Assurant 2010 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2010 Assurant annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8ASSURANT, INC. 2010 Form 10K

PART I

ITEM 1 Business

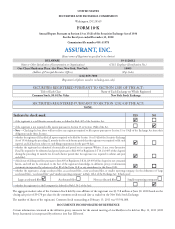

Assurant Employee Benefi ts

For the Years Ended

December 31, 2010 December 31, 2009

Net Earned Premiums and Other Considerations:

Group dental $ 420,690 $ 425,288

Group disability 488,813 434,381

Group life 191,892 192,468

TOTAL $ 1,101,395 $ 1,052,137

Segment net income $ 63,538 $ 42,156

Loss ratio (1) 69.6 % 72.0 %

Expense ratio (2) 35.1 % 36.4 %

Equity (3) $ 582,574 $ 537,041

(1) The loss ratio is equal to policyholder benefits divided by net earned premiums and other considerations.

(2) The expense ratio is equal to selling, underwriting and general expenses divided by net earned premiums and other considerations and fees and other income. (Fees and other income

are not included in the above table)

(3) Equity excludes accumulated other comprehensive income.

Products and Services

We focus on the needs of businesses with fewer than 500 employees.

We believe that our small group risk selection expertise, administrative

systems, and strong relationships with brokers who work primarily with

small businesses give us a competitive advantage versus other carriers.

We off er group disability, dental, vision, life and supplemental worksite

products as well as individual dental products. e group products are

off ered with funding options ranging from fully employer-paid to fully

employee-paid (voluntary). In addition, we reinsure disability and life

products through our wholly owned subsidiary, Disability Reinsurance

Management Services, Inc. (“DRMS”).

Group Disability

Group disability insurance provides partial replacement of lost earnings

for insured employees who become disabled, as defi ned by their plan

provisions. Our products include both short- and long-term disability

coverage options. We also reinsure disability policies written by other

carriers through our DRMS subsidiary.

Group Dental

Dental benefi t plans provide funding for necessary or elective dental

care. Customers may select a traditional indemnity arrangement, a PPO

arrangement, or a prepaid or managed care arrangement. Coverage is

subject to deductibles, coinsurance and annual or lifetime maximums.

In a prepaid plan, members must use participating dentists in order

to receive benefi ts.

Success in the group dental business is heavily dependent on a strong

provider network. Assurant Employee Benefi ts owns and operates Dental

Health Alliance, L.L.C., a leading dental PPO network. We also have

an agreement with Aetna, extending through 2012, that allows us to

use Aetna’s Dental Access ® network, which we believe increases the

attractiveness of our products in the marketplace.

Group Vision

Fully-insured vision coverage is off ered through our agreement with

Vision Service Plan, Inc. (“VSP”), a leading national supplier of vision

insurance. Our plans cover eye exams, glasses, and contact lenses and

are usually sold in combination with one or more of our other products.

Group Life

Group term life insurance provided through the workplace provides

benefi ts in the event of death. We also provide accidental death and

dismemberment (“AD&D”) insurance. Insurance consists primarily of

renewable term life insurance with the amount of coverage provided

being either a fl at amount, a multiple of the employee’s earnings, or a

combination of the two. We also reinsure life policies written by other

carriers through DRMS.

Supplemental Worksite Products

In addition to the traditional voluntary products, we provide group

critical illness, cancer, accident, and gap insurance. ese products are

generally paid for by the employee through payroll deduction, and the

employee is enrolled in the coverage(s) at the worksite.

Marketing and Distribution

Our products and services are distributed through a group sales

force located in 34 offi ces near major metropolitan areas. Our sales

representatives distribute our products and services through independent

brokers and employee-benefi ts advisors. Daily account management is

provided through the local sales offi ces, further supported by regional

sales support centers and a home offi ce customer service department.

Compensation of brokers in some cases includes an annual performance

incentive, based on volume and retention of business.

DRMS provides turnkey group disability and life insurance solutions to

insurance carriers that want to supplement their core product off erings.

Our services include product development, state insurance regulatory

fi lings, underwriting, claims management, and other functions typically

performed by an insurer’s back offi ce. Assurant Employee Benefi ts

reinsures the risks written by DRMS’ clients, with the clients generally

retaining shares ranging from 10% to 60% of the risk.