of customers. During the year, we continued to focus on simpler ... -

Page 29

... 2008. Our aim remains to improve profitability and grow our new business sales at least in line with the market, while maintaining or increasing our overall new business margin from current levels. 25 Business review "Find the Fisherman" campaign We believe that all companies should be taking... -

Page 30

... rating action across many segments of our business, and have announced several measures to bring our expense base in line with the industry 'best of breed' within the United Kingdom. Igal Mayer Chief executive, Norwich Union Insurance UK - General insurance, health and related services IFRS profit... -

Page 31

...best practice and innovation. Analysis of UK general insurance and health results IFRS operating profit 2007 2006 Net written premiums 2007 2006 Norwich Union Insurance Aviva Re NU Healthcare United Kingdom 380 53 - 433 1,081 36 1 1,118 5,440 50 406 5,896 5,583 59 358 6,000 27 Business review... -

Page 32

Aviva plc Annual Report and Accounts 2007 Business review continued: UK - General insurance, health and related services continued In our core insurance markets, we have continued to use our leading position to provide rating leadership in the current very competitive marketplace. In personal ... -

Page 33

...Alain Dromer CEO, Morley Fund Management and Aviva Investors UK - Fund management Operating profit IFRS basis 12 months 2007 £m 12 months 2006 £m Operating profit EEV basis 12 months 2007 £m 12 months 2006 £m Morley The Royal Bank of Scotland Norwich Union investment funds Total 87 (9) (1) 77... -

Page 34

... UK's largest active fund managers and the largest fund management business in the Aviva group, with £165 billion (2006: £166 billion) of total funds under management. Our aim at Morley is to build a client-centric business that is among the best in our chosen asset classes and markets and in line... -

Page 35

...continuing investment in Lifetime, our wrap platform business. 31 Business review UK fund management In addition to sales under the Morley brand, we sell ISAs, unit trusts, open-ended investment companies (Oeics) and structured products under the Norwich Union and The Royal Bank of Scotland brands... -

Page 36

... plc Annual Report and Accounts 2007 Business review continued: Europe Total sales £19,719m (2006: £17,018m) PVNBP Investment sales Net written premiums £14,914m £1,572m £3,233m £19,719m EEV operating profit £1,971m (2006: £1,581m) Long-term savings Fund management General insurance... -

Page 37

... management services to its pension, investment and life insurance clients Looking forward: Our medium-term targets are to: - Grow life new business premiums and new business contribution by an average 10% pa to 2010 - Realise cost savings in our mature businesses of £50 million by end 2009 - Meet... -

Page 38

... enhancements to our broker channel have led to an increase in market share in Ireland. We increased sales in France and the Netherlands despite difficult market conditions. In France, we successfully worked with the AFER association to modernise the core savings product and sales responded strongly... -

Page 39

...plc Annual Report and Accounts 2007 Total sales (£m) 20,000 15,000 10,000 5,000 5000 General insurance Investment sales Life and Pensions France Life Aviva France is one of the top-ten long-term savings businesses in France with a market share of 5%. Our business focuses on the higher-margin unit... -

Page 40

... Report and Accounts 2007 Business review continued: Europe continued General insurance and health Our French general insurance business has a 4% share of the agent and broker market, selling predominantly personal and small commercial insurance through our 875-strong agent network and our direct... -

Page 41

... successful marketing campaigns. In 2007 Aviva has formed a joint venture with Banco Popolare, which includes a new long-term agreement to sell protection and non-life insurance products which began on 1 January 2008. This replaces our previous agreement with Banco Popolare Italiana to distribute... -

Page 42

... plc Annual Report and Accounts 2007 Business review continued: Europe continued Direct motor insurance launched in Poland using group expertise 38 Business review Fund management Delta Lloyd Asset Management manages investments both for Delta Lloyd's own insurance operations and for third parties... -

Page 43

...-owned bank. In the Czech Republic and Hungary, sales through the broker and direct sales force channel have increased during the year. In Romania, we have established a new company to sell newly created mandatory pensions. In all of these markets, pension reform continues to offer a long term... -

Page 44

Aviva plc Annual Report and Accounts 2007 Business review continued: North America Total sales £5,014m (2006: £2,273m) PVNBP Net written premiums £3,602m £1,412m £5,014m EEV operating profit £408m (2006: £183m) Long-term savings Fund management General insurance Other operations £255m ... -

Page 45

...-rating of our US life business to widen distribution Leverage group expertise to expand asset management capabilities in the region Streamline back-office processes, enhance risk selection and pricing sophistication Build brand awareness across the region, including employee brand Instill customer... -

Page 46

... business and our general insurance business is based in Canada. These great businesses currently serve their home markets and we are exploring possible cross-border selling opportunities across the North American region. Strengthening the Aviva brand across the North America region is a strategy... -

Page 47

... and Accounts 2007 Aviva's presence in the North America Region is underpinned by two highly successful and diverse businesses, the Aviva USA life business and the Aviva Canada general insurance business. The Aviva USA operation ranks first and second in the indexed life and indexed annuity markets... -

Page 48

Aviva plc Annual Report and Accounts 2007 Business review continued: North America continued Our success in 2007 has been achieved by remaining focused on our customers, agents and employees while going through a major transformation integrating our businesses following the acquisition of AmerUs ... -

Page 49

... performance. We are also making a strong investment in communicating the Aviva brand. The launch of our brand campaign in 2008 will significantly raise consumer awareness. Operating profit (£m) 45 Business review In personal lines, our premiums increased by 3% in a market with flat rates... -

Page 50

Aviva plc Annual Report and Accounts 2007 Business review continued: Asia Pacific Total sales £4,117m (2006: £2,572m) PVNBP Investment sales Net written premiums £1,429m £2,660m £28m £4,117m EEV operating profit £97m (2006: £92m) Long-term savings Fund management General insurance Other... -

Page 51

... and service delivery - Joined forces with Aviva USA and Spain to share knowledge on product design and industry trends. Delegates from Asia Pacific included Australia, China, Hong Kong, Singapore and Taiwan Looking forward: Our medium-term target is to: - Grow long-term savings new business sales... -

Page 52

... Pacific. The Aviva brand is becoming well known, our business model is successful, and we are confident that we can continue to build on this strong base. Simon Machell Chief executive, Asia Pacific General insurance Investment sales Life and Pensions Long-term savings 2007 IFRS profit before tax... -

Page 53

... and increased competition. In 2007, our customer advocacy scores across most of our markets improved, meeting key performance targets. Our focus to build brand awareness made further progress as the operations in Singapore, Australia, Hong Kong and India launched a shared brand campaign utilising... -

Page 54

... adviser (IFA) channel, which now accounts for more than half of our sales, and our continued bancassurance success with the Development Bank of Singapore (DBS), South East Asia's largest banking group. As one of the fastest growing life insurers in Hong Kong, we aim to continue to build our market... -

Page 55

Aviva plc Annual Report and Accounts 2007 India India's young urban population base provides strong growth potential in the long-term savings market. Our strategy is to acquire new customers through distribution relationships with banks as well as through our 30,000 strong direct sales force (2006:... -

Page 56

Aviva plc Annual Report and Accounts 2007 Business review continued: Finance Finance -

Page 57

... Accounting Standard's Board preliminary views in November - Looking forward - - We will build on the progress made to date to deliver and embed the Global Finance strategy across the group In line with other CFO forum members, we are working to roll out market consistent embedded value reporting... -

Page 58

... of the long term underlying value of the capital employed in the Group's life and related businesses. This basis allows for the impact of uncertainty in the future investment returns more explicitly and is consistent with the way the life business is priced and managed. Accordingly, in addition... -

Page 59

... dividends, are covered by EEV operating profit was 9.8 times (2006: 10.3 times). 55 Business review Long-term savings General insurance and health Other business including fund management Corporate* Total capital employed Financed by: Equity shareholders' funds Minority interests** Direct capital... -

Page 60

... date to be paid to in-force policyholders in the future in respect of smoothing costs, guarantees and promises. Realistic balance sheet information is shown below for the three main UK with-profit funds; CGNU Life, Commercial Union Life Assurance Company (CULAC) and Norwich Union Life & Pensions... -

Page 61

... to equity market volatility by selling £2.6bn and £0.8bn of equities in our general insurance shareholder funds and the staff pension schemes respectively. These actions are consistent with our ongoing focus on efficient capital management and enhancing returns to shareholders. Rating agency... -

Page 62

... and Operating Risk Board CSR Committee Risk & Regulatory Committee Audit Committee Executive Committee Asset Liability Management Committee Operational Risk Committee Life Insurance Capital Management IT Compliance General Insurance Reserving Business Protection Corporate Reputation... -

Page 63

... Committee are members. We also continually monitor the financial impact of changes to market values through a number of measurements of economic capital or sensitivities to key performance indicators. Several of our long term savings businesses sell products where the majority of the market risk is... -

Page 64

... held in our staff pension schemes. We formulate our equity risk management strategy taking into account the full range of our equity holdings. Interest rate risk Interest rate risk is the risk that arises from both the products we sell and the value of our investments due to changes in the level of... -

Page 65

...the level of risk we are prepared to take, and we are using increasingly detailed analysis to define our optimal balance between risk and reward, monitoring the types of investment available to us to achieve best our aims. We also consider the risk of a fall in the value of fixed interest securities... -

Page 66

...strategic and group risks. Operational risks include risks relating to: - Regulation, information technology, financial crime, business protection, human resources, outsourcing, purchasing, communications, and legal - Brand management, customer management, products, sales management and distribution... -

Page 67

... of deposit. Details are given in note 2 to the financial statements. Previously this methodology has been applied to our general insurance and health businesses but following the adoption of a new operating profit definition in November 2007, this has been extended to our long-term savings business... -

Page 68

Aviva plc Annual Report and Accounts 2007 Business review continued: Employees and responsibility Employees and responsibility -

Page 69

... review is an update on our progress and achievements to date. It represents a level of performance of which we can be proud, and one on which we can build further to meet our plans to be an employer of choice and a responsible corporate citizen. John Ainley Group human resources director Talking... -

Page 70

..., group human resources director, is responsible for implementing the employee and responsibility strategy and is supported by strong teams at the group, regional and business unit level who work together to deliver our objectives. Apart from regular monthly meetings and global task forces, annual... -

Page 71

... and is a key performance management, governance and communication tool. Findings from this survey are presented to local executive teams and the Board. Our European Consultative Forum and employee forum in the UK ("Your Forum") provide an opportunity for regular sharing of information and dialogue... -

Page 72

... group. This network resulted in the creation of local networks in London and Norwich with over 200 members involved. Since its launch our gay, lesbian and bisexual network, Pride Aviva, has increased its membership to 150 in the UK. Pride Aviva was also instrumental in securing Aviva's sponsorship... -

Page 73

... change into dayto-day life now to avoid larger economic costs going forward. We co-authored, and were a founder signatory to, the ClimateWise principles - the first climate change principles created to address the role that multi-line insurers can have in respect of risk analysis, business lines... -

Page 74

... Business review Aviva 'Best in Class' for carbon disclosure Suppliers We understand that our suppliers play an important role in ensuring that we continue to meet the needs of our customers and the delivery of our services to them. The embedding of CSR in the Aviva global purchasing policy means... -

Page 75

..., and is initially aimed at the UK. This innovation meets a currently unfulfilled need across the population in the UK and hopes to address similar needs in other countries as plans are afoot to launch in other sites around the world. Accounting for Sustainability Working with the Accounting for... -

Page 76

Aviva plc Annual Report and Accounts 2007 Business review continued: Employees and responsibility continued Accounting for Sustainability: Climate, waste and resource impact Key indicators Direct company impacts Cash flow performance Non-financial indicators 120,000 100,000 80,000 60,000 40,000 ... -

Page 77

... covered by the driver. The UK business has also pioneered digital flood mapping to more closely match risk to premium and has showcased flood resistant and resilient measures to assist customers with climate change adaptation. In the Netherlands, Delta Lloyd Asset Management Business has two funds... -

Page 78

-

Page 79

Governance Hong Kong Aviva advertising In 2007 Hong Kong launched their new brand campaign. The new strapline is 'Focus on Today. Partner with us for a better tomorrow', which is highlighted in the advertisements by a binocular visual to symbolise a vision to the future. The campaign was featured on... -

Page 80

Aviva plc Annual Report and Accounts 2007 Board of directors 1 7 2 8 76 Governance 3 9 4 10 5 11 6 -

Page 81

... 2007. Joined Norwich Union in 1973 and held a number of senior positions before joining the Norwich Union board in 1993. Formerly, responsible for the group's insurance businesses outside Europe and Morley, the group's UK fund management operations. Currently a non-executive director of Diageo plc... -

Page 82

... and Accounts 2007 Executive management Andrew Moss Group chief executive Age 49 See page 77 Anupam Sahay Group strategy and development director Age 38 Joined the Group in 2007. Formerly a partner with the global financial services group at McKinsey & Company, advising leading insurers and banks... -

Page 83

... 2008, the Group's UK long-term business operation Norwich Union Life, announced a one-off, special bonus worth £2.3 billion. Further details can be found in Note 59 on page 235. Share capital The issued ordinary share capital of the Company was increased by 56 million ordinary shares during the... -

Page 84

... were re-elected by shareholders at last year's Annual General Meeting will retire on 31 December 2008, in line with the Board's plans to renew and refresh its composition. Andrew Moss and Philip Scott are executive directors and each has a service contract with the Company, details of which can be... -

Page 85

... at The Barbican Centre, Silk Street, London EC2Y 8DS at 11am. A separate document accompanying the Annual Report and Accounts contains the Notice convening the Meeting and a description of the business to be conducted thereat. By order of the Board. Graham Jones Group Company Secretary 27 February... -

Page 86

... - Capital structure; - Dividend policy; - Shareholder documentation; - The constitution of Board committees; and - Key business policies, including the remuneration policy. The full terms of reference for the Board can be found on the Company's website www.aviva.com and are available from the Group... -

Page 87

...In addition, members of the Audit and Risk and Regulatory Committees received two tailored training sessions. Training sessions have been built into the Board's and committees' work plans for 2008. The Board made visits to the Group's businesses located in the United Kingdom and North America during... -

Page 88

... - 0/0 Internal controls The Combined Code requires directors to review and report annually to shareholders on the effectiveness of the Company's systems of internal control which include financial, operational and compliance controls, and risk management. The Board has the overall responsibility... -

Page 89

..., considers the risks relating to life assurance, general insurance, reserving, capital management, credit and investment. Similarly, a Group Operational Risk Committee monitors risks associated with information technology, business protection, human resource management, business standards and... -

Page 90

... for shareholders on the website can be found on the Shareholder information pages 270 to 272. The Company's Annual General Meeting provides a valuable opportunity for the Board to communicate with private investors. At the meeting, the Company complies with the Combined Code as it relates to... -

Page 91

Aviva plc Annual Report and Accounts 2007 Morley maintains a detailed Corporate Governance and Voting Policy as part of its investment strategy, which underpins its approach to engaging and voting at company general meetings. The policy also extends to cover social, environmental and ethical issues... -

Page 92

... and works closely with the Risk and Regulatory Committee, which reviews the non-financial controls. During the Board's visit to the Group's North American operations in September 2007, the Committee held joint meetings with the Risk and Regulatory Committee and members of the local business unit... -

Page 93

... members. As of 1 April 2007, the Group internal audit structure was modified and the reporting line of all internal audit resources from each business unit have been centralised so that they report to the Group Audit Director, rather than to the business unit head. Annually, the Committee reviews... -

Page 94

... of the senior management team during 2007 there has been a reduction in the number of executive directors on the Board. The Committee will review the position during 2008. As part of the ongoing planning process for the smooth replacement of current non-executive directors, including refreshing the... -

Page 95

... in a review of the risk policy (including risk appetite) statements for each of the main categories of risk faced by the Group, and in a review of the processes for identifying, controlling and reporting risks in the business units, regions and Group centre. A new Chief Risk Officer has been... -

Page 96

...to the Group's corporate social responsibility (CSR) programme, review the risks and opportunities relating to the seven individual elements in the programme (namely: standards of business conduct, environment, human rights and diversity, community, customers, suppliers and employees) and to monitor... -

Page 97

... customers and employees. Within the context of these objectives, the Committee's main responsibilities are to: - Recommend to the Board the Group's remuneration policy for the executive directors and members of senior management, covering basic salary, bonus, long term incentives, retirement... -

Page 98

... Hibernian's All Employee Share Scheme - A review of dilution limits - Approval of recommendations on contributions into the Aviva Capital Accumulation Plan - Approval of the 2006 Directors' remuneration report - An initial review of the potential retirement terms of Group Chief Executive, Richard... -

Page 99

... strategic aims of the Group, good governance and best practice. - The LTIP encourages a longer-term management focus on Return on Capital Employed (ROCE) and relative TSR. These metrics measure how the Company is performing in both relative and absolute terms. It also ensures direct line of sight... -

Page 100

... - Annual Bonus Plan - LTIP - Long-term savings - Pension - Benefits - All-employee share schemes. Basic salary - Benchmarked as for total remuneration but with positioning and progression - Monthly in cash taking account of individual and business performance and the levels of increase - Reviewed... -

Page 101

Aviva plc Annual Report and Accounts 2007 Policy How delivered Aviva Staff Pension Scheme (ASPS) The UK ASPS provides a competitive post-retirement package. No executive director - Deferred cash payable on is currently accruing service based benefits in the ASPS. retirement in the form of a lump ... -

Page 102

... service during the performance period. - The Trustee of the Plan accepted Aviva's recommendation and made an award to the benefit of Mr Harvey into the plan. LTIP - face value of grant Aviva Capital Accumulation Plan Other benefits £600,000 £11,083 cash car allowance Private medical insurance... -

Page 103

... value of grant £600,000 (forfeited on resignation) Other benefits £13,300 cash car allowance Private medical insurance Annual Bonus Plan (ABP) - target setting The financial targets which underpin the ABP (accounting for 50% of annual bonus) are derived from Aviva's return, growth and capital... -

Page 104

...to reï¬,ect shareholders' long-term interest in absolute (ROCE) and relative (TSR) performance. ROCE targets are set annually within the context of Aviva's three year business plan. Vesting depends upon performance over the three year period against a target return. Aviva's external auditor provides... -

Page 105

... the three year performance period on those shares that vest. Deferred/Annual Bonus Plan and Long Term Incentive Plan Awards At 1 January 20071 Number Awards granted during year2 Number Awards vesting during year2 Number Market Awards At price at lapsing 31 December date awards 2. during year2 2007... -

Page 106

Aviva plc Annual Report and Accounts 2007 Directors' remuneration report continued At Awards Awards 1 January granted vesting 20071 during year2 during year2 Number Number Number Market Awards At price at lapsing 31 December date awards during year2 20072 granted Number Number Pence Market price... -

Page 107

... groups for our executive directors. As a result of the review, and subject to the outcome of consultation with institutional investors, we therefore to intend to put to shareholders at the 2008 Annual General Meeting a proposal to introduce a matching element to a proportion of the shares deferred... -

Page 108

...- 30 working days plus public holidays. - In line with senior management terms, ie 100% basic salary for 52 weeks, and 75% thereafter. - During employment and for six months after leaving. Director Andrew Moss Philip Scott Tidjane Thiam Patrick Snowball Richard Harvey Date current contract commenced... -

Page 109

... by the Board within the limits set by shareholders. The current aggregate limit of £1.5 million was approved by shareholders at the Company's 2005 Annual General Meeting. The amount paid in 2007 was £1.04 million. Executive directors are remunerated under their service contracts and receive... -

Page 110

... performance under the Annual Bonus Plan (ie the cash bonus paid plus the amount deferred and granted in the form of shares). 2. "Beneï¬ts". All the executive directors received life assurance beneï¬ts during the year that relate to the cost incurred by the Company of insuring the directors' life... -

Page 111

Aviva plc Annual Report and Accounts 2007 8. Fees earned in 2007 by the non-executive directors are set out below. Fees as non-executive Chairman of the Group's operations in Spain Committee Chairman / Membership Corporate Social Responsibility Risk and Regulatory Board membership fees Senior ... -

Page 112

...ts in the Pension Scheme until he left the Company on 30 June 2007. His deferred pension at that date is that shown above at 31 December 2007, which will increase until his retirement in line with RPI subject to a maximum of 5%. 5. Mr. Thiam was appointed as Group Executive Director with effect from... -

Page 113

... accounting policies and practices in 2005, including adopting International Financial Reporting Standards and European Embedded Value principles for supplementary reporting, affected a number of the key performance indicators and performance measures used in connection with the Company's long term... -

Page 114

... the Aviva Long Term Incentive Plans which vest only if the performance conditions are achieved. 4. "Options" are options over shares granted under the Aviva Savings Related Share Option Scheme. 110 Governance The following changes to directors' interests which relate to shares acquired each month... -

Page 115

... Code specified for our review by the Listing Rules of the Financial Services Authority, and we report if it does not. We are not required to consider whether the Board's statements on internal control cover all risks and controls, or form an opinion on the effectiveness of the Group's corporate... -

Page 116

-

Page 117

... future' brand campaign. The advertisements feature a box of golden light to convey that Aviva is an innovative life insurance and annuity company that will help to ensure our customer will have a bright future. The ads featured in mainstream TV, trade and consumer press. Region: North America -

Page 118

... policies Aviva plc (the "Company"), a public limited company incorporated and domiciled in the United Kingdom (UK), together with its subsidiaries (collectively, the "Group" or "Aviva") transacts life assurance and long-term savings business, fund management, and most classes of general insurance... -

Page 119

... business policyholder funds have invested in a number of property limited partnerships (PLPs), either directly or via property unit trusts (PUTs), through a mix of capital and loans. The PLPs are managed by general partners (GPs), in which the long-term business shareholder companies hold equity... -

Page 120

...'s post-acquisition changes to shareholders' funds, is included as an asset in the consolidated balance sheet. As explained in policy N, the cost includes goodwill identiï¬ed on acquisition. The Group's share of their post-acquisition proï¬ts or losses is recognised in the income statement and its... -

Page 121

... premiums. General insurance and health premiums written reï¬,ect business incepted during the year, and exclude any sales-based taxes or duties. Unearned premiums are those proportions of the premiums written in a year that relate to periods of risk after the balance sheet date. Unearned premiums... -

Page 122

... At each reporting date, the Group reviews its unexpired risks and carries out a liability adequacy test for any overall excess of expected claims and deferred acquisition costs over unearned premiums, using the current estimates of future cash ï¬,ows under its contracts after taking account of the... -

Page 123

... to the current unit fund value, plus additional non-unit reserves if required on a fair value basis. For non-linked contracts, the fair value liability is equal to the present value of expected cash ï¬,ows on a market-consistent basis. Amortised cost is calculated as the fair value of consideration... -

Page 124

Aviva plc Annual Report and Accounts 2007 Accounting policies continued Intangible assets Intangibles consist primarily of brands, certain of which have been assessed as having indeï¬nite useful lives, and contractual relationships such as access to distribution networks and customer lists. The ... -

Page 125

... is used where the relevant long-term business liability (including shareholders' funds) is passively managed. Purchases and sales of investments are recognised on the trade date, which is the date that the Group commits to purchase or sell the assets, at their fair values. Debt securities are... -

Page 126

... Group's risk management positions, do not qualify for hedge accounting under the speciï¬c IFRS rules and are therefore treated as derivatives held for trading. Their fair value gains and losses are recognised immediately in other trading income. (U) Loans Loans with ï¬xed maturities, including... -

Page 127

...contribution basis (generally related to the amount invested, investment return and annuity rates), the assets of which are generally held in separate trustee-administered funds. The pension plans are generally funded by payments from employees and the relevant Group companies, taking account of the... -

Page 128

...calculated in line with local regulations, with movements being charged to the income statement within staff costs. Equity compensation plans The Group offers share award and option plans over the Company's ordinary shares for certain employees, including a Save As You Earn plan (SAYE plan), details... -

Page 129

... from total shareholders' equity. Gains and losses on sales of own shares are charged or credited to the treasury share account in equity. (AE) Fiduciary activities Assets and income arising from ï¬duciary activities, together with related undertakings to return such assets to customers, are... -

Page 130

... Net earned premiums Fee and commission income Net investment income Share of (loss)/profit after tax of joint ventures and associates Profit on the disposal of subsidiaries and associates Expenses Claims and benefits paid, net of recoveries from reinsurers Change in insurance liabilities, net... -

Page 131

... Long-term business Fund management General insurance and health Other Other operations and regional costs Corporate centre Group debt costs and other interest IFRS operating profit before adjusting items and tax attributable to shareholders' profits Adjusted for the following: Investment return... -

Page 132

...2,748 (157) (363) 2,228 Year ended 31 December 2006 Long-term business £m Fund management £m General insurance and health £m Other operations £m Restated Total £m UK Europe North America Asia Pacific Corporate centre Group debt costs and other interest 629 648 13 44 1,334 70 73 3 9 155... -

Page 133

... to profit Impairment losses on revalued assets Share of fair value changes in joint ventures and associates taken to equity Actuarial gains/(losses) on pension schemes Actuarial (gains)/losses on pension schemes transferred to unallocated divisible surplus and other movements Foreign exchange rate... -

Page 134

... for sale Total assets Equity Capital Ordinary share capital Preference share capital Capital reserves Share premium Merger reserve Other reserves Retained earnings Equity attributable to shareholders of Aviva plc Direct capital instrument Minority interests Total equity Liabilities Gross insurance... -

Page 135

...: £nil) was classified as held for sale (see note 3(d)). Cash and cash equivalents in long-term business operations are primarily held for the benefit of policyholders and so are generally not available for use by the Group. The accounting policies (identified alphabetically) on pages 114 to125... -

Page 136

... from the underlying business performance. The new definition uses "expected rates of investment return" to report the operating profit of our long-term savings business, thus bringing this business into line with the way we report our general insurance and health operating profit. It also brings... -

Page 137

..., net assets or total equity at either 1 January 2006 or 31 December 2006. (ii) Restatement of cash equivalents As described in accounting policy X, cash equivalents include short-term highly liquid investments which normally have maturity dates of less than three months from the date of acquisition... -

Page 138

... initial 5% holding on completion on 6 June 2007. The Group has the power to control the financial and operating policies of Cajamurcia Vida through having the majority vote at meetings of the company's board of directors. We have therefore consolidated its results and balance sheet since that date. -

Page 139

Aviva plc Annual Report and Accounts 2007 3 - Subsidiaries continued The acquisition of the initial 5% shareholding has given rise to goodwill on acquisition of £2 million, calculated as follows: Purchase cost: £m Cash paid Attributable costs Total consideration The book and fair values of the ... -

Page 140

... opportunity in the fast-growing protection sector. The Group paid £184 million to secure the long-term bancassurance agreement with Banco Popolare and to acquire 50% plus one share of Avipop Assicurazioni SpA (Avipop Assicurazioni), a non-life subsidiary of the bank. Life protection business will... -

Page 141

... million of HSBC Bank's UK customers. The acquisition of Hamilton Insurance Company Limited has given rise to goodwill on acquisition of £2 million, calculated as follows: Purchase cost: £m 137 Financial statements Cash paid Attributable costs Total consideration The book and fair values of the... -

Page 142

... Hamilton Life Assurance Company Limited (Hamilton Life) has given rise to goodwill on acquisition of £21 million, calculated as follows: Purchase cost: £m Cash paid Attributable costs Total consideration The assets and liabilities at the date of acquisition were: Fair value and accounting policy... -

Page 143

... Insurance Co. Ltd ("LIG Life"), a South Korean life insurance company, for KRW 137.2 billion (£73 million). After completion, the Group will hold 40.65% of LIG Life. Aviva and Woori plan to develop LIG Life's business distribution, predominantly through bancassurance via Woori's banking network... -

Page 144

...underwriting risk and policy administration. DL will continue to market and distribute health insurance products from CZ to its existing customers, and to provide asset management for the transferred business. DL will also have exclusive rights to market life, general insurance and income protection... -

Page 145

... Long-term Fund business management £m £m General insurance and health £m Other £m Total £m For the year ended 31 December 2007 Gross written premiums Premiums ceded to reinsurers Net written premiums Net change in provision for unearned premiums Net earned premiums Fee and commission income... -

Page 146

... profit before tax attributable to shareholders' profits Long-term Fund business management £m £m General insurance and health £m Other £m Total £m For the year ended 31 December 2007 Segment result before tax Finance costs on central borrowings Adjusted for the following: Investment return... -

Page 147

... plc Annual Report and Accounts 2007 4 - Segmental information continued Long-term business £m Fund management £m General insurance and health £m Other £m Restated Total £m For the year ended 31 December 2006 Gross written premiums Premiums ceded to reinsurers Net written premiums Net change... -

Page 148

... to shareholders' profits Long-term business £m Fund management £m General insurance and health £m Other £m Restated Total £m For the year ended 31 December 2006 Segmental result before tax Finance costs on central borrowings Adjusted for the following items: Investment return variances... -

Page 149

Aviva plc Annual Report and Accounts 2007 4 - Segmental information continued Long-term business £m Fund management £m General insurance and health £m Other £m Restated Total £m As at 31 December 2006 Goodwill Acquired value of in-force business and intangible assets Interests in, and loans ... -

Page 150

Aviva plc Annual Report and Accounts 2007 Notes to the consolidated financial statements continued 4 - Segmental information continued (ii) Segmental results and balance sheets - geographical segment Year ended 31 December 2007 United Kingdom £m Europe £m North America £m Asia Pacific £m Total... -

Page 151

... 41c(iii)) Net change in provision for unearned premiums Net earned premiums Fee and commission income Fee income from investment contract business Fund management fee income Other fee income Reinsurance commissions receivable Other commission income Net change in deferred revenue Total revenue Net... -

Page 152

... statement. Restated 2006 £m 2007 £m Claims and benefits paid Claims and benefits paid to policyholders on long-term business Insurance contracts Participating investment contracts Non-participating investment contracts Claims and benefits paid to policyholders on general insurance and health... -

Page 153

... backing annuity business due to interest rate changes. This compares to a significantly positive net impact of economic items on profit in 2006. In 2006 the positive investment variance was driven primarily by favourable equity market performance worldwide and increases in market interest rates in... -

Page 154

... fixed interest securities are classified as available for sale, the expected investment return comprises the expected interest or dividend payments and amortisation of the premium or discount at purchase. 150 Financial statements 9 - Longer term investment return for general insurance and health... -

Page 155

... principal general insurance and health business unit. In respect of equities and properties, the return is calculated by multiplying the opening market value of the investments, adjusted for sales and purchases during the year, by the longer term rate of investment return. The longer term rate of... -

Page 156

... 10 - Employee information continued Total staff costs were: 2007 £m 2006 £m Wages and salaries Social security costs Post-retirement obligations Defined benefit schemes (note 46d) Defined contribution schemes (note 46d) Profit sharing and incentive plans Equity compensation plans (note 29d... -

Page 157

...Long-term business technical provisions and other insurance items Deferred acquisition costs Unrealised gains on investments Pensions and other post-retirement obligations Unused losses and tax credits Subsidiaries, associates and joint ventures Intangibles and additional value of in-force long-term... -

Page 158

...the Group's profit before tax differs from the theoretical amount that would arise using the tax rate of the home country of the Company as follows: 2007 £m 2006 £m Profit before tax Tax calculated at standard UK corporation tax rate of 30% (2006: 30%) Different basis of tax for UK life insurance... -

Page 159

... declared and charged to equity in the year Coupon payments on direct capital instrument 155 492 309 801 17 53 871 418 275 693 17 52 762 Financial statements Subsequent to 31 December 2007, the directors proposed a final dividend for 2007 of 21.10 pence per ordinary share (2006:19.18 pence... -

Page 160

... useful lives (detailed in note 17) 2007 £m 2006 £m 2007 £m Total 2006 £m 156 Financial statements United Kingdom Long-term business General insurance and health (see (i) below) RAC non-insurance operations (see (ii) below) Other Europe France (long-term business) (see (iii) below) Ireland... -

Page 161

...) The recoverable amount of the UK general insurance and health unit has been determined based on a value in use calculation. The calculation uses cash flow projections based on business plans approved by management covering a three year period and a risk adjusted discount rate of 10.17% (2006: 10... -

Page 162

...of a risk-free rate and a risk margin to make prudent allowance for the risk that experience in future years may differ from that assumed. (ix) United States (long-term business) The recoverable amount of the United States unit has been determined based on a fair value less costs to sell calculation... -

Page 163

... Annual Report and Accounts 2007 17 - Acquired value of in-force business (AVIF) and intangible assets This note shows the movements in cost and amortisation of the in-force business and intangible assets acquired when we have purchased subsidiaries. Other intangible assets with finite useful lives... -

Page 164

Aviva plc Annual Report and Accounts 2007 Notes to the consolidated financial statements continued 18 - Interests in, and loans to, joint ventures In several business units, Group companies and other parties jointly control certain entities. This note analyses these interests and describes the ... -

Page 165

Aviva plc Annual Report and Accounts 2007 18 - Interests in, and loans to, joint ventures continued (c) Long-term business undertakings The principal joint ventures are as follows: Company Class of share Country of Proportion incorporation held and operation AVIVA-COFCO Life Insurance Co. Limited ... -

Page 166

... subsidiary, CIMB Bank, for the distribution of life and takaful insurance products through the bank's branches. 162 Financial statements (iv) Taiwan On 27 April 2007, the Group signed an agreement with First Financial Holding Co., Ltd (FFHC) to form a joint venture, First-Aviva Life Assurance Co... -

Page 167

... we do not control but where we have significant influence. (a) Carrying amount Goodwill £m Equity interests £m Loans £m Total £m At 1 January 2006 Share of results before tax Share of tax Share of results after tax Amortisation of acquired value of in-force business Share of profit after tax... -

Page 168

...Class of share Proportion held Country of incorporation and operation Aviva Life Insurance Company India Private Limited Banca Network Investimenti SpA Cyrte Fund I CV Cyrte Fund II BV Cyrte Fund III CV RBSG Collective Investments Limited RBS Life Investments Limited Insurance Product distribution... -

Page 169

...vacant possession of all parts of the property required by the business and disregarding potential alternative uses. The valuation assessment adopts market-based evidence and is in line with guidance from the International Valuation Standards Committee and the requirements of IAS 16, Property, Plant... -

Page 170

... external valuers or by local qualified staff of the Group in overseas operations, all with recent relevant experience. Values are calculated using a discounted cash flow approach and are based on current rental income plus anticipated uplifts at the next rent review, assuming no future growth in... -

Page 171

... and measured at fair value. The fair value has been calculated by discounting the future cash flows using appropriate current interest rates for each portfolio of mortgages. The change in fair value of these loans during the year, attributable to a change in credit risk, was a loss of £210 million... -

Page 172

... not own, directly or indirectly, any of the share capital of the securitisation companies or their parent companies, they retain control of the residual or ownership risks related to them, and these companies have therefore been treated as subsidiaries in the consolidated financial statements. DLL... -

Page 173

... cost and fair value. These will change from one period to the next as a result of new business written, claims paid and market movements. (a) Carrying amount Financial investments comprise: 2007 At fair value through profit or loss Trading £m Other than trading £m Available for sale £m Total... -

Page 174

... 2006 At fair value through profit or loss Other than trading Restated £m Available for sale £m Total Restated £m Trading £m Debt securities UK government Non-UK government Corporate - UK Corporate - Non-UK Other Equity securities Corporate - UK Corporate - Non-UK Other investments Unit trusts... -

Page 175

... of these arrangements. The level of collateral held is monitored regularly, with further collateral obtained where this is considered necessary to manage the Group's risk exposure. In certain markets, the Group or the Group's appointed stock lending managers obtain legal ownership of the collateral... -

Page 176

... costs in respect of: Insurance contracts - Long-term business Insurance contracts - General insurance and health business Participating investment contracts Non-participating investment contracts Retail fund management business Total deferred acquisition costs Surpluses in the staff pension schemes... -

Page 177

... share premium account. 29 - Equity compensation plans This note describes the various equity compensation plans we use, and shows how we value the options and awards of shares in the Company. (a) Description of the plans The Group maintains a number of active stock option and award schemes. These... -

Page 178

... statements continued 29 - Equity compensation plans continued (b) Outstanding options and awards (i) Share options At 31 December 2007, options to subscribe for ordinary shares of 25 pence each in the Company were outstanding as follows: Aviva Savings Related Share Option Scheme Option price... -

Page 179

... Annual Report and Accounts 2007 29 - Equity compensation plans continued (ii) Share awards At 31 December 2007, awards issued under the Company's executive incentive plans over ordinary shares of 25 pence each in the Company were outstanding as follows: Aviva Long-Term Incentive Plan 2005 Number... -

Page 180

... to satisfy awards under the Group's Long-Term Incentive Plan and Deferred Bonus Plans. Details of the features of the plans can be found in the Directors' renumeration report. These shares were purchased in the market and are carried at cost less amounts changed to the income statement in prior... -

Page 181

... shares. The Company does not have a contractual obligation to deliver cash or other financial assets to the preference shareholders and therefore the directors may make dividend payments at their discretion. 32 - Direct capital instrument This note gives details of the direct capital instrument... -

Page 182

... Fair value gains transferred to profit on disposals Fair value gains transferred to retained earnings on disposals (note 35) Impairment losses on revalued assets Reserves credit for equity compensation plans (note 29d) Shares issued under equity compensation plans (note 35) Foreign exchange rate... -

Page 183

Aviva plc Annual Report and Accounts 2007 35 - Retained earnings This note analyses the movements in the consolidated retained earnings during the year. 2007 £m 2006 £m Balance at 1 January Profit for the year attributable to equity shareholders Actuarial gains/(losses) on pension schemes (note ... -

Page 184

... contracts Outstanding claims provisions Long-term business General insurance and health Provisions for claims incurred but not reported Provision for unearned premiums Provision arising from liability adequacy tests Other technical provisions Totals Less amounts classified as held for sale... -

Page 185

..." funds of Norwich Union Annuity and NUL&P, where shareholders are entitled to 100% of the distributed profits. Shareholder profits on unitised with-profit business written by Norwich Union Life & Pensions and on stakeholder unitised with-profit business are derived from management fees and policy... -

Page 186

... regular and final bonuses. The items included in the cost of future policy-related liabilities include: - Maturity Guarantees; - Smoothing (which can be negative); - Guaranteed Annuity Options; - GMP underpin on Section 32 transfers; and - Expected payments under Mortgage Endowment Promise. In... -

Page 187

...Annual Report and Accounts 2007 38 - Insurance liabilities continued For unit-linked and some unitised with-profit business, the provisions are valued by adding a prospective non-unit reserve to the bid value of units. The prospective non-unit reserve is calculated by projecting the future non-unit... -

Page 188

... with US GAAP as at the date of acquisition. The liability for future policy benefits for traditional life insurance is computed using the net level method, based on guaranteed interest and mortality rates as used in calculating cash surrender values. Reserve interest assumptions ranged from 2.00... -

Page 189

... on undiscounted estimates of future claim payments, except for the following classes of business for which discounted provisions are held: Rate Country Class 2007 2006 Mean term of liabilities 2007 2006 Netherlands UK Permanent health and injury Reinsured London Market business 3.87% 5.00% 3.61... -

Page 190

.... This is being increased in each succeeding additional year, until ten years of information is included. The Group aims to maintain strong reserves in respect of its non-life and health business in order to protect against adverse future claims experience and development. As claims develop and the... -

Page 191

...plc Annual Report and Accounts 2007 38 - Insurance liabilities continued (ii) Gross figures Before the effect of reinsurance, the loss development table is: Accident year All prior years £m 2001 £m 2002 £m 2003 £m 2004 £m 2005 £m 2006 £m 2007 £m Total £m Gross cumulative claim payments At... -

Page 192

... year. The impact of using varying exchange rates is shown at the bottom of each table. Disposals are dealt with by treating all outstanding and IBNR claims of the disposed entity as "paid" at the date of disposal. The loss development tables above include information on asbestos and environmental... -

Page 193

...systematic basis over the contract term. The amount of the related deferred acquisition cost asset is shown in note 26 and the deferred income liability is shown in note 49. In the United States, funding agreements consist of one to ten year fixed rate contracts. These contracts may not be cancelled... -

Page 194

..., various Group companies have given guarantees and options, including investment return guarantees, in respect of certain long-term insurance and fund management products. Further information on assumptions is given in notes 38 and 39. (a) UK Life with-profit business In the UK, life insurers are... -

Page 195

...) Guaranteed unit price on certain products Certain unit-linked pension products linked to long-term life insurance funds provide policyholders with guaranteed benefits at retirement or death. No additional provision is made for this guarantee as the investment management strategy for these funds is... -

Page 196

...pensions business, it is often possible to recapture guarantee costs through adjustments to surrender values or to premium rates. On transition to IFRS, Delta Lloyd changed the reserving basis for most traditional contracts to reflect current market interest rates, for consistency with the reporting... -

Page 197

... fair value. At 31 December 2007, the liabilities for total return strategy products were £1.2 billion (2006: £1.4 billion). The Group offers an optional lifetime guaranteed income benefit focused on the retirement income segment of the deferred annuity marketplace to help customers manage income... -

Page 198

Aviva plc Annual Report and Accounts 2007 Notes to the consolidated financial statements continued 41 - Reinsurance assets continued (b) Assumptions The assumptions used for reinsurance contracts follow those used for insurance contracts. Reinsurance assets are valued net of an allowance for their... -

Page 199

... the rise in market interest rates over the year. The mortality impacts relate to assumption changes in the UK. The impact on existing business of applying FSA Policy Statement 06/14, Prudential Changes for Insurers, in 2007 is £60 million, relating to UK income protection business. This is... -

Page 200

...Long-term business technical provisions and other insurance items Deferred acquisition costs Unrealised gains on investments Pensions and other post-retirement obligations Unused losses and tax credits Subsidiaries, associates and joint ventures Intangibles and additional value of in-force long-term... -

Page 201

...to limit the risk of the assets failing to meet the liabilities of the schemes over the long term, and to maximise returns consistent with an acceptable level of risk so as to control the long-term costs of these schemes. An actuarial report has been submitted for each of the defined benefit schemes... -

Page 202

... for reviewing the level of contributions they pay and the choice of investment fund to ensure these are appropriate to their attitude to risk and their retirement plans. The employers' contribution rates for members of the defined contribution section throughout 2007 were 8% of pensionable salaries... -

Page 203

...main actuarial assumptions used to calculate scheme liabilities under IAS 19 are: UK 2007 2006 2007 Netherlands 2006 2007 Canada 2006 2007 Ireland 2006 199 Financial statements Inflation rate General salary increases Pension increases Deferred pension increases Discount rate Basis of discount rate... -

Page 204

... Plan assets in the UK and Dutch schemes include investments in Group-managed funds and insurance policies with other Group companies. Their treatment in the relevant parts of the financial statements is as follows : Plan assets - The treatment of these funds and policies in the consolidated balance... -

Page 205

Aviva plc Annual Report and Accounts 2007 46 - Pension obligations continued (iv) Pension expense As noted above, plan assets in the UK and Dutch schemes include insurance policies with other Group companies. To avoid double-counting of investment income on scheme assets and the assets backing the ... -

Page 206

... considerably less material but their risks are managed in a similar way to those in the main UK scheme. (vii) Balance sheet recognition The assets and liabilities of the schemes, attributable to defined benefit members, including investments in Group insurance policies (see footnote below), at 31... -

Page 207

...Adjust for Group insurance policies £m IAS 19 pensions deficit £m Deficits in the schemes at 1 January Employer contributions Employee contributions Benefits paid Current and past service cost (see (iv) above) Losses on curtailments (see (iv) above) Credit/(charge) to investment income (see (iv... -

Page 208

... payments to the main UK scheme made by the employing companies. 47 - Borrowings Our borrowings are either core structural borrowings, such as subordinated debt, debenture loans and most commercial paper, or operational borrowings, such as bank loans and financing for securitised mortgage loan... -

Page 209

... 15 years. Annual interest payments for these borrowings are £79 million (2006: £91 million). Contractual undiscounted interest payments are calculated based on underlying fixed interest rates or prevailing market floating rates as applicable. Year end exchange rates have been used for interest... -

Page 210

...10 years £m 10-15 years £m Over 15 years £m Total £m Amounts owed to credit institutions Bank loans Securitised mortgage loan notes UK lifetime mortgage business Dutch domestic mortgage business Total Contractual undiscounted interest payments 1,064 Various 375 306 314 9 60 1,064 1,674... -

Page 211

... capital. The dated subordinated notes rank ahead of the undated subordinated notes. The fair value of these notes at 31 December 2007 was £3,006 million (2006: £3,076 million), calculated with reference to quoted prices. (ii) Debenture loans The 9.5% guaranteed bonds were issued by the Company... -

Page 212

...UK long-term business subsidiaries, Norwich Union Life & Pensions Limited (NULAP), entered into a securitisation arrangement with The Royal Bank of Scotland Group plc (RBSG), to provide funding to cover initial new business acquisition and administration costs. Under the arrangement, an RBSG company... -

Page 213

... mortgage loan notes designated as fair value through profit or loss were attributable to changes in market conditions. These loan notes have external credit ratings which have not changed since the inception of the loans. (f) Undrawn borrowings The Group has the following undrawn committed central... -

Page 214

..., various Group companies have given guarantees and options, including interest rate guarantees, in respect of certain long-term insurance and fund management products. Note 40 gives details of these guarantees and options. In providing these guarantees and options, the Group's capital position is... -

Page 215

...Aviva USA litigation In November 2006, the Group completed the acquisition of the AmerUs Group, a US-based insurer. In common with other companies operating in the sector, AmerUs is subject to litigation, including class-action litigation, arising out of its sale of equity-based index-linked annuity... -

Page 216

Aviva plc Annual Report and Accounts 2007 Notes to the consolidated financial statements continued 51 - Commitments This note gives details of our commitments to capital expenditure and under operating leases. (a) Capital commitments Contractual commitments for acquisitions or capital expenditures... -

Page 217

...debt securities Premium or discount on loans Premium or discount on borrowings Acquired value of in-force business and intangibles Change in unallocated divisible surplus Interest expense on borrowings Net finance income on pension schemes Foreign currency exchange (gains) Changes in working capital... -

Page 218

... credit lines and access to a range of capital markets - allocate capital rigorously across the Group, to drive value adding growth in accordance with risk appetite. - increase the dividend on a basis judged prudent, while retaining capital to support future business growth, using dividend cover on... -

Page 219

... of the value of capital employed in the life and related businesses. Internally generated AVIF represents the additional value of in-force long term business recognised under the EEV basis. Further detail on the EEV basis is set out in the "Alternative method of reporting long-term business profits... -

Page 220

... EEV net assets 2006 £m Long-term savings General insurance and health Other business Corporate Total capital employed Financed by Equity shareholders' funds and minority interests Direct capital instrument Preference shares Subordinated debt External debt Net internal debt 15,290 5,487 1,056... -

Page 221

...the Provident Mutual with-profit fund. 4. Other operations include general insurance and fund management business. 5. Goodwill and other intangibles includes goodwill of £535 million and JVs and associates 6. On 5 February 2008 Norwich Union Life announced a one-off special bonus worth an estimated... -

Page 222

... the changes in management policy line. Equity performance was moderate, which had a direct effect on the equity content of the estate assets. In addition, the implied market volatility for equities has increased, which raises the assumed asset share volatility and consequently guarantee costs have... -

Page 223

Aviva plc Annual Report and Accounts 2007 54 - Capital statement continued Within the Aviva group there exist intra-group arrangements to provide capital to particular business units. Included in these arrangements is a subordinated loan of £200 million from Aviva plc to the NUL&P non-profit fund ... -

Page 224

... from the Board to Board committees, executive management committees and senior management; 220 Financial statements - A Group policy framework that sets out risk appetite, risk management, control and business conduct standards for the Group's worldwide operations. Each policy has a member of... -

Page 225

... and the Group defined benefit pension funds; - the indirect impact from changes in the value of equities held in policyholders' funds from which management charges or a share of performance are taken; - its interest in the free estate of long-term funds. At business unit level, equity price risk is... -

Page 226

... by the group, in particular from policies that carry investment guarantees on early surrender or at maturity, where claim values can become higher than the value of backing assets when interest rates rise or fall. The Group manages this risk by adopting close asset liability matching criteria, to... -

Page 227

... annuity options, and minimum surrender and maturity values. Details of material guarantees and options are given in note 40. (c) Credit risk Monitoring credit risk We have a significant exposure to credit risk through our investments in corporate bonds, commercial mortgages, and other securities... -

Page 228

... on mortgages or debt matching annuity liabilities) this risk is translated into a more conservative discount rate used to value the liabilities, creating a greater capital requirement, and this credit risk is actively managed. The impact of aggregation of credit risk is monitored as described... -

Page 229

...plc Annual Report and Accounts 2007 55 - Risk management continued Unit-linked business As discussed previously, in unit-linked business the policyholder bears the market risk, including credit risk, on investment assets in the unit funds, and the shareholders' exposure to credit risk is limited to... -

Page 230

... this policy. Individual life insurance risks are managed at a business unit level. The management of life insurance risk is undertaken primarily in business units but is also monitored at Group level. The impact of life insurance risks is monitored by the business units as part of the control cycle... -

Page 231

...options, option to cease premium payment, options for withdrawals free of market value adjustment, annuity option, guaranteed insurability options. Guarantees: embedded floor (guaranteed return), maturity guarantee, guaranteed death benefit, guaranteed minimum rate of annuity payment. Other: indexed... -

Page 232

... strategy and appetite is agreed by the Executive Committee and communicated via specific policy statements and guidelines. Like life insurance risk, general insurance risk is managed primarily at business unit level with oversight at a Group level, through a number of general insurance risk... -

Page 233

... action plans are implemented. The ORC operates a number of sub-committees which focus on specific areas of operational risk covering business protection, IT, compliance, human resources, and business standards. (g) Risk and capital management Sensitivity test analysis The Group uses a number of... -

Page 234

...plc Annual Report and Accounts 2007 Notes to the consolidated financial statements continued 55 - Risk management continued Sensititvity test results Some results of sensitivity testing for long-term business, general insurance and health business and the fund management and non-insurance business... -

Page 235

... in the alternative method of reporting long-term business profits section. General insurance and health business Sensitivities as at 31 December 2007 Impact on profit before tax (£m) Interest rates +1% Interest rates -1% Equity/ property +10% Equity/ property -10% Expenses +10% Gross loss ratios... -

Page 236

... statements continued 55 - Risk management continued Fund management and non-insurance business Sensitivities as at 31 December 2007 Impact on profit before tax (£m) Interest rates +1% Interest rates -1% Equity/ property +10% Equity/ property -10% Total Impact before tax on shareholders' equity... -

Page 237

Aviva plc Annual Report and Accounts 2007 56 - Derivative financial instruments This note gives details of the various derivative instruments we use to mitigate risk. The Group uses cash flow, fair value and net investment hedges to mitigate risk, as detailed below. (a) Cash flow hedges The Group ... -

Page 238

... value of in-force long-term business Total EEV assets included in the balance sheet Third party funds under management Unit trusts, OEICs, Peps and Isas Segregated funds Non-managed assets Funds under management Funds not managed by Aviva fund managers Funds under management by Aviva fund managers... -

Page 239

... as key management, being those having authority and responsibility for planning, directing and controlling the activities of the Group, including the executive and non-executive directors is as follows: 2007 £m 2006 £m Salary and other short-term benefits Post-employment benefits Equity... -

Page 240

...£m 2006 £m Fair value (losses)/gains on investments in subsidiaries Fair value gains transferred to income statement Aggregate tax effect Actuarial gains/(expenses) on pension scheme Net (expenses)/income recognised directly in equity Profit/(loss) for the year Total recognised income and expense... -

Page 241

... owed by subsidiaries Deferred tax assets Current tax assets Current assets Loans owed by subsidiaries Other amounts owed by subsidiaries Other assets Cash and cash equivalents Total assets Equity Ordinary share capital Preference share capital Called up capital Share premium account Merger reserve... -

Page 242

...plc Annual Report and Accounts 2007 Financial statements of the Company continued Cash flow statement For the year ended 31 December 2007 All the Company's operating and investing cash requirements are met by subsidiary companies and settled through intercompany loan accounts. As the direct method... -

Page 243

... losses Total (ii) Staff costs Total staff costs were: 92 95 6 193 87 71 43 201 2007 £m 2006 £m Wages and salaries Social security costs Post-retirement obligations Defined benefit schemes (see (iii) below) Defined contribution schemes Profit sharing and incentive plans Equity compensation... -

Page 244

.../(loss) before tax Tax calculated at standard UK corporation tax rate of 30% (2006: 30%) Adjustment to tax charge in respect of prior years Non-assessable dividends Disallowable expenses Non-taxable profit on sale of subsidiary Deferred tax asset not recognised Total tax credited to income statement... -

Page 245

... Fair value gains on investments in subsidiaries Fair value gains transferred to income statement Actuarial losses on pension schemes Dividends and appropriations Reserves credit for equity compensation plans Shares issued in lieu of dividends Issue of share capital under equity compensation scheme... -

Page 246

... at fair value in accordance with accounting policy D. The fair values of the subsidiaries and joint venture are estimated using applicable valuation models, underpinned by the Company's market capitalisation. This uses a three month rolling average of the Company's share price. Given that the key... -

Page 247

...related parties' payables are not secured and no guarantees were received in respect thereof. The payables will be settled in accordance with normal credit terms. The directors and key management of the Company are considered to be the same as for the Group. Information on both the Company and Group... -

Page 248

-

Page 249

...- Information on the European Embedded Value Norwich Union advertising In September 2007 Norwich Union launched a new brand advertising campaign. The adverts show a number of problems in life that we can't solve alongside the benefits Norwich Union can provide.The advertising shows how Norwich Union... -

Page 250

... Consolidated Income Statement, Consolidated Statement of Recognised Income and Expense, Reconciliation of Movements in Consolidated Shareholders' Funds, Summarised Consolidated Balance Sheet and the related notes on pages 247 to 267. The alternative method of reporting long-term business has... -

Page 251