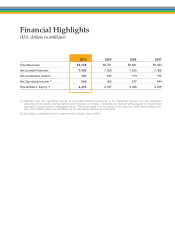

Assurant 2010 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2010 Assurant annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ASSURANT-2010 Annual Report2

insurance business continued to deliver strong results with

double-digit increases in new sales and an improvement

in operating results.

We added clients with products that support wireless and

handheld devices. This reaffi rms our belief that growth

in the wireless market will continue to outpace the

general economy. We continued to diversify our U.S.

client base by growing the original equipment manufacturer

(OEM) channel. Internationally, growth is strong in Latin

America, and more challenging in Europe. Looking ahead,

the priorities for Assurant Solutions are to invest in new

business opportunities while closely managing expenses.

Assurant Specialty Property

The loan-tracking technology and risk-management

expertise of Assurant Specialty Property combine to

deliver superior service to our clients and strong results

for our shareholders. Net operating income for the year

was $424.3 million and net earned premiums were $1.95

billion. Catastrophic activity was minimal again in 2010,

improving full-year results. Assurant Specialty Property

implemented process improvements to control expenses

while adding new clients for lender-placed homeowners’

coverage.

We continue to believe that revenue growth will

be challenged over time as the overall mortgage loan

inventory declines and placement rates return to more

historical levels. Our alignment with leading mortgage

servicers, along with sales growth of other products such

as renters and fl ood insurance, will temper these trends.

Assurant Health

In 2010, Assurant Health delivered solid results while

transforming to operate in an environment of new

regulations and changing market dynamics. Net operating

income for the year was $54.0 million and net earned

premiums were $1.86 billion. Plan design changes,

substantial cost reductions and pricing actions improved

Assurant Health’s year-over-year fi nancial performance.

Looking ahead, we will continue to adapt our strategy

as we more fully understand how consumers, providers

and distributors adjust to the new healthcare landscape.

2011 will be a transition year at Assurant Health and we

remain optimistic about our future as we adapt to the

changing needs of our customers.

Assurant Employee Benefi ts

Improved results for Assurant Employee Benefi ts in 2010

were driven by favorable claims experience and strong

expense management throughout the year. Net operating

income for the year was $63.5 million and net earned

premiums were $1.10 billion.

Revenue growth will continue to challenge the Assurant

Employee Benefi ts team until U.S. employment levels

improve and small business payrolls expand. In the

meantime, niche offerings such as worksite and voluntary

products and our reinsurance capabilities will enhance

our long-term competitive position while benefi ting small

businesses and their employees.

PRIORITIES FOR 2011

For 2011, our priorities are clear:

focus on growth by creating new revenue streams,

fi nd additional operating effi ciencies,

develop enhanced capabilities valued by our customers,

leverage our risk-management expertise in all we do,

and

continue to effectively manage our capital to create

value for our shareholders.

I am confident we will be successful because of our

employees. They are a very committed group, united by

our shared values of common sense, common decency,

uncommon thinking and uncommon results. Their expertise

and excellence combine to generate superior service for

our customers and long-term value for our shareholders.

Sincerely,

ROBERT B. POLLOCK

President and Chief Executive Offi cer