Assurant 2010 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2010 Assurant annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ASSURANT-2010 Annual Report 1

To Our Shareholders:

In 2010, Assurant delivered

solid results. We again af rmed

the adaptability of our strategy

to ongoing economic challenges and

regulatory changes in the specialty

markets we serve.

Robert B. POLLOCK

President and Chief Executive Offi cer, Assurant

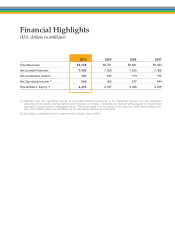

Assurant’s net earned premiums were $7.4 billion for the

year, and our operating return on average equity

1 was 12.1

percent. We increased net operating income

2 20 percent

to $560.1 million. Net income for the year decreased to

$279.2 million, due to the impairment of goodwill that

originated from acquisitions completed many years ago.

Our diluted book value per share, excluding AOCI3, was

up year-over-year by 6 percent. The Assurant investment

portfolio remains solid and we are optimistic about each of

our businesses as we enter 2011.

Throughout 2010, we continued to exercise discipline in

our deployment of capital. We returned more than $600

million to shareholders in repurchases and dividends.

Our share repurchases represented 13 percent of the

shares outstanding at year-end 2009. We also increased our

dividend for the seventh consecutive year. These actions

underscore the ability of the Assurant specialty platform

to generate free cash fl ow.

We ended the year with $880 million in corporate capital,

an increase of nearly 24 percent from the previous year.

Our capital deployment strategy provides financial

flexibility guided by three principles: safeguarding

the balance sheet against risk, finding opportunities

to grow through acquisition, and returning value to

our shareholders.

During 2010, we streamlined operations to improve

the customer experience while reducing costs. We also

developed new revenue opportunities through a broader

set of products and services that we can build on in 2011

and beyond.

2010 RESULTS FROM OPERATIONS

Assurant Solutions

Assurant Solutions focused on developing new client

relationships and distribution channels in 2010. Net

operating income for the year was $103.2 million and net

earned premiums were $2.48 billion. We were especially

pleased with the full-year improvement in our international

operating results. Domestic revenues were down due to the

impact of reduced levels of consumer spending. Our preneed